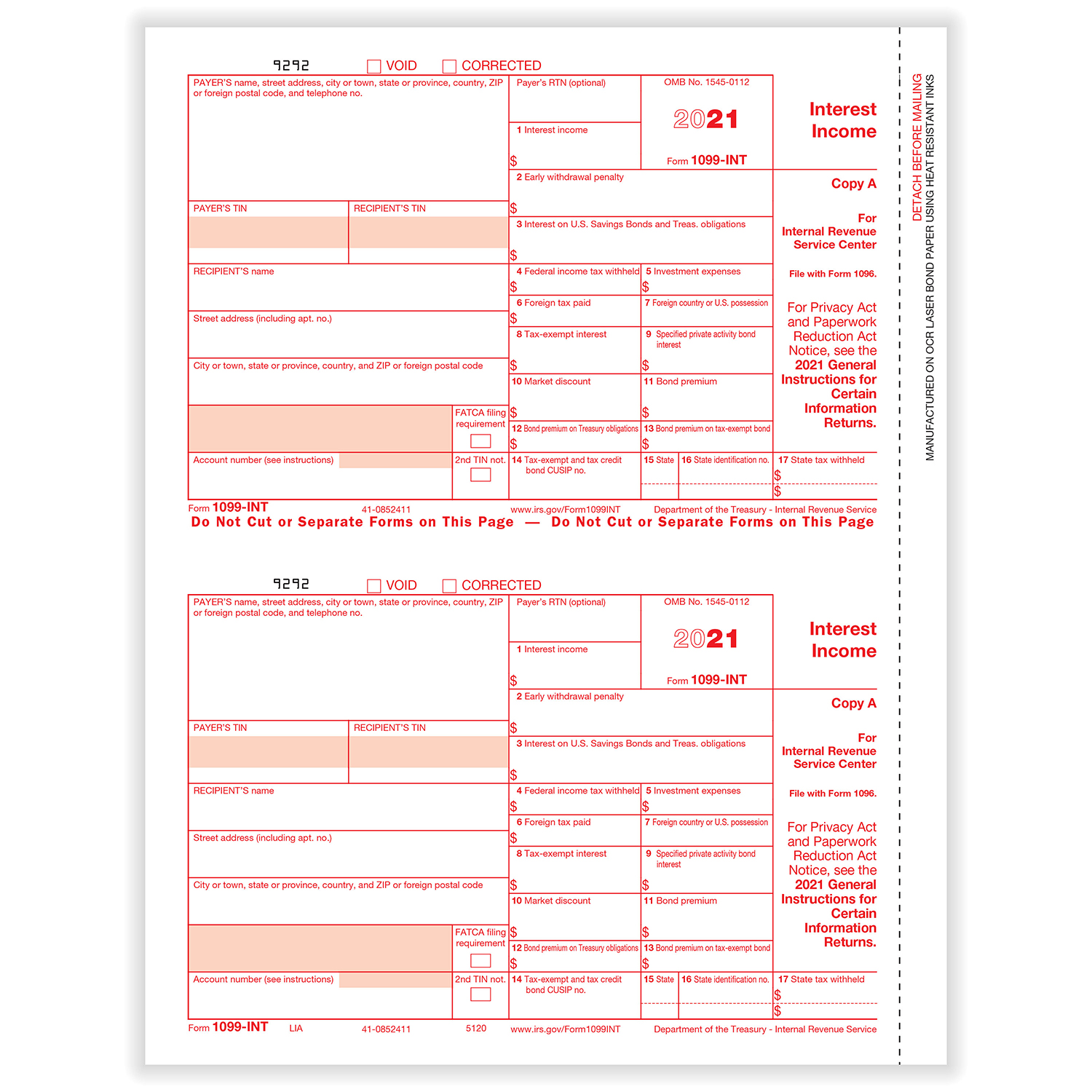

1099 Int Form Template

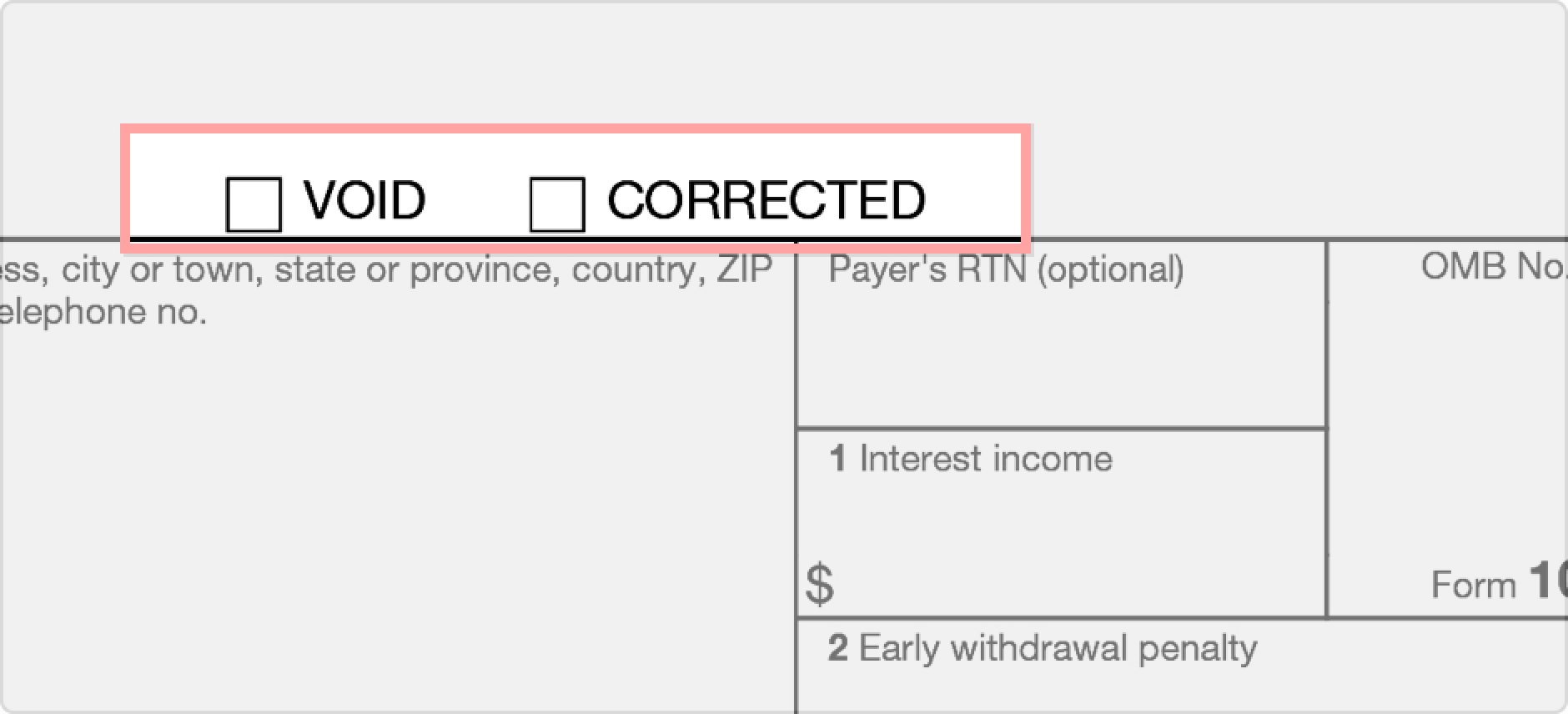

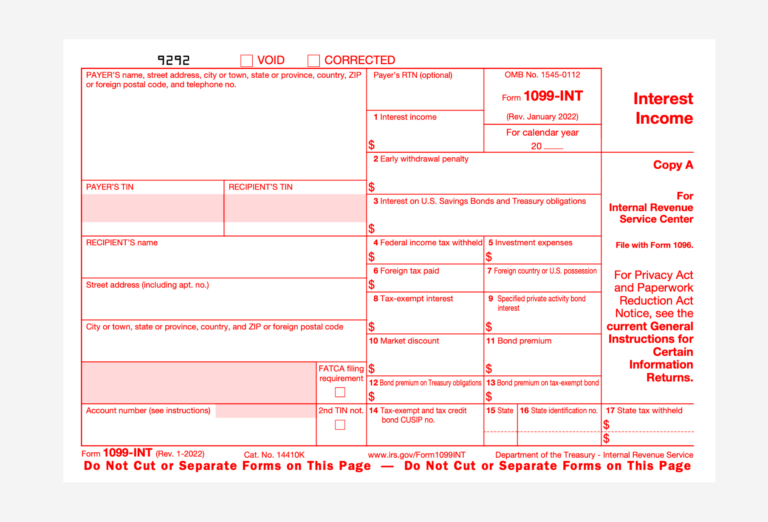

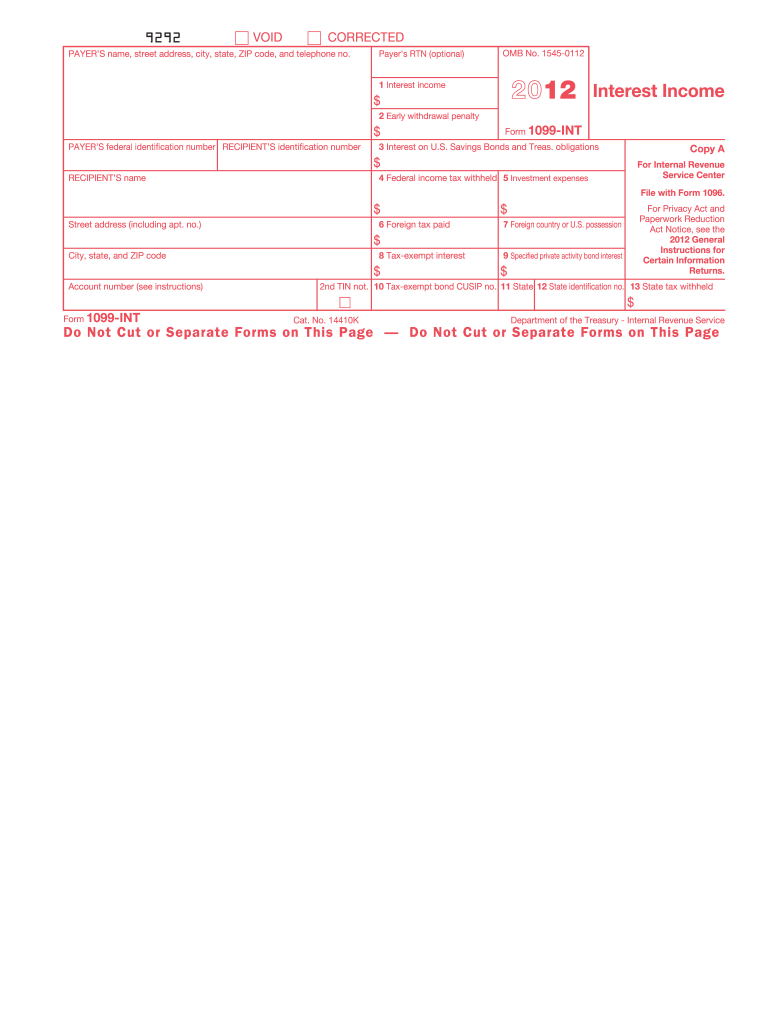

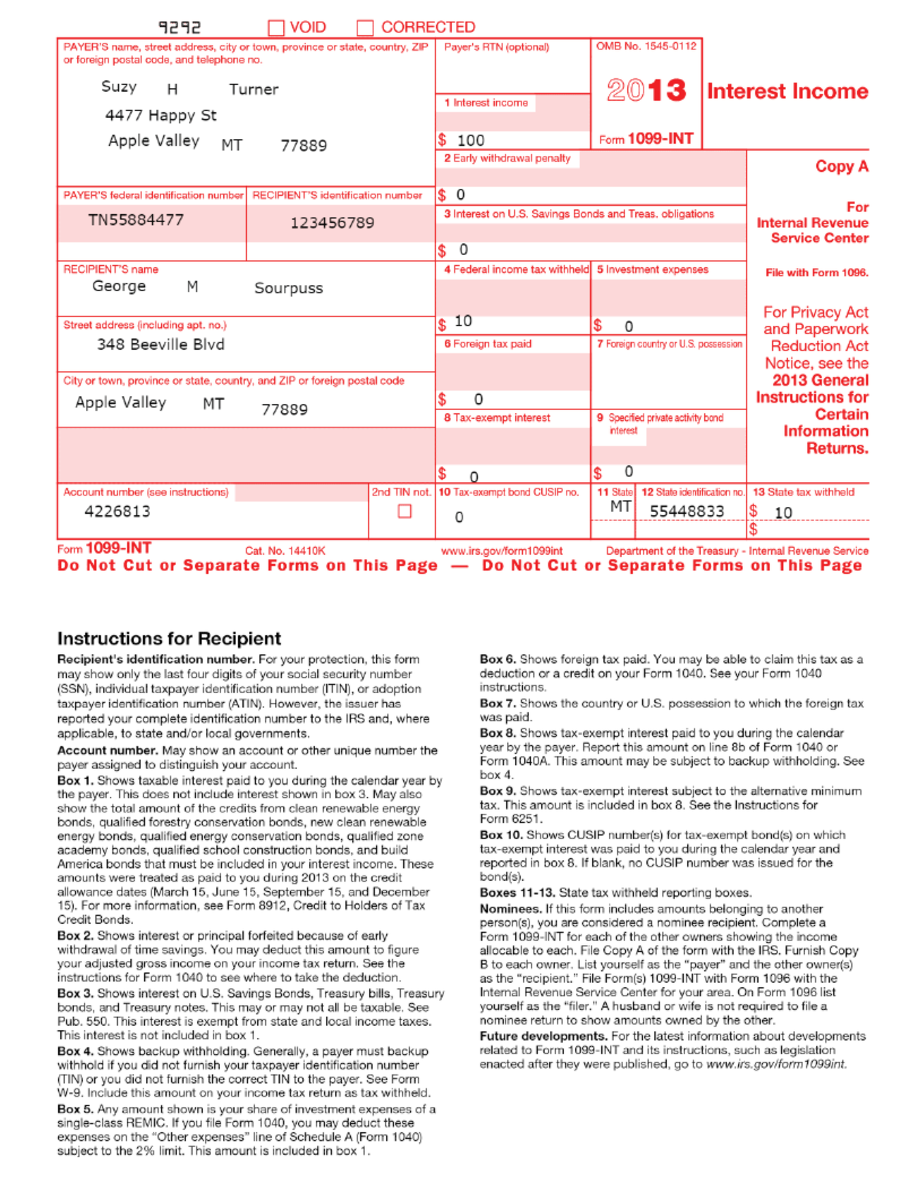

1099 Int Form Template - There are nearly two dozen different kinds of 1099 forms, and each. This form reports interest earnings to both the taxpayer and the irs, ensuring accurate tax filings and helping avoid penalties. Often issued with a 1099. Easily align and print your. Recipient’s taxpayer identification number (tin). Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Eliminates common costly errors when using fillable pdf forms on other websites. This form is used to report income. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification. Ensure your interest income is reported accurately with our guidance. This form is used to report income. Complete, fill out, and authorize your irs reporting online or print out the pdf forms. In five minutes or less! Recipient’s taxpayer identification number (tin). This does not have the usual number of boxes because it is only reporting one item,. Often issued with a 1099. There are nearly two dozen different kinds of 1099 forms, and each. Eliminates common costly errors when using fillable pdf forms on other websites. Minimum interest requirements for form. This interest is usually from a bank. Easily align and print your. Ensure your interest income is reported accurately with our guidance. This interest is usually from a bank. Complete, fill out, and authorize your irs reporting online or print out the pdf forms. Recipient’s taxpayer identification number (tin). Eliminates common costly errors when using fillable pdf forms on other websites. This form is used to report income. Often issued with a 1099. In five minutes or less! Choose your type of this legal template. Easily align and print your. This interest is usually from a bank. Eliminates common costly errors when using fillable pdf forms on other websites. Minimum interest requirements for form. This does not have the usual number of boxes because it is only reporting one item,. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or. Minimum interest requirements for form. Complete, fill out, and authorize your irs reporting online or print out the pdf forms. In five minutes or less! Ensure your interest income is. In five minutes or less! This does not have the usual number of boxes because it is only reporting one item,. This form is used to report income. Choose your type of this legal template. Ensure your interest income is reported accurately with our guidance. This form reports interest earnings to both the taxpayer and the irs, ensuring accurate tax filings and helping avoid penalties. This interest is usually from a bank. Ensure your interest income is reported accurately with our guidance. This form is used to report income. Often issued with a 1099. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Minimum interest requirements for form. This form is used to report income. Complete, fill out, and authorize your. This form reports interest earnings to both the taxpayer and the irs, ensuring accurate tax filings and helping avoid penalties. Minimum interest requirements for form. This interest is usually from a bank. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your. There are nearly two dozen different kinds of 1099 forms, and each. Minimum interest requirements for form. Choose your type of this legal template. Complete, fill out, and authorize your irs reporting online or print out the pdf forms. In five minutes or less! Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Choose your type of this legal template. Eliminates common costly errors when using fillable pdf forms on other websites. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of. Often issued with a 1099. This form is used to report income. Ensure your interest income is reported accurately with our guidance. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification. Easily align and print your. Complete, fill out, and authorize your irs reporting online or print out the pdf forms. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. This form reports interest earnings to both the taxpayer and the irs, ensuring accurate tax filings and helping avoid penalties. This interest is usually from a bank. There are nearly two dozen different kinds of 1099 forms, and each. Recipient’s taxpayer identification number (tin). Choose your type of this legal template. In five minutes or less!1099 INT Form PDF Template 2024 2023 With Print and Clear Buttons Etsy

1099 Int Template

1099Int Template. Create A Free 1099Int Form.

1099INT Form Print Template for Word or PDF 1096 Transmittal Summary

1099 Int Template

Form 1099INT Interest Definition

1099INT Form Fillable, Printable, Downloadable. 2024 Instructions

1099INT Interest Excel Template for Printing Onto IRS Form 2022 Taxes

1099 Int Template

1099INT Form Everything You Need to Know About Reporting Interest

Minimum Interest Requirements For Form.

This Does Not Have The Usual Number Of Boxes Because It Is Only Reporting One Item,.

Eliminates Common Costly Errors When Using Fillable Pdf Forms On Other Websites.

To Whom You Paid Amounts Reportable In Boxes 1, 3, Or 8 Of At Least $10 (Or At Least $600 Of Interest Paid In The Course Of Your Trade Or.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)