623 Dispute Letter Template

623 Dispute Letter Template - The method allows you to dispute a debt. Docdraft's 623 dispute letter templates are tailored for speed, accuracy, and compliance. It refers to section 623 of the fair credit reporting act and. With a 623 credit disputing letter, consumers request the credit agency to provide evidence to validate that the debt is theirs. Up to $40 cash back what is a 623 dispute letter? You can dispute the listings with them. What is a 609 dispute letter template? A 609 letter is a tool that helps you request information about items on your credit report and address errors. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific. The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). Generally, the 623 dispute is done with the original creditor. If you have tried disputing inaccurate information found on your credit report but these attempts were met with failed results, the 623 dispute method may be a viable alternative to getting. A 623 dispute letter is a specific type of letter that consumers can send to credit reporting agencies (cras) like equifax, experian, and transunion to dispute inaccurate or. This is known as the 623 dispute. Up to $40 cash back what is a 623 dispute letter? It refers to section 623 of the fair credit reporting act and. The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). A dispute letter is a formal document that businesses create and contains all information that they deem incorrect in their credit report along with supporting documentation as well as pieces of. It's named after section 609. For anything serious i recommend not using the online dispute mechanism, it's too easy for the cra to just use. What is a 609 dispute letter template? A 623 dispute letter is a specific type of letter that consumers can send to credit reporting agencies (cras) like equifax, experian, and transunion to dispute inaccurate or. This is known as the 623 dispute. The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). A 623. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific. The method allows you to dispute a debt. The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). In order to use the 623. A 623 dispute letter, sometimes referred to as a 623 credit dispute letter, is a specific sort of letter a consumer can send to the credit bureaus— experian, equifax, or transunion—to challenge. This is known as the 623 dispute. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company. A 623 dispute letter is a specific type of letter that consumers can send to credit reporting agencies (cras) like equifax, experian, and transunion to dispute inaccurate or. Whether you're an entrepreneur, lawyer, or individual, we've designed our legal templates to help you. With a 623 credit disputing letter, consumers request the credit agency to provide evidence to validate that. If you have tried disputing inaccurate information found on your credit report but these attempts were met with failed results, the 623 dispute method may be a viable alternative to getting. This is known as the 623 dispute. Docdraft's 623 dispute letter templates are tailored for speed, accuracy, and compliance. It is also referred to as a debt validation letter. The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). Docdraft's 623 dispute letter templates are tailored for speed, accuracy, and compliance. However, in this forum, there is no. Up to $40 cash back what is a 623 dispute letter? A 623 dispute letter is a specific type of letter that consumers can send. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific. However, in this forum, there is no. You can dispute the listings with them. The term 623 refers to section 623 of the fcra,. Up to $40 cash back what. It refers to section 623 of the fair credit reporting act and. Up to $40 cash back what is a 623 dispute letter? For anything serious i recommend not using the online dispute mechanism, it's too easy for the cra to just use. Whether you're an entrepreneur, lawyer, or individual, we've designed our legal templates to help you. A dispute. Whether you're an entrepreneur, lawyer, or individual, we've designed our legal templates to help you. The method allows you to dispute a debt. A dispute letter is a formal document that businesses create and contains all information that they deem incorrect in their credit report along with supporting documentation as well as pieces of. A 623 dispute letter, sometimes referred. If you have tried disputing inaccurate information found on your credit report but these attempts were met with failed results, the 623 dispute method may be a viable alternative to getting. A 623 dispute letter is a specific type of letter that consumers can send to credit reporting agencies (cras) like equifax, experian, and transunion to dispute inaccurate or. A. Up to $40 cash back what is a 623 dispute letter? For anything serious i recommend not using the online dispute mechanism, it's too easy for the cra to just use. However, in this forum, there is no. A dispute letter is a formal document that businesses create and contains all information that they deem incorrect in their credit report along with supporting documentation as well as pieces of. The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). It is also referred to as a debt validation letter and typically only. If you have tried disputing inaccurate information found on your credit report but these attempts were met with failed results, the 623 dispute method may be a viable alternative to getting. It's named after section 609. The method allows you to dispute a debt. The term 623 refers to section 623 of the fcra,. What is a 609 dispute letter template? Whether you're an entrepreneur, lawyer, or individual, we've designed our legal templates to help you. This is known as the 623 dispute. Once you have gone through the process of sending a general dispute. A 623 dispute letter, sometimes referred to as a 623 credit dispute letter, is a specific sort of letter a consumer can send to the credit bureaus— experian, equifax, or transunion—to challenge. It refers to section 623 of the fair credit reporting act and.623 Dispute Letter Template

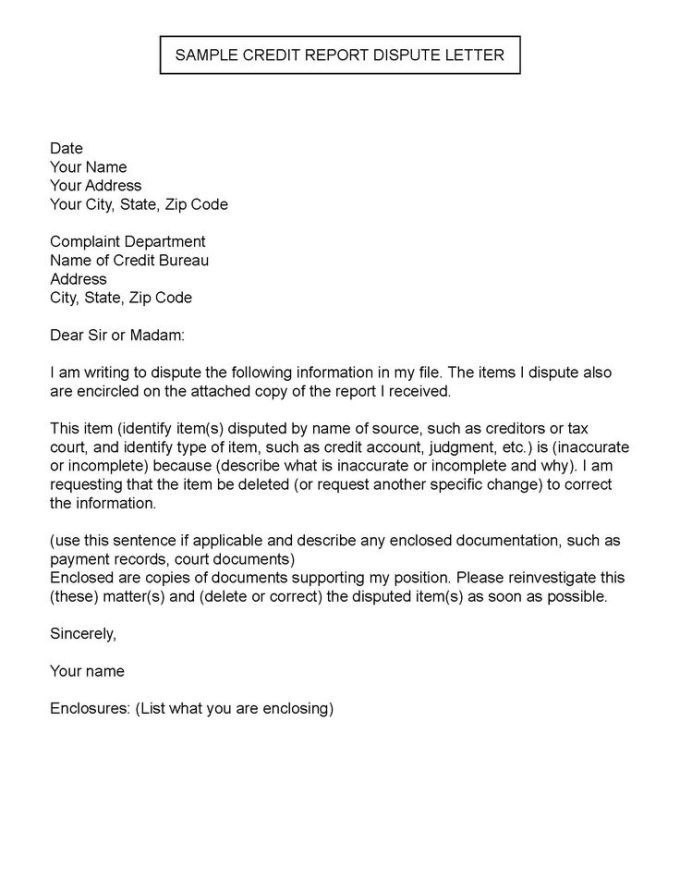

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Credit Report Dispute Letter Template TEMPLATES EXAMPLE TEMPLATES

623 Letter Template

623 Dispute Letter Template

Credit Report Dispute Letter Template (4) PROFESSIONAL TEMPLATES

What is a 623 Dispute Letter? Fair Credit

Download 623 Dispute Letter Sample Cecilprax

Example Of 609 Dispute Letter

Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

You Can Dispute The Listings With Them.

A Business Uses A 623 Credit Dispute Letter When All Other Attempts To Remove Dispute Information Have Failed.

A 623 Dispute Letter Is A Specific Type Of Letter That Consumers Can Send To Credit Reporting Agencies (Cras) Like Equifax, Experian, And Transunion To Dispute Inaccurate Or.

You Can Download Each Company’s Dispute Form Or Use The Letter Included In This Guide, Which Provides The Credit Reporting Company With Enough Information To Identify You And The Specific.

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-02-790x1022.jpg)

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/Credit-Dispute-Letter-1-1086x1536.jpg)