Bad Check Letter Template

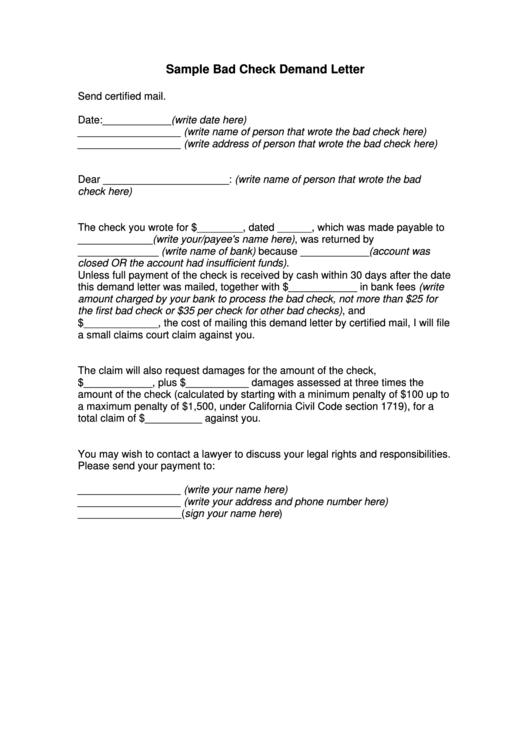

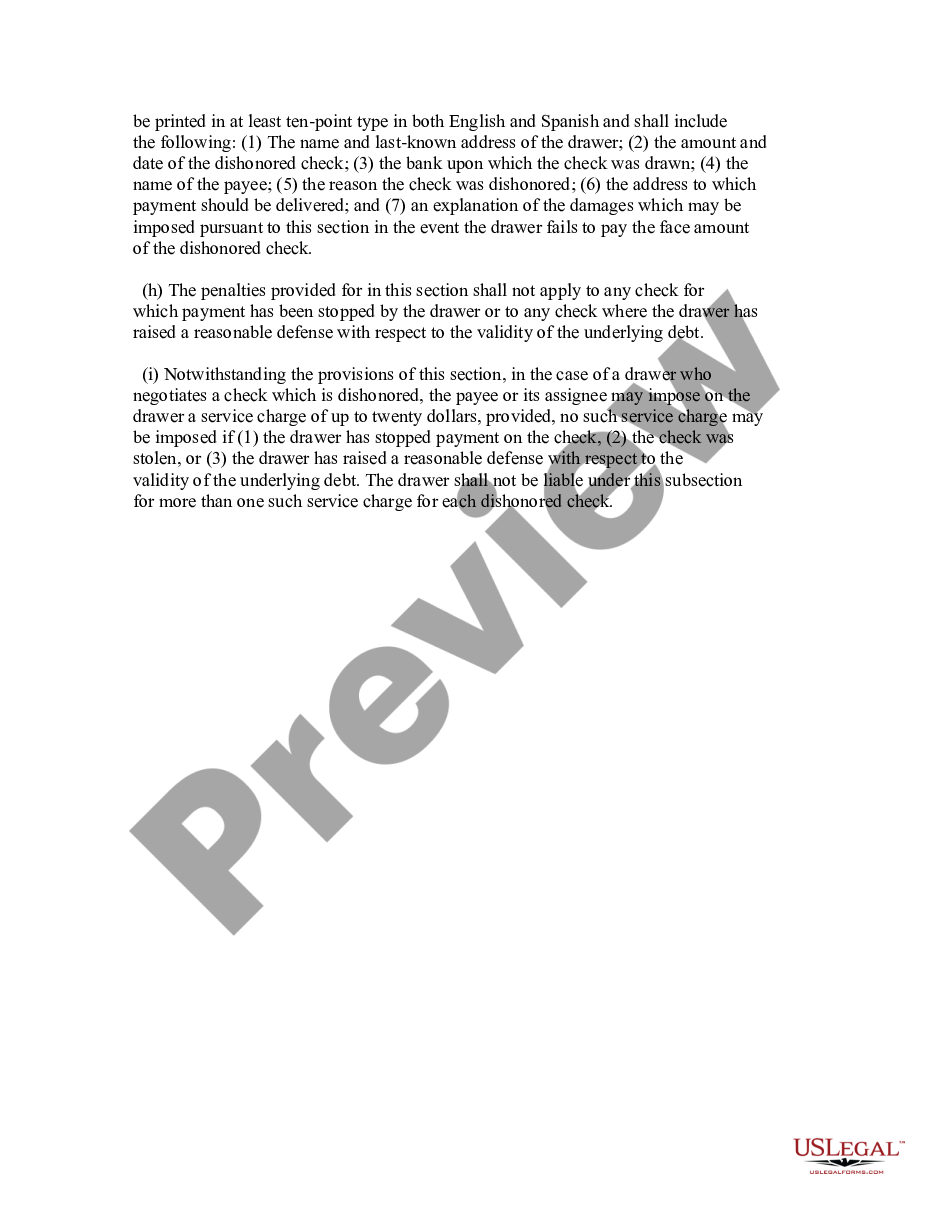

Bad Check Letter Template - Your bank returned the check to us due to insufficient funds (or because the account was closed). This customizable letter notifies a customer that a check has been returned for insufficient funds. It includes instructions for notifying the check writer and details for filing with the restitution program. Name of bank you are hereby notified that the following instrument(s): Free to download and print You are hereby notified that a check, numbered drawn. Bad checks are less of a problem when your customer base is mostly commercial rather than consumer, but the potential is always there and you should be. It requests the sender to collect the bad check and promptly settle the. The notice serves as a warning. This file provides a template for victims of bad checks to demand payment. This file provides a template for victims of bad checks to demand payment. You are hereby notified that a check, numbered drawn. A bad check collection letter is generally written as a formal notification after receiving a bad check. Your bank returned the check to us due to insufficient funds (or because the account was closed). 7.7 kb ) for free. This customizable letter notifies a customer that a check has been returned for insufficient funds. Since you still must recover the funds the debtor owes you, you should use a firm but. You are hereby notified that a check or instrument numbered ________________, issued by you on ______________ (date), drawn upon _________________________________ (name of. You must make payment to us immediately to avoid legal action. Using a returned check notice lets the check writer know that their bank has failed to make payment on the check and that they still owe money. A bad check notice is a legal document sent to an individual or business when a check they have written has been returned to the bank due to insufficient funds. It includes instructions for notifying the check writer and details for filing with the restitution program. Please visit us in person to. Number drawn upon date amount and. Free bad. Please visit us in person to. Using a returned check notice lets the check writer know that their bank has failed to make payment on the check and that they still owe money. Free to download and print The notice serves as a warning. Checks marched “account closed,” “no account,” “refer to maker,” or “unable to locate” can be referred. Send each letter via certified mail with “return. I am writing to inform you that a check issued by you, dated [check date], and bearing the check number [check number], has been returned by the bank due to insufficient funds. Please visit us in person to. It requests the sender to collect the bad check and promptly settle the. You. I am writing to inform you that a check issued by you, dated [check date], and bearing the check number [check number], has been returned by the bank due to insufficient funds. 7.7 kb ) for free. Free to download and print Your bank returned the check to us due to insufficient funds (or because the account was closed). This. Free bad check letter sample. The notice serves as a warning. This file provides a template for victims of bad checks to demand payment. A bad check notice is a legal document sent to an individual or business when a check they have written has been returned to the bank due to insufficient funds. This letter's purpose is to notify. Bad check statutory form letter state: Number drawn upon date amount and. Checks marched “account closed,” “no account,” “refer to maker,” or “unable to locate” can be referred to the program without notifying the. It includes instructions for notifying the check writer and details for filing with the restitution program. Since you still must recover the funds the debtor owes. Please visit us in person to. Send each letter via certified mail with “return. Download or preview 1 pages of pdf version of bad check demand letter (doc: This first form is designed to assist you in drafting a series of letters to a customer to advise them that a check they wrote payable to you, and which you deposited,. You are hereby notified that a check or instrument numbered ________________, issued by you on ______________ (date), drawn upon _________________________________ (name of. Using a returned check notice lets the check writer know that their bank has failed to make payment on the check and that they still owe money. Please visit us in person to. A bad check collection letter. Name of bank you are hereby notified that the following instrument(s): Bad checks are less of a problem when your customer base is mostly commercial rather than consumer, but the potential is always there and you should be. Free to download and print A bad check notice is a legal document sent to an individual or business when a check. It requests the sender to collect the bad check and promptly settle the. Since you still must recover the funds the debtor owes you, you should use a firm but. Attorney’s bad check restitution program. Number drawn upon date amount and. Send each letter via certified mail with “return. Using a returned check notice lets the check writer know that their bank has failed to make payment on the check and that they still owe money. Download or preview 1 pages of pdf version of bad check demand letter (doc: Checks marched “account closed,” “no account,” “refer to maker,” or “unable to locate” can be referred to the program without notifying the. You are hereby notified that a check or instrument numbered ________________, issued by you on ______________ (date), drawn upon _________________________________ (name of. Free to download and print You must make payment to us immediately to avoid legal action. Free bad check letter sample. A bad check collection letter is generally written as a formal notification after receiving a bad check. It includes instructions for notifying the check writer and details for filing with the restitution program. Since you still must recover the funds the debtor owes you, you should use a firm but. Your bank returned the check to us due to insufficient funds (or because the account was closed). It requests the sender to collect the bad check and promptly settle the. This file provides a template for victims of bad checks to demand payment. 7.7 kb ) for free. You are hereby notified that a check, numbered drawn. This first form is designed to assist you in drafting a series of letters to a customer to advise them that a check they wrote payable to you, and which you deposited, has been returned to you by.Bad Check Notice Sample Free Fillable PDF Forms

Printable Bad Check Letter

Bad Check Letter Template Fill Out, Sign Online and Download PDF

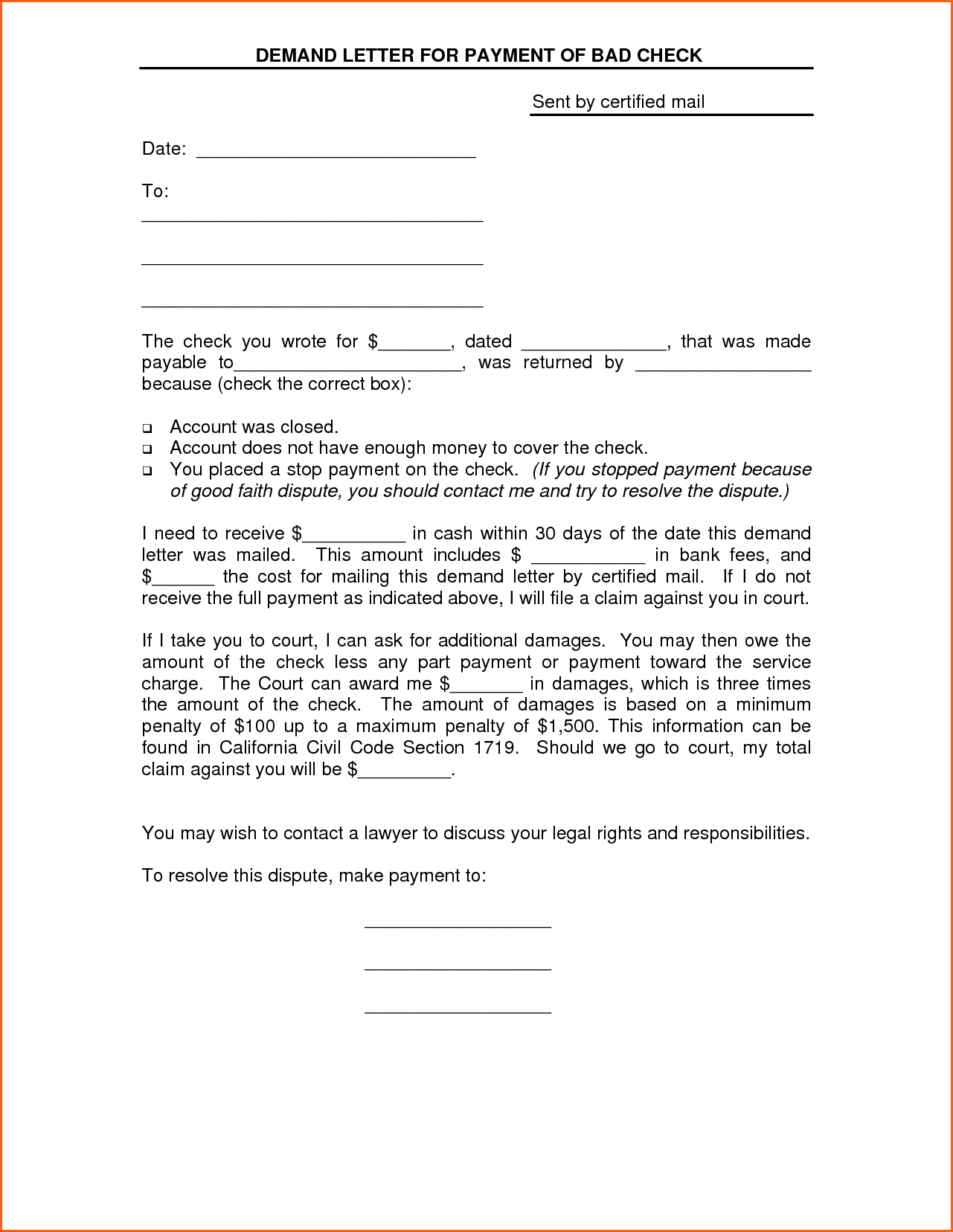

Demand Letter For Payment of Bad Check PDF

Bad Check Demand Letter, Bad Check Demand Letter Template, Bad Check

Sample Bad Check Demand Letter Template printable pdf download

Bad Check Letter Template For Employee US Legal Forms

Check deception demand letter sample in Word and Pdf formats

Bad Check Demand Letter, Bad Check Demand Letter Template, Bad Check

Bad Check Letter Template Resume Letter

I Am Writing To Inform You That A Check Issued By You, Dated [Check Date], And Bearing The Check Number [Check Number], Has Been Returned By The Bank Due To Insufficient Funds.

Attorney’s Bad Check Restitution Program.

Please Visit Us In Person To.

Bad Check Statutory Form Letter State:

Related Post: