Business Credit Application With Gurantor Template

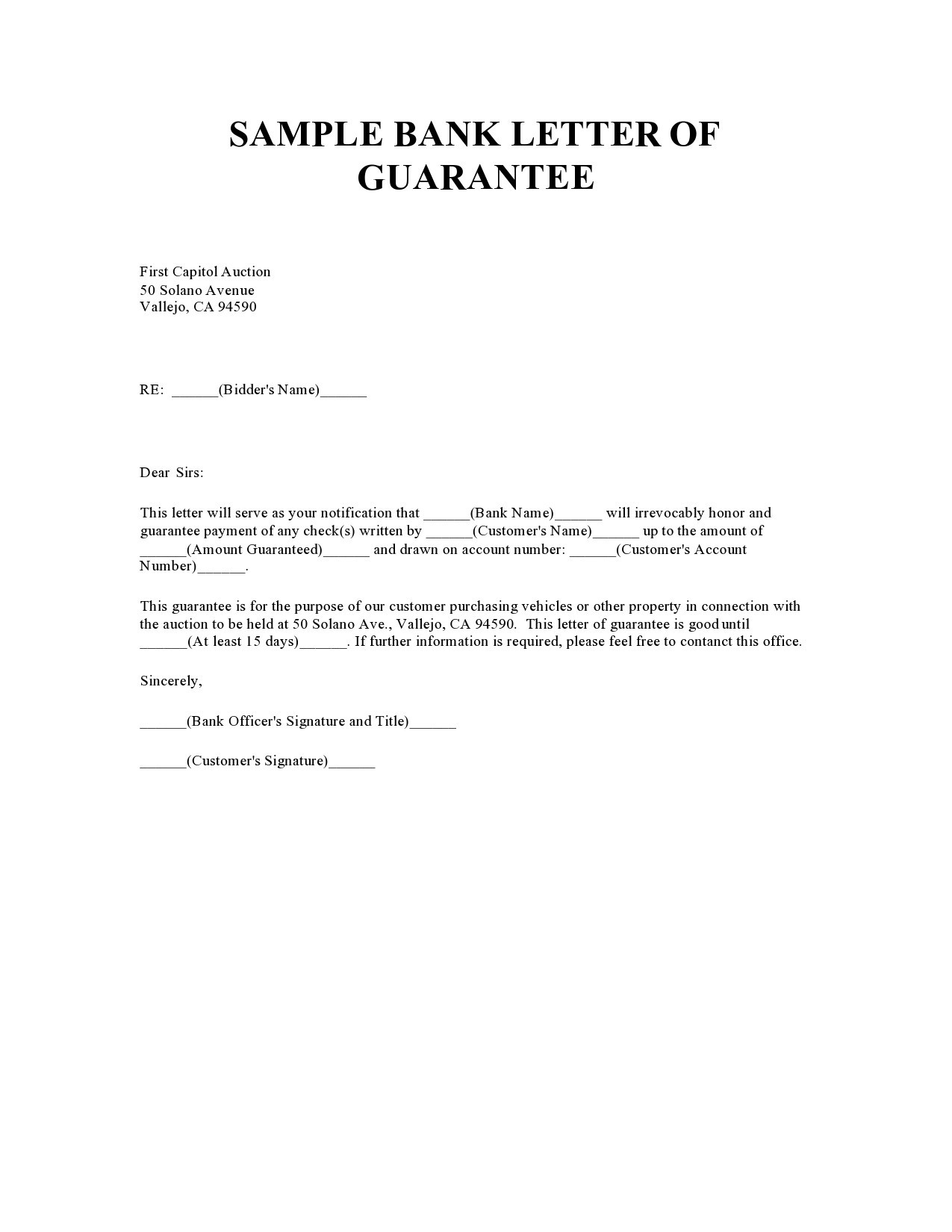

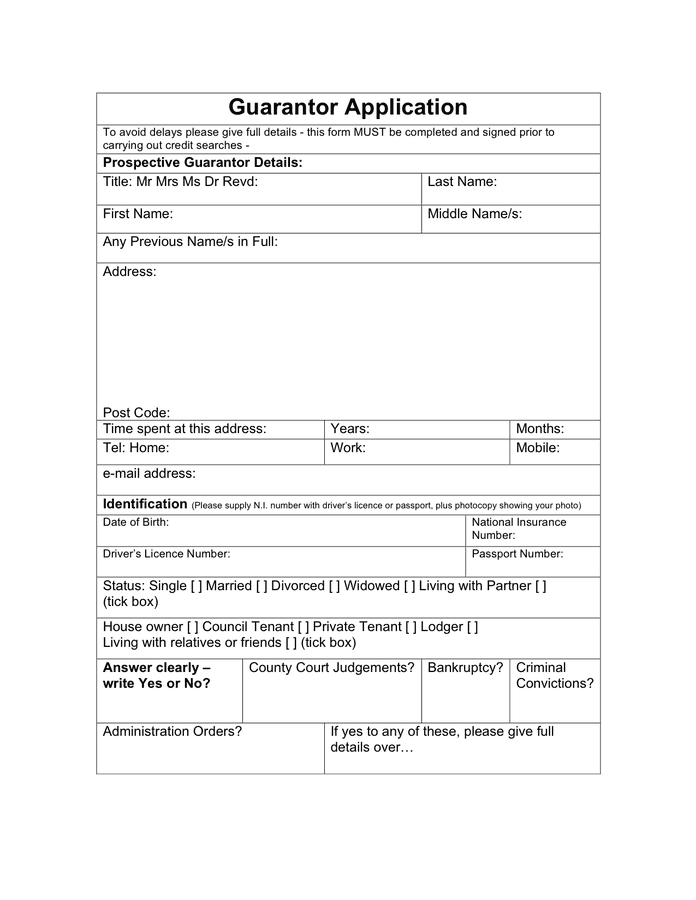

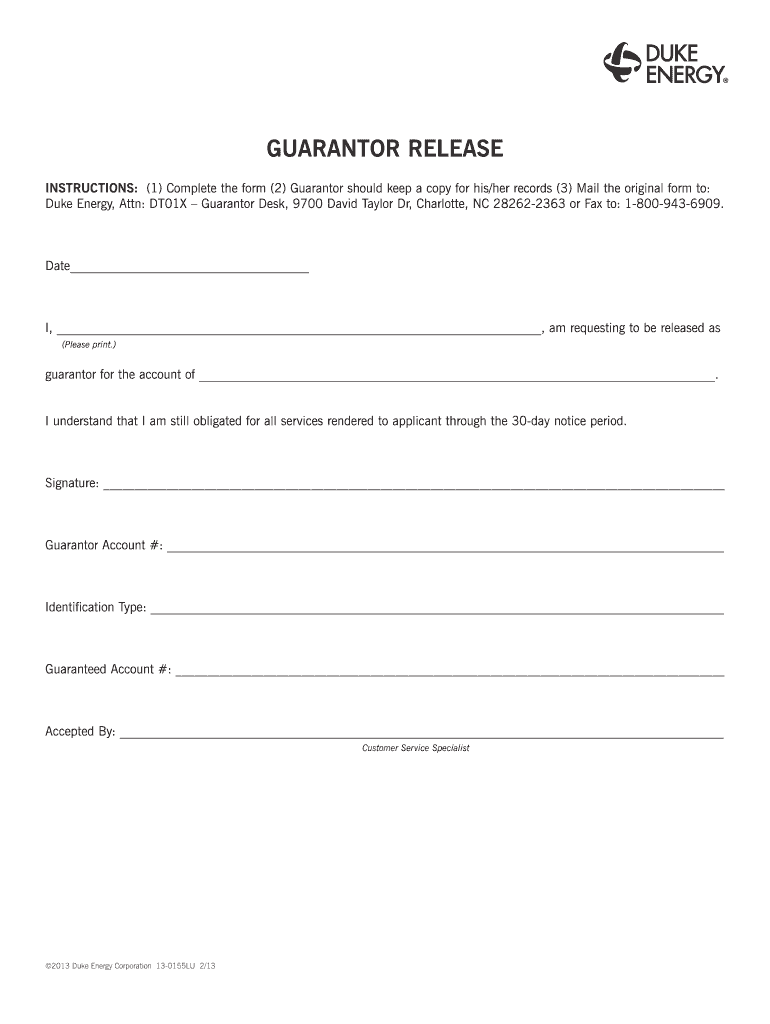

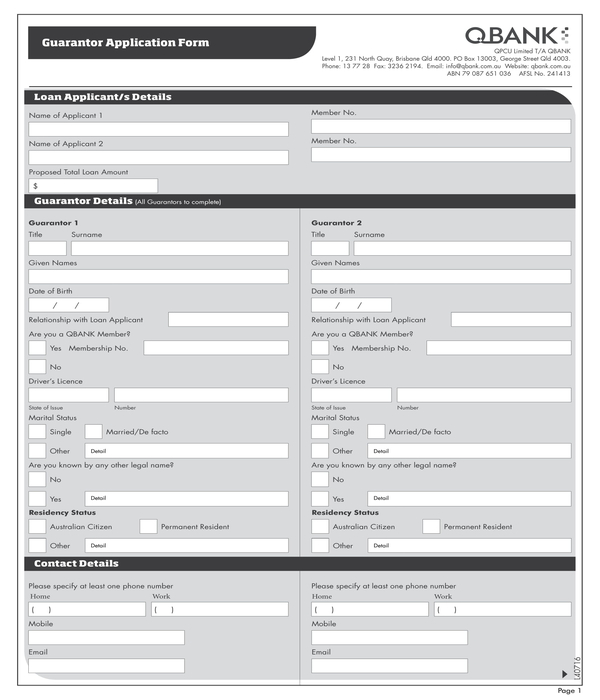

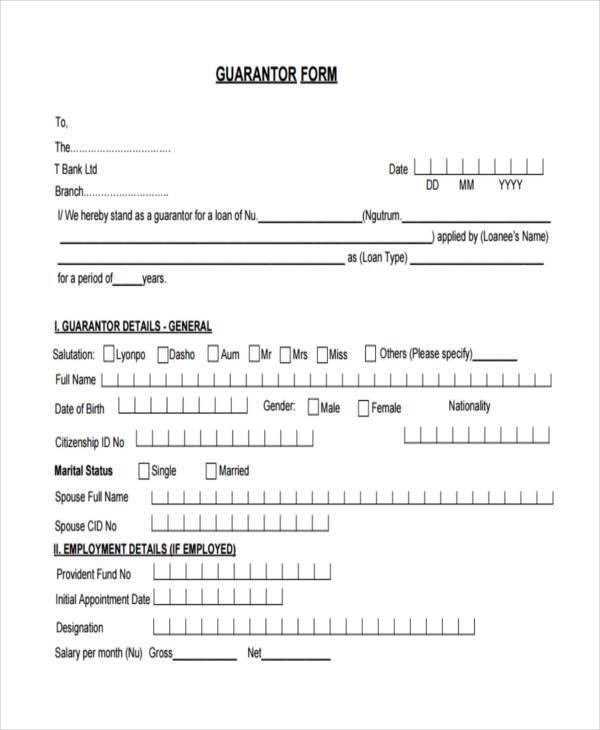

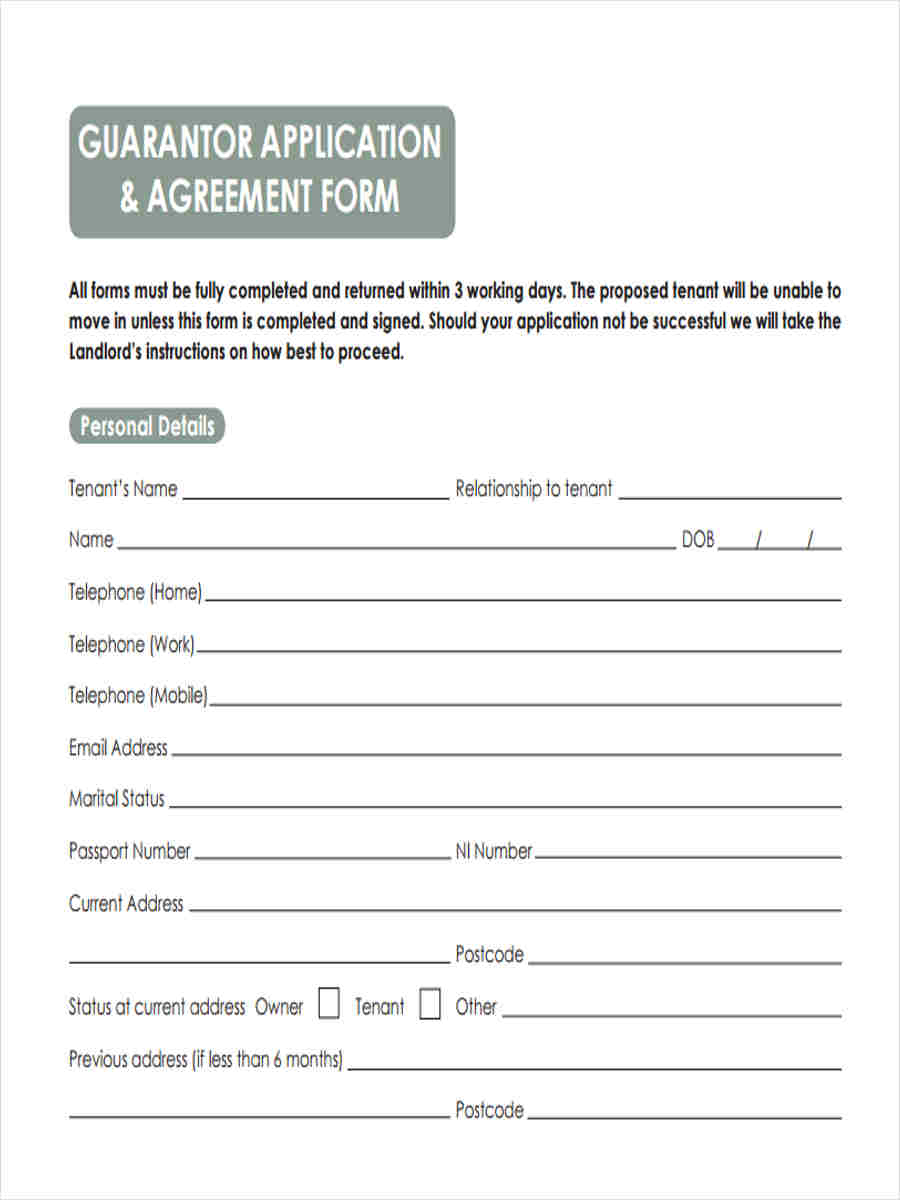

Business Credit Application With Gurantor Template - The credit application must provide all required details without which the lender cannot proceed with. Credit card applications are usually filed by prospective borrowers then submitted to lenders. Apply for business credit easily with our free, customizable credit application template. Clients who wish to be able to print and/or edit the credit application should contact their irg. Available in a4 & us letter sizes. Up to 40% cash back get the business credit application with personal guarantee accomplished. What is a business credit application? Here you can find useful templates that will help you creating a business credit application form, that is essential for evaluating the creditworthiness of potential clients. Download your adjusted document, export it to the cloud, print it from the. This form gathers essential financial and personal information, helping to. Up to 40% cash back get the business credit application with personal guarantee accomplished. The information that you give in this. Here you can find useful templates that will help you creating a business credit application form, that is essential for evaluating the creditworthiness of potential clients. A credit application form is a standardized document used by financial businesses such as lenders and banks to determine if a borrower should be given a loan or line of credit. Download your adjusted document, export it to the cloud, print it from the. Clients who wish to be able to print and/or edit the credit application should contact their irg. A business credit application is a formal document that a company submits to a creditor when applying for a line of credit. A business credit application form is used by lenders, suppliers, and vendors to collect information from credit applicants. You can protect your company by controlling credit risks. There are two ways to submit these applications: Available in a4 & us letter sizes. There are two ways to submit these applications: Credit card applications are usually filed by prospective borrowers then submitted to lenders. The template typically includes sections for entering the guarantor’s and. Here you can find useful templates that will help you creating a business credit application form, that is essential for evaluating the. Creating a business credit application form is essential for evaluating the creditworthiness of potential clients. The credit application must provide all required details without which the lender cannot proceed with. A business credit application is a formal document that a company submits to a creditor when applying for a line of credit. Clients who wish to be able to print. A business credit application form is used by lenders, suppliers, and vendors to collect information from credit applicants. It evaluates creditworthiness and determines suitable credit. This essential document helps businesses evaluate the creditworthiness of potential clients by collecting critical financial and personal. The credit application must provide all required details without which the lender cannot proceed with. This form gathers. Please click, below, to view a sample of the irg credit application and personal guarantee. Here are the printable credit application templates that you can download for free. This form gathers essential financial and personal information, helping to. This form collects key financial and personal information, enabling informed. Are you in need of a credit application form template? The template typically includes sections for entering the guarantor’s and. Here you can find useful templates that will help you creating a business credit application form, that is essential for evaluating the creditworthiness of potential clients. Clients who wish to be able to print and/or edit the credit application should contact their irg. This essential document helps businesses evaluate the. Through online or offline modes or in person at the premises of the lender. There are two ways to submit these applications: It evaluates creditworthiness and determines suitable credit. This form collects key financial and personal information, enabling informed. Explore our comprehensive collection of business credit application templates, designed to simplify the credit evaluation process for businesses seeking to extend. This form collects key financial and personal information, enabling informed. The credit application must provide all required details without which the lender cannot proceed with. Credit card applications are usually filed by prospective borrowers then submitted to lenders. Creating a business credit application form is essential for evaluating the creditworthiness of potential clients. This form gathers essential financial and personal. Apply for business credit easily with our free, customizable credit application template. Through online or offline modes or in person at the premises of the lender. There are two ways to submit these applications: Up to 40% cash back get the business credit application with personal guarantee accomplished. Here are the printable credit application templates that you can download for. This form collects key financial and personal information, enabling informed. Through online or offline modes or in person at the premises of the lender. Please click, below, to view a sample of the irg credit application and personal guarantee. Creating a business credit application form is essential for evaluating the creditworthiness of potential clients. Are you in need of a. Up to 40% cash back get the business credit application with personal guarantee accomplished. Credit card applications are usually filed by prospective borrowers then submitted to lenders. You can protect your company by controlling credit risks. Download your adjusted document, export it to the cloud, print it from the. There are two ways to submit these applications: Instantly download business credit application template, sample & example in microsoft word (doc), google docs, apple pages format. Creating a business credit application form is crucial for evaluating the creditworthiness of potential clients. Here you can find useful templates that will help you creating a business credit application form, that is essential for evaluating the creditworthiness of potential clients. A credit application form is a standardized document used by financial businesses such as lenders and banks to determine if a borrower should be given a loan or line of credit. A business credit application with a a guarantor template simplifies the loan application process. Here are the printable credit application templates that you can download for free. This form collects key financial and personal information, enabling informed. Up to 40% cash back get the business credit application with personal guarantee accomplished. A business credit application form is used by lenders, suppliers, and vendors to collect information from credit applicants. You can protect your company by controlling credit risks. It evaluates creditworthiness and determines suitable credit. There are two ways to submit these applications: What is a business credit application? The template typically includes sections for entering the guarantor’s and. Please click, below, to view a sample of the irg credit application and personal guarantee. Creating a business credit application form is essential for evaluating the creditworthiness of potential clients.Letter Of Guarantee Template

FREE 69+ Guarantee Letter Samples in PDF, Word, Google Docs, Pages

Guarantor form in Word and Pdf formats

Guarantor form Fill out & sign online DocHub

Credit Application Form for Company and Guarantor

FREE 11+ Guarantor Forms in PDF MS Word

FREE 8+ Sample Guarantor Agreement Forms in PDF MS Word

Guarantor Letter For Employment Sample PDF Template

FREE 13+ Guarantor Agreement Form Samples, PDF, MS Word, Google Docs

Free Business Loan Application Template Rocket Lawyer

A Business Credit Application Is A Formal Document That A Company Submits To A Creditor When Applying For A Line Of Credit.

This Form Gathers Essential Financial And Personal Information, Helping To.

Credit Card Applications Are Usually Filed By Prospective Borrowers Then Submitted To Lenders.

This Essential Document Helps Businesses Evaluate The Creditworthiness Of Potential Clients By Collecting Critical Financial And Personal.

Related Post: