Charitable Contribution Receipt Template

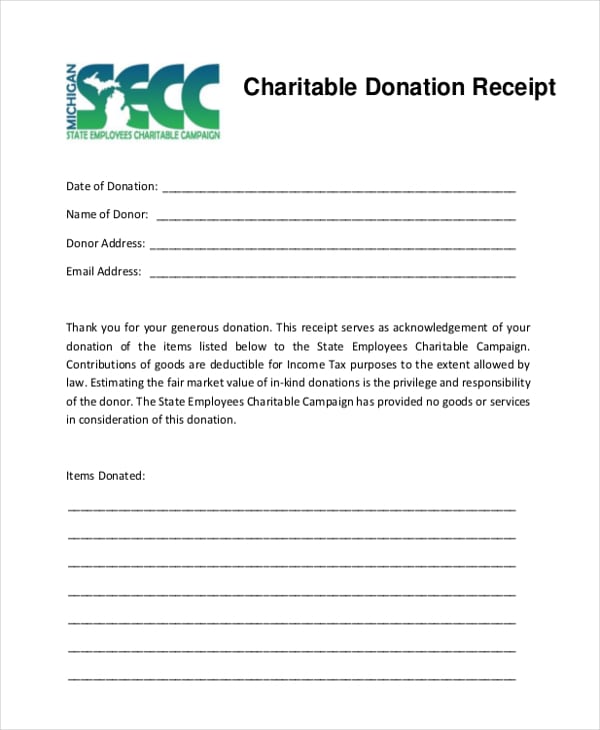

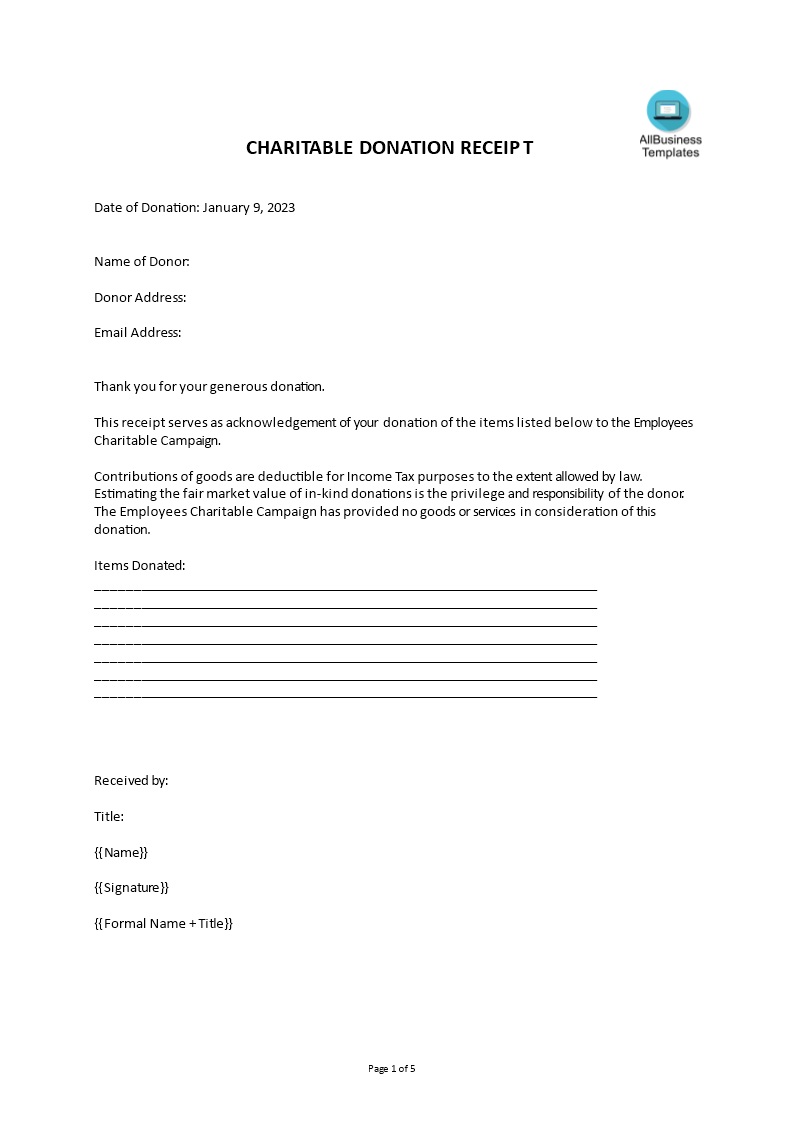

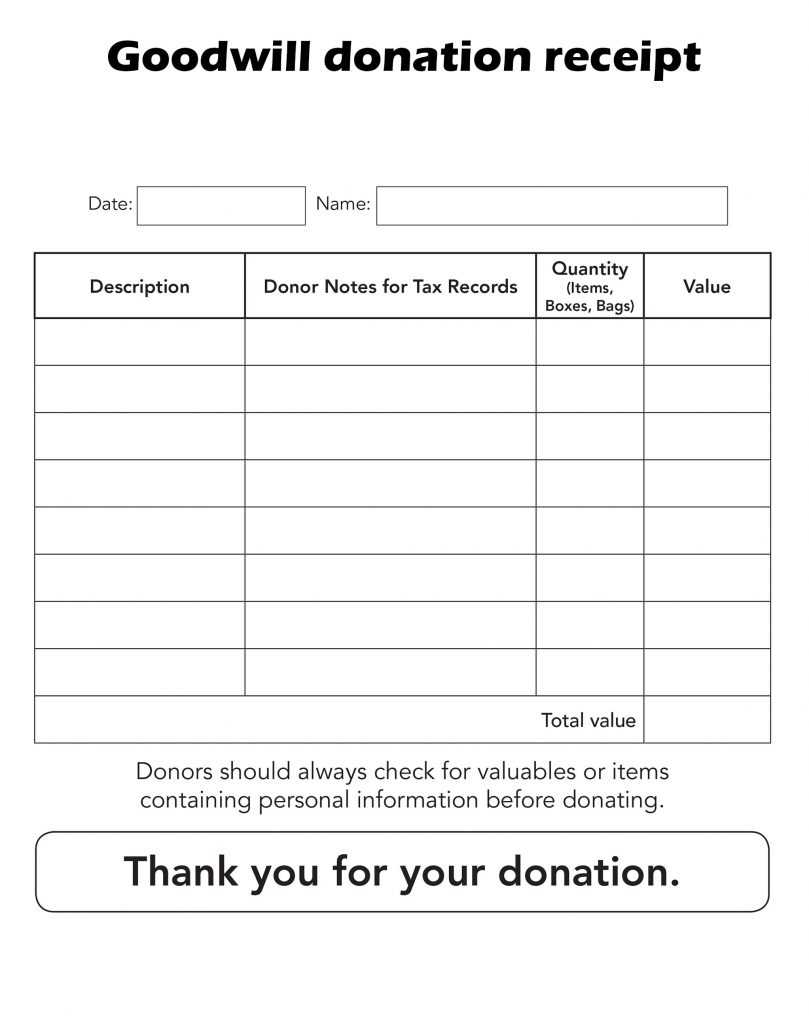

Charitable Contribution Receipt Template - Printable and customizable in pdf and word formats. Given below are donation receipt templates: When you make a charitable. At the very least, a 501 (c) (3) donation receipt must include the following information: Nonprofits and charitable organizations use these to acknowledge and record. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. A donation receipt is an official. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that you can customize and make your own. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. A donation receipt is an official. At the very least, a 501 (c) (3) donation receipt must include the following information: Easily create a donation receipt for your charitable organization with our free donation receipt template. Statement that the charity didn’t provide any goods or services in exchange for the donation. It is typically provided by. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. Given below are donation receipt templates: Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. All 501(c)(3) organizations must be approved by. Donorbox tax receipts are highly editable. Donorbox tax receipts are highly editable. A pledge or promise to pay does not count. Printable and customizable in pdf and word formats. Statement that the charity didn’t provide any goods or services in exchange for the donation. All 501(c)(3) organizations must be approved by. A pledge or promise to pay does not count. In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that you can customize and make your own. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has. When you make a charitable. Printable and customizable in pdf and word formats. In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that you can customize and make your own. A donation receipt is an official. It is typically provided by. Nonprofits and charitable organizations use these to acknowledge and record. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. At the very least, a 501 (c) (3) donation receipt must include the following information: A nonprofit receipt template is a helpful document. Easily create a donation receipt for your charitable organization with our free donation receipt template. It is typically provided by. Consider making the receipt look more like a letter, so it’s more. When you make a charitable. At the very least, a 501 (c) (3) donation receipt must include the following information: A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Easily create a donation receipt for your charitable organization with our free donation receipt template. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation.. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. A pledge or promise to pay does not count. Donation receipt templates are essential tools for any organization involved in charitable activities. Nonprofits and charitable organizations use these to acknowledge and record. In this article, we are going to explain how donation. At the very least, a 501 (c) (3) donation receipt must include the following information: Statement that the charity didn’t provide any goods or services in exchange for the donation. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. Given below. Donation receipt templates are essential tools for any organization involved in charitable activities. Easily create a donation receipt for your charitable organization with our free donation receipt template. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. It is typically provided by. Donorbox tax receipts are highly editable. A donation receipt is an official. Donation receipt templates are essential tools for any organization involved in charitable activities. A pledge or promise to pay does not count. All 501(c)(3) organizations must be approved by. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity. All 501(c)(3) organizations must be approved by. Easily create a donation receipt for your charitable organization with our free donation receipt template. Nonprofits and charitable organizations use these to acknowledge and record. When you make a charitable. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. A pledge or promise to pay does not count. Donorbox tax receipts are highly editable. Printable and customizable in pdf and word formats. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Consider making the receipt look more like a letter, so it’s more. Given below are donation receipt templates: It is typically provided by. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that you can customize and make your own.Charitable Donation Receipt Template FREE DOWNLOAD Aashe

Donation Receipt Template Fill Out, Sign Online and Download PDF

5 Charitable Donation Receipt Templates Free Sample Templates

Charitable Donation Receipt Templates at

FREE 5+ Donation Receipt Forms in PDF MS Word

501c3 Donation Receipt, 501c3 Donation Receipt Template, 501c3 Donation

Free Sample Printable Donation Receipt Template Form

5 Free Donation Receipt Templates in MS Word Templates

35 501c3 Donation Receipt Template Hamiltonplastering

Donation Receipt 10+ Examples, Format, How to Create, Google Docs

Donation Receipt Templates Are Essential Tools For Any Organization Involved In Charitable Activities.

Statement That The Charity Didn’t Provide Any Goods Or Services In Exchange For The Donation.

A Donation Receipt Is An Official.

At The Very Least, A 501 (C) (3) Donation Receipt Must Include The Following Information:

Related Post: