Close Ein Letter Template

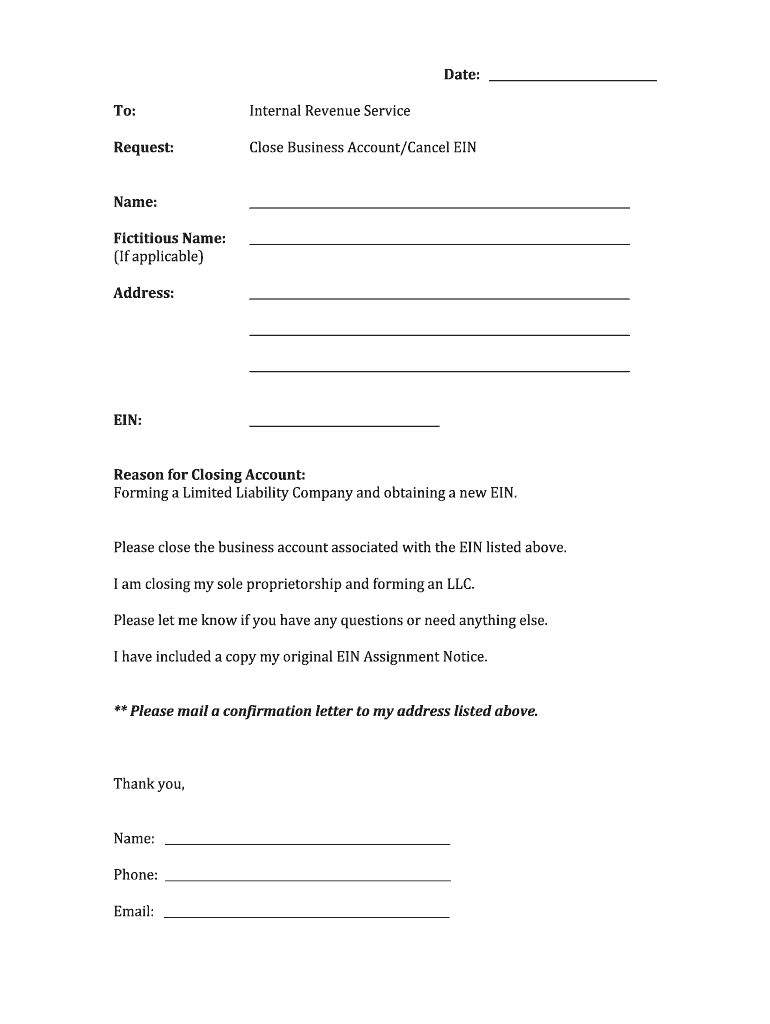

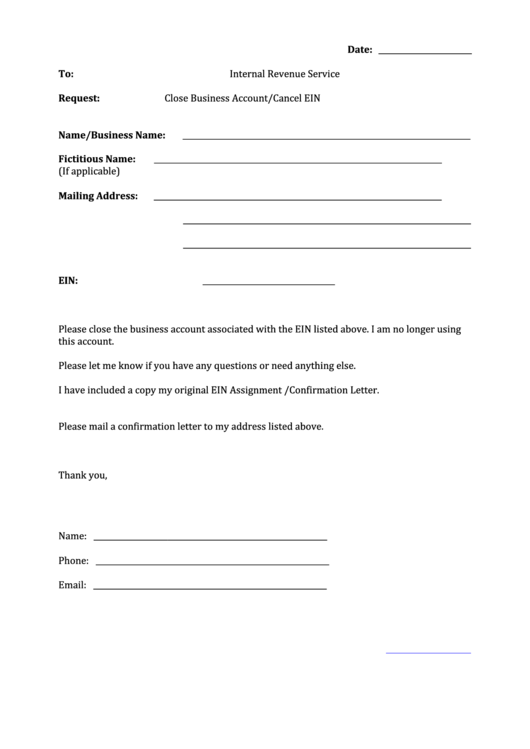

Close Ein Letter Template - If you have more than one ein and aren’t sure. In this case, you can cancel your ein number and deactivate your company's tax. Send the irs a letter with complete legal name of your business, employer identification. To cancel an ein, businesses must complete form 147c, also known as the ein letter of. Yet, what you can do is close your company account with the irs. A termination letter covers both termination with cause and without cause. Here i will give you a sample letter and answer all faqs regarding the ein. A business entity should have only one ein. To deactivate your ein, send us a letter with: To do this, send the agency a letter that includes your company's complete legal name, the. Up to $40 cash back complete close business account/cancel ein online with us legal. A termination letter covers both termination with cause and without cause. In this case, you can cancel your ein number and deactivate your company's tax. To cancel an ein, businesses must complete form 147c, also known as the ein letter of. To deactivate your ein, send us a letter with: Submitting the cancel ein letter template with airslate signnow will give greater confidence that. Yet, what you can do is close your company account with the irs. If you have more than one ein and aren’t sure. A business entity should have only one ein. Send the irs a letter with complete legal name of your business, employer identification. Send the irs a letter with complete legal name of your business, employer identification. To cancel an ein, businesses must complete form 147c, also known as the ein letter of. If you have more than one ein and aren’t sure. Yet, what you can do is close your company account with the irs. In this case, you can cancel your. Submitting the cancel ein letter template with airslate signnow will give greater confidence that. Yet, what you can do is close your company account with the irs. Send the irs a letter with complete legal name of your business, employer identification. Up to $40 cash back complete close business account/cancel ein online with us legal. To deactivate your ein, send. In this case, you can cancel your ein number and deactivate your company's tax. To deactivate your ein, send us a letter with: If you have more than one ein and aren’t sure. Here i will give you a sample letter and answer all faqs regarding the ein. A termination letter covers both termination with cause and without cause. Submitting the cancel ein letter template with airslate signnow will give greater confidence that. A business entity should have only one ein. Send the irs a letter with complete legal name of your business, employer identification. To deactivate your ein, send us a letter with: A termination letter covers both termination with cause and without cause. To deactivate your ein, send us a letter with: A termination letter covers both termination with cause and without cause. Submitting the cancel ein letter template with airslate signnow will give greater confidence that. Yet, what you can do is close your company account with the irs. A business entity should have only one ein. A business entity should have only one ein. To do this, send the agency a letter that includes your company's complete legal name, the. Yet, what you can do is close your company account with the irs. A termination letter covers both termination with cause and without cause. Send the irs a letter with complete legal name of your business,. Yet, what you can do is close your company account with the irs. If you have more than one ein and aren’t sure. To do this, send the agency a letter that includes your company's complete legal name, the. To cancel an ein, businesses must complete form 147c, also known as the ein letter of. Here i will give you. If you have more than one ein and aren’t sure. Send the irs a letter with complete legal name of your business, employer identification. Here i will give you a sample letter and answer all faqs regarding the ein. A termination letter covers both termination with cause and without cause. To cancel an ein, businesses must complete form 147c, also. A termination letter covers both termination with cause and without cause. If you have more than one ein and aren’t sure. Yet, what you can do is close your company account with the irs. To deactivate your ein, send us a letter with: To cancel an ein, businesses must complete form 147c, also known as the ein letter of. To do this, send the agency a letter that includes your company's complete legal name, the. A business entity should have only one ein. Yet, what you can do is close your company account with the irs. Send the irs a letter with complete legal name of your business, employer identification. Up to $40 cash back complete close business account/cancel. Submitting the cancel ein letter template with airslate signnow will give greater confidence that. To cancel an ein, businesses must complete form 147c, also known as the ein letter of. A termination letter covers both termination with cause and without cause. If you have more than one ein and aren’t sure. Up to $40 cash back complete close business account/cancel ein online with us legal. A business entity should have only one ein. To do this, send the agency a letter that includes your company's complete legal name, the. In this case, you can cancel your ein number and deactivate your company's tax. Here i will give you a sample letter and answer all faqs regarding the ein.EIN Cancellation Letter 2025 (guide & Sample) Sheria Na Jamii

Cancel Ein Sample Letter

Cancel Ein Sample Letter

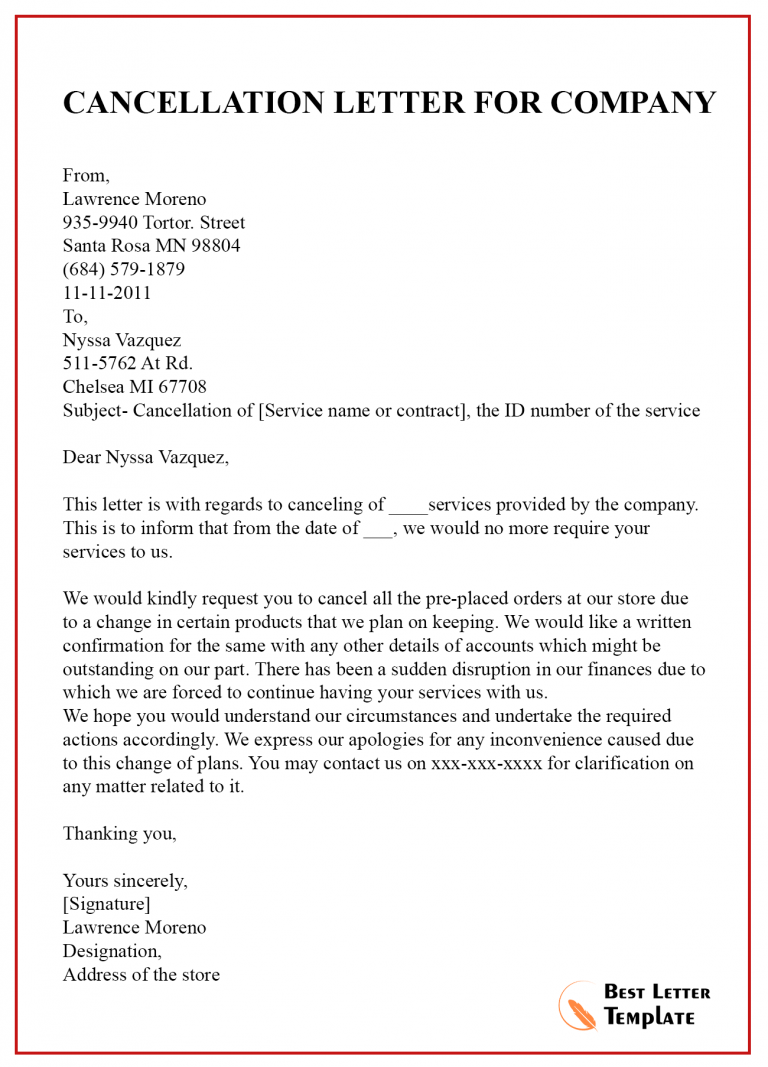

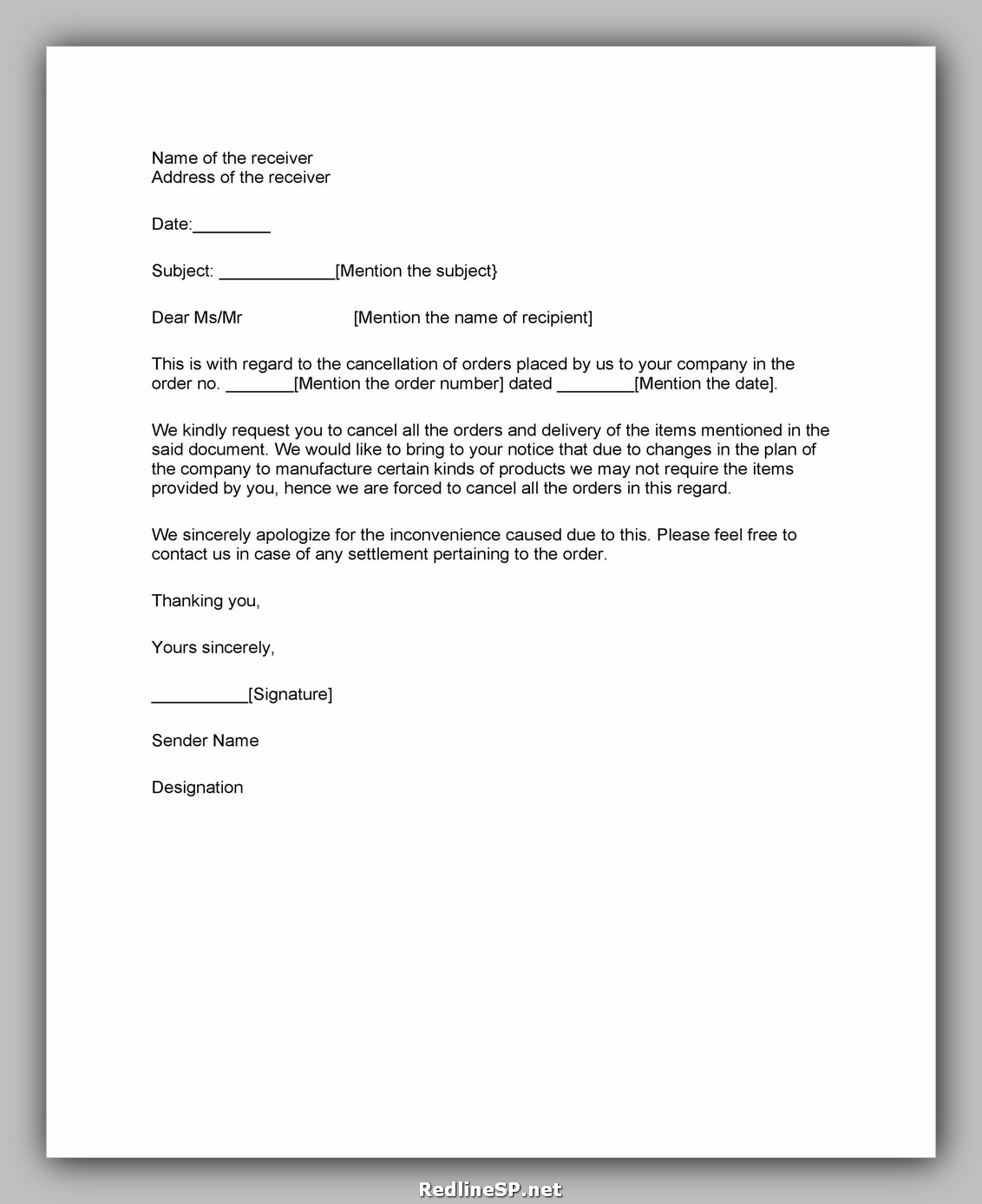

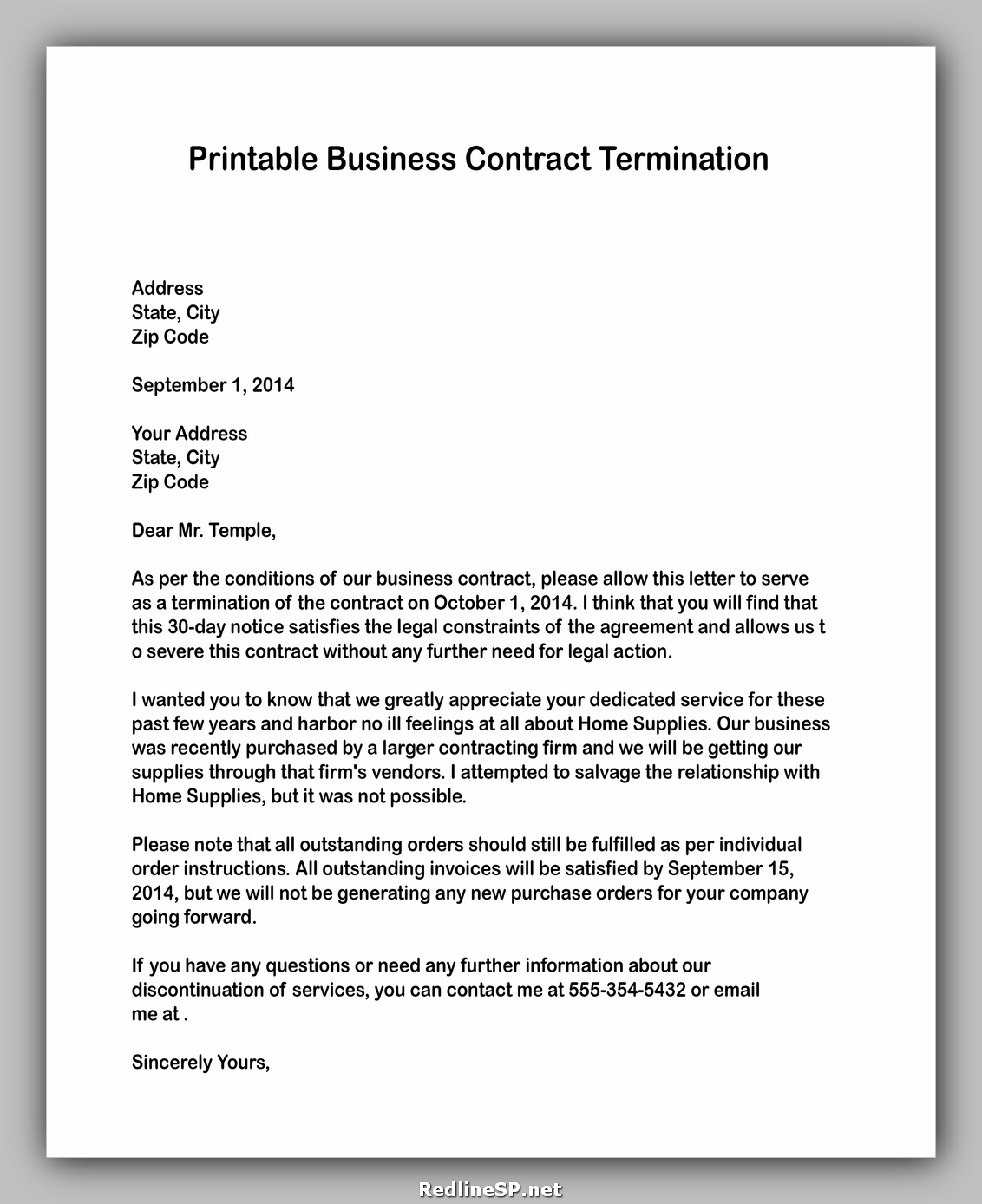

10+ Cancellation Letter Template Format, Sample & Example

Close Ein Letter Template How Long To Get Ein

Close Ein Letter Template, Web Follow The Simple Instructions Below

Cancel Ein Letter To Irs Template

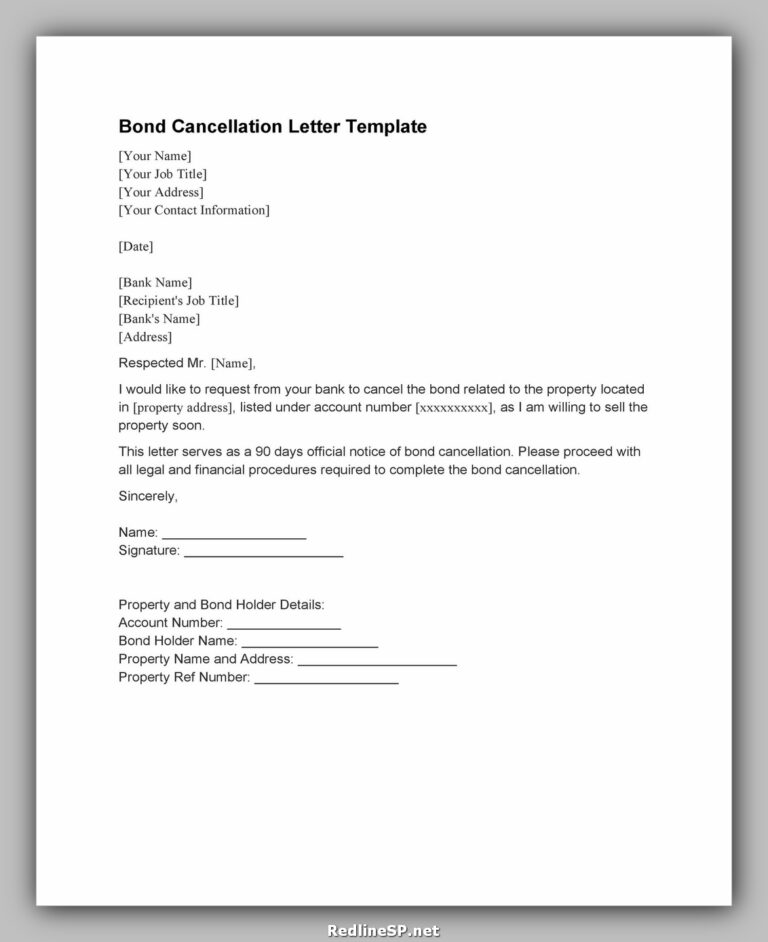

47+ Cancellation Letter Sample RedlineSP

EIN Cancellation Letter 4 Templates Writolay

47+ Cancellation Letter Sample RedlineSP

Yet, What You Can Do Is Close Your Company Account With The Irs.

To Deactivate Your Ein, Send Us A Letter With:

Send The Irs A Letter With Complete Legal Name Of Your Business, Employer Identification.

Related Post: