Dispute Charges Letter Template

Dispute Charges Letter Template - Findlaw explains your rights when dealing with false charges on your credit card and provides a sample letter to send to your lender in a billing dispute. Include pertinent details, such as your account. In this article, we'll guide you through a simple letter template to help tackle the. Here's a sample dispute letter that consumers can use to challenge fraudulent or incorrect credit or debit card transactions, including unauthorized purchases or disputed ach transfers. Up to $40 cash back letter dispute charges sample format is a written document used to contest or question the accuracy, legitimacy, or validity of charges that have been made on an. Use this letter to dispute an incorrect charge on your credit card bill. Bank transaction dispute letter is in editable, printable format. I am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. Write this type of letter to a creditor when you want to dispute charges and/or fees that they included on your credit card statement. Banks require you to try sorting things out with the seller first. To whom it may concer n: Whether it's a billing error or an unfamiliar transaction, knowing how to address these issues effectively can save you both money and stress. I am writing to dispute a fraudulent (charge or debit) on my account in the amount of $______. Include pertinent details, such as your account. The charge is in error because [explain the problem briefly. I am disputing a charge on my bill dated ___________. In this article, we ll guide you through a simple letter template to address. Write this type of letter to a creditor when you want to dispute charges and/or fees that they included on your credit card statement. Below is a sample letter you can use when you need to dispute credit card charges. If you spot an incorrect or invalid charge, your first move should be to reach out to the merchant. For best results, send this letter within 60 days after receiving the first statement containing the incorrect charge So, if you re ready to tackle. Include pertinent details, such as your account. To whom it may concer n: It can cause too many issues down the line. I am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. In this article, we'll guide you through a simple letter template to help tackle the. Up to $40 cash back letter dispute charges sample format is a written document used to contest or question the accuracy, legitimacy, or validity. Write this type of letter to a creditor when you want to dispute charges and/or fees that they included on your credit card statement. Use this letter to dispute an incorrect charge on your credit card bill. Up to $40 cash back dispute charges letter samples with reasons are formal letters written to inform and explain the reasons behind disputing. For best results, send this letter within 60 days after receiving the first statement containing the incorrect charge So, if you re ready to tackle. Don’t start any client’s project without a tax engagement letter. In your letter, include the transaction or transactions that you’re disputing and the reason you’re making the. Bank transaction dispute letter is in editable, printable. For best results, send this letter within 60 days after receiving the first statement containing the incorrect charge In this article, we'll guide you through a simple letter template to help tackle the. Whether it's a billing error or an unfamiliar transaction, knowing how to address these issues effectively can save you both money and stress. Below is a sample. I am a victim of identity theft, and i did not make this (charge or debit). I am disputing a charge on my bill dated ___________. Here's a sample dispute letter that consumers can use to challenge fraudulent or incorrect credit or debit card transactions, including unauthorized purchases or disputed ach transfers. If you spot an incorrect or invalid charge,. Use this letter to dispute an incorrect charge on your credit card bill. In this article, we'll guide you through a simple letter template to help tackle the. To whom it may concer n: In your letter, include the transaction or transactions that you’re disputing and the reason you’re making the. For best results, send this letter within 60 days. The charge is in error because [explain the problem briefly. The charge is dated _____________ and is in the amount of ____________. Add information specific to your situation in the bracketed areas below: In this article, we ll guide you through a simple letter template to address. Here's a sample dispute letter that consumers can use to challenge fraudulent or. The charge is in error because [explain the problem briefly. Add information specific to your situation in the bracketed areas below: Use this letter to dispute an incorrect charge on your credit card bill. Bank transaction dispute letter is in editable, printable format. In your letter, include the transaction or transactions that you’re disputing and the reason you’re making the. Enhance this design & content with free ai. It can cause too many issues down the line. Here's a sample dispute letter that consumers can use to challenge fraudulent or incorrect credit or debit card transactions, including unauthorized purchases or disputed ach transfers. Below is a sample letter you can use when you need to dispute credit card charges. Use. Up to $40 cash back dispute charges letter samples with reasons are formal letters written to inform and explain the reasons behind disputing certain charges on a bill or statement. Banks require you to try sorting things out with the seller first. Below is a sample letter you can use when you need to dispute credit card charges. Include pertinent details, such as your account. Write this type of letter to a creditor when you want to dispute charges and/or fees that they included on your credit card statement. Bank transaction dispute letter is in editable, printable format. The charge is in error because [explain the problem briefly. Learn more about this engagement letter, plus a free template to use. It's crucial to act swiftly and effectively to dispute these charges, ensuring your finances stay secure. The charge is in error because [explain the problem briefly. I am a victim of identity theft, and i did not make this (charge or debit). I am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. Don’t start any client’s project without a tax engagement letter. In this article, we ll guide you through a simple letter template to address. So, if you re ready to tackle. In this article, we'll guide you through a simple letter template to help tackle the.9 Dispute Letter Templates SampleTemplatess SampleTemplatess

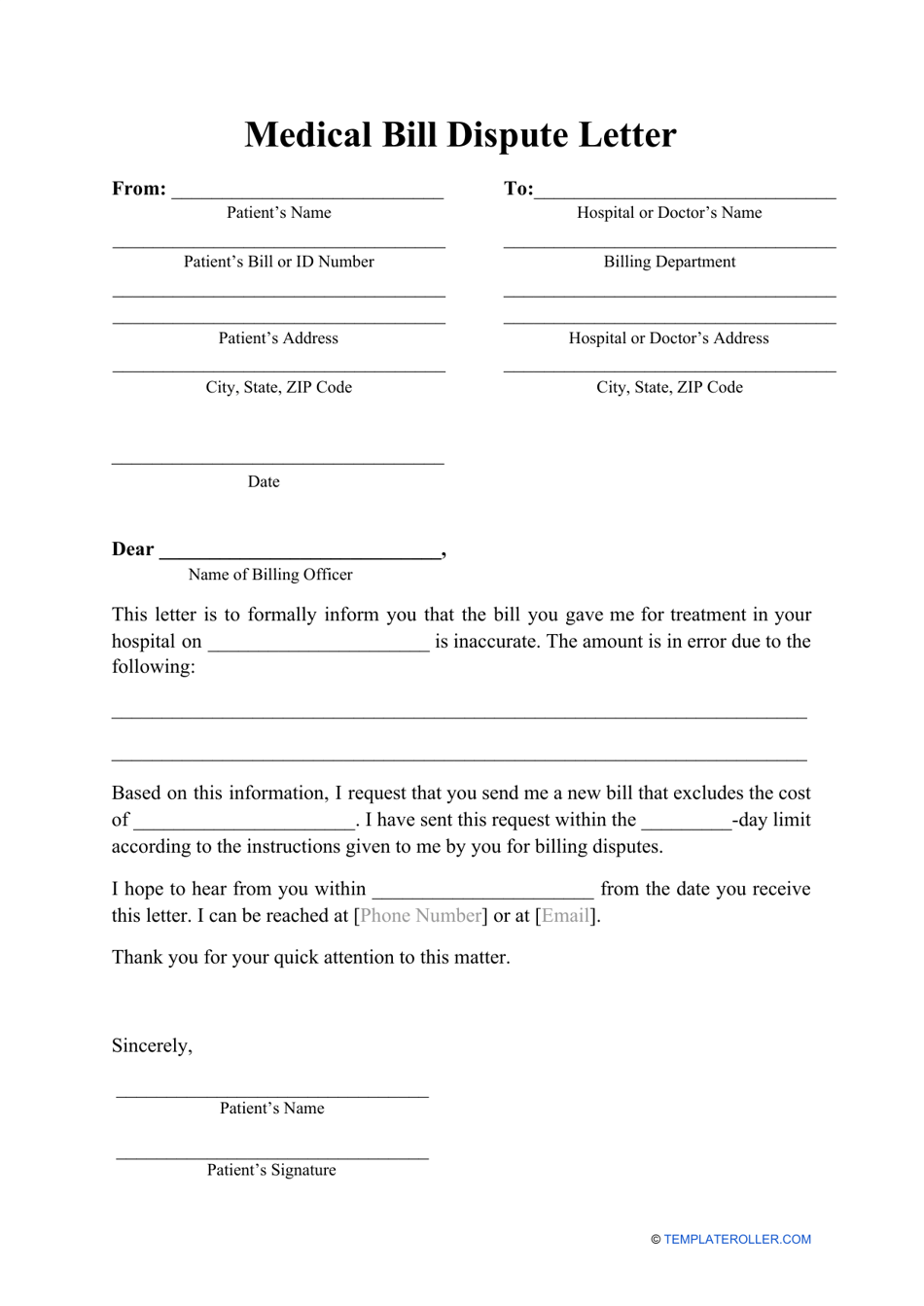

Medical Bill Dispute Letter Template Download Printable PDF

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

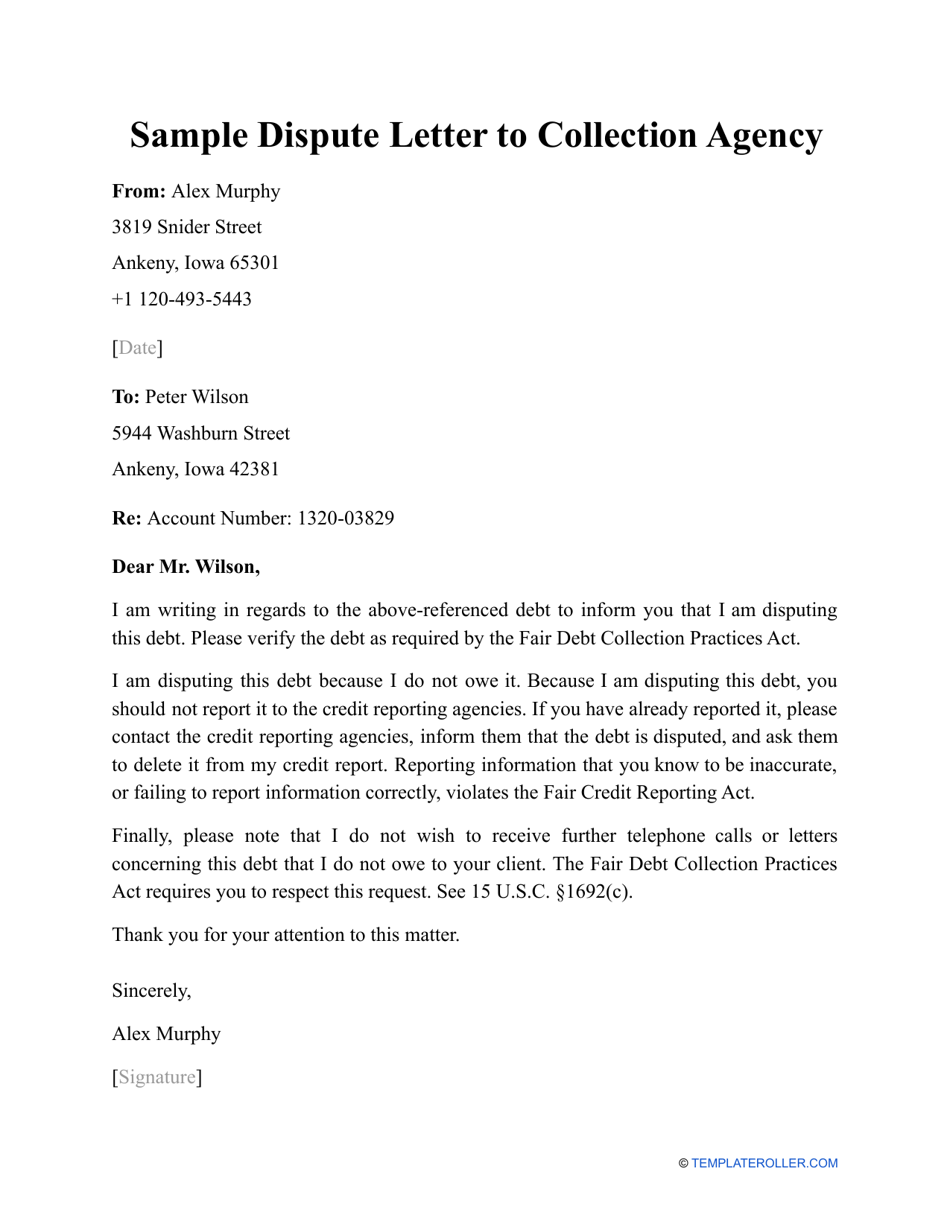

Sample Dispute Letter to Collection Agency Fill Out, Sign Online and

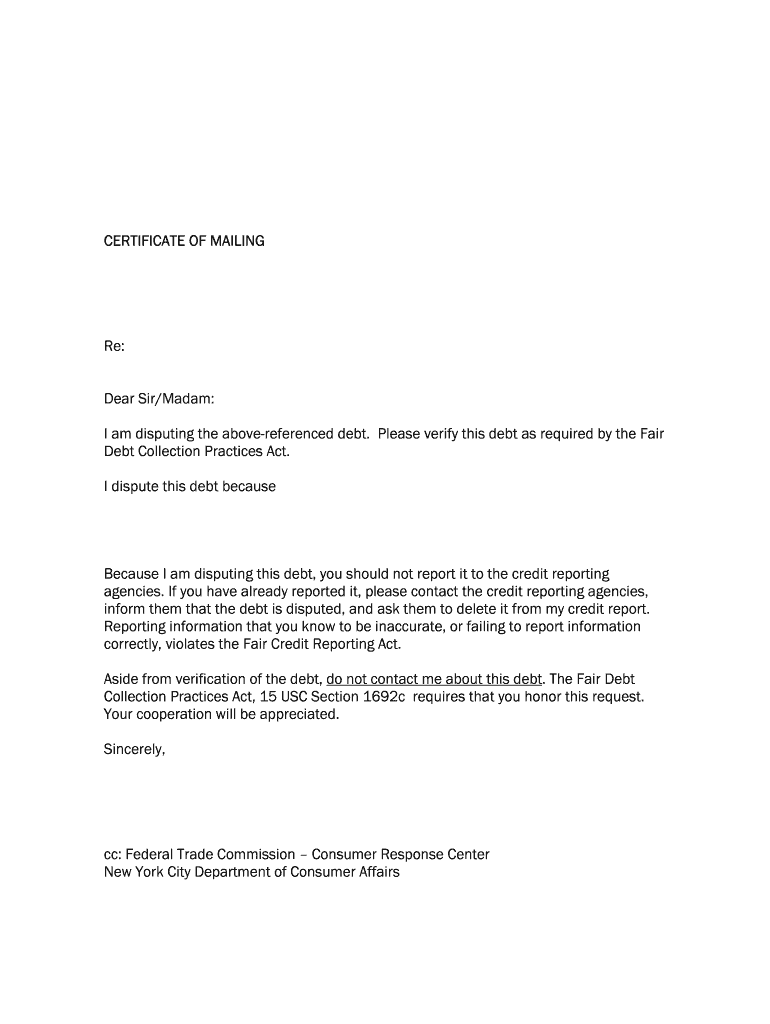

Printable Credit Dispute Letters Pdf 20202022 Fill and Sign

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

FREE 23+ Sample Letter Templates in PDF MS Word Excel

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Up To $40 Cash Back Letter Dispute Charges Sample Format Is A Written Document Used To Contest Or Question The Accuracy, Legitimacy, Or Validity Of Charges That Have Been Made On An.

I Am Writing To Dispute A Fraudulent (Charge Or Debit) On My Account In The Amount Of $______.

Use This Letter To Dispute An Incorrect Charge On Your Credit Card Bill.

Whether It's A Billing Error Or An Unfamiliar Transaction, Knowing How To Address These Issues Effectively Can Save You Both Money And Stress.

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-01-790x1022.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-09.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-17.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-19-790x1022.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-34.jpg)