General Ledger Account Reconciliation Template

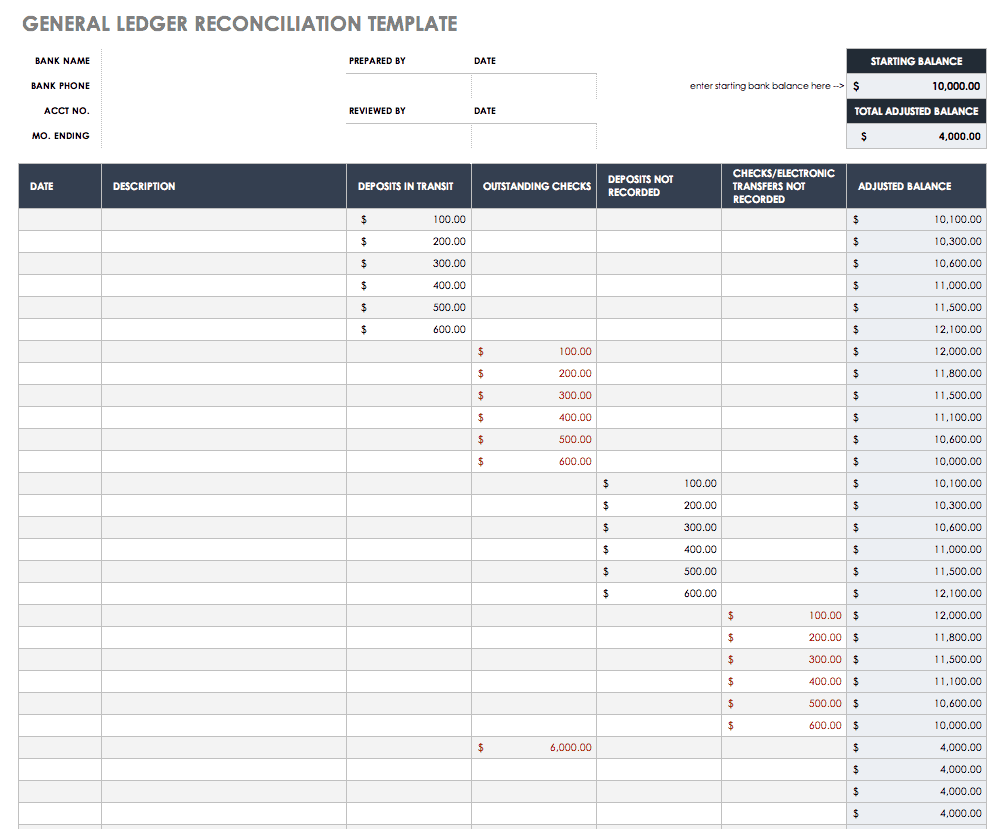

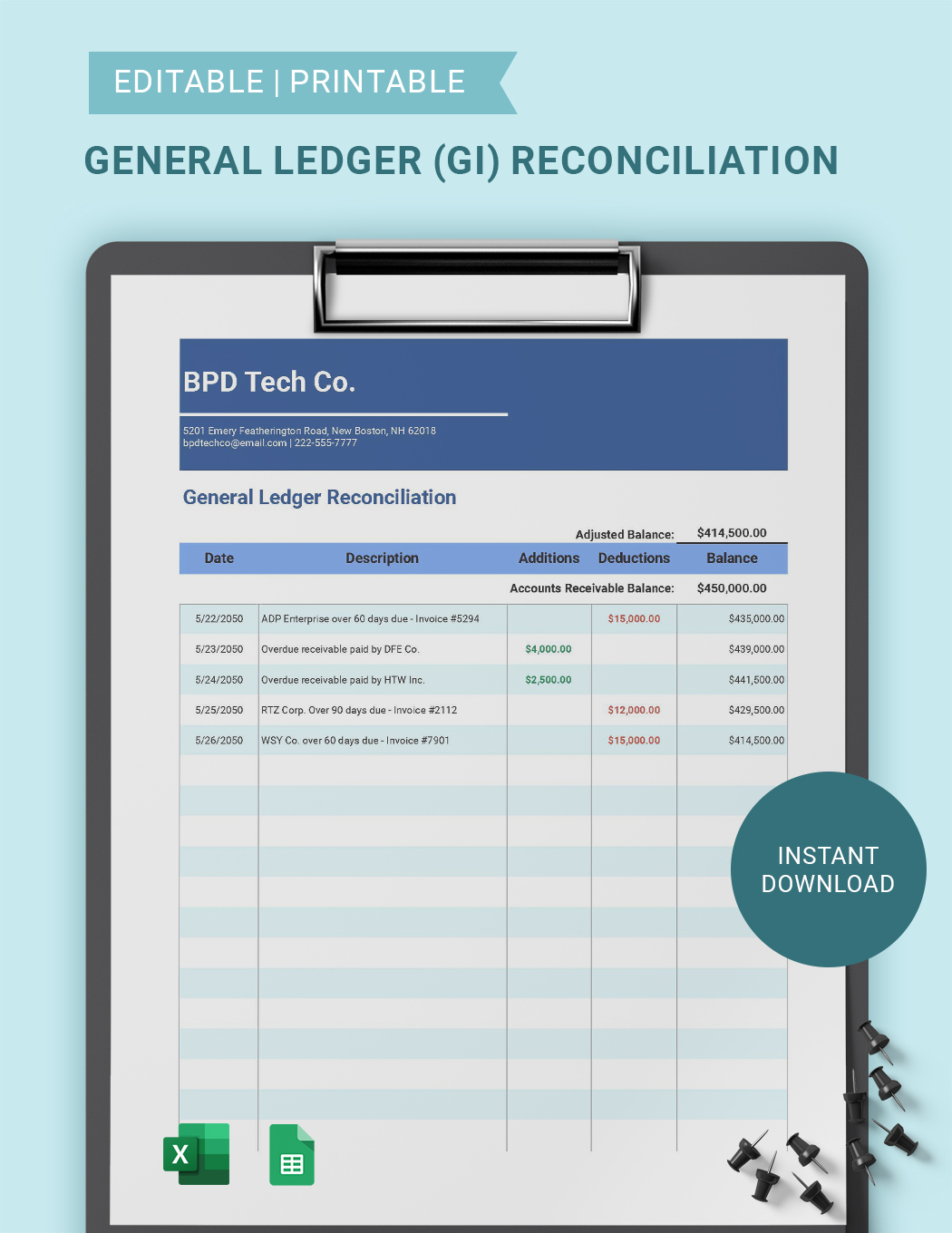

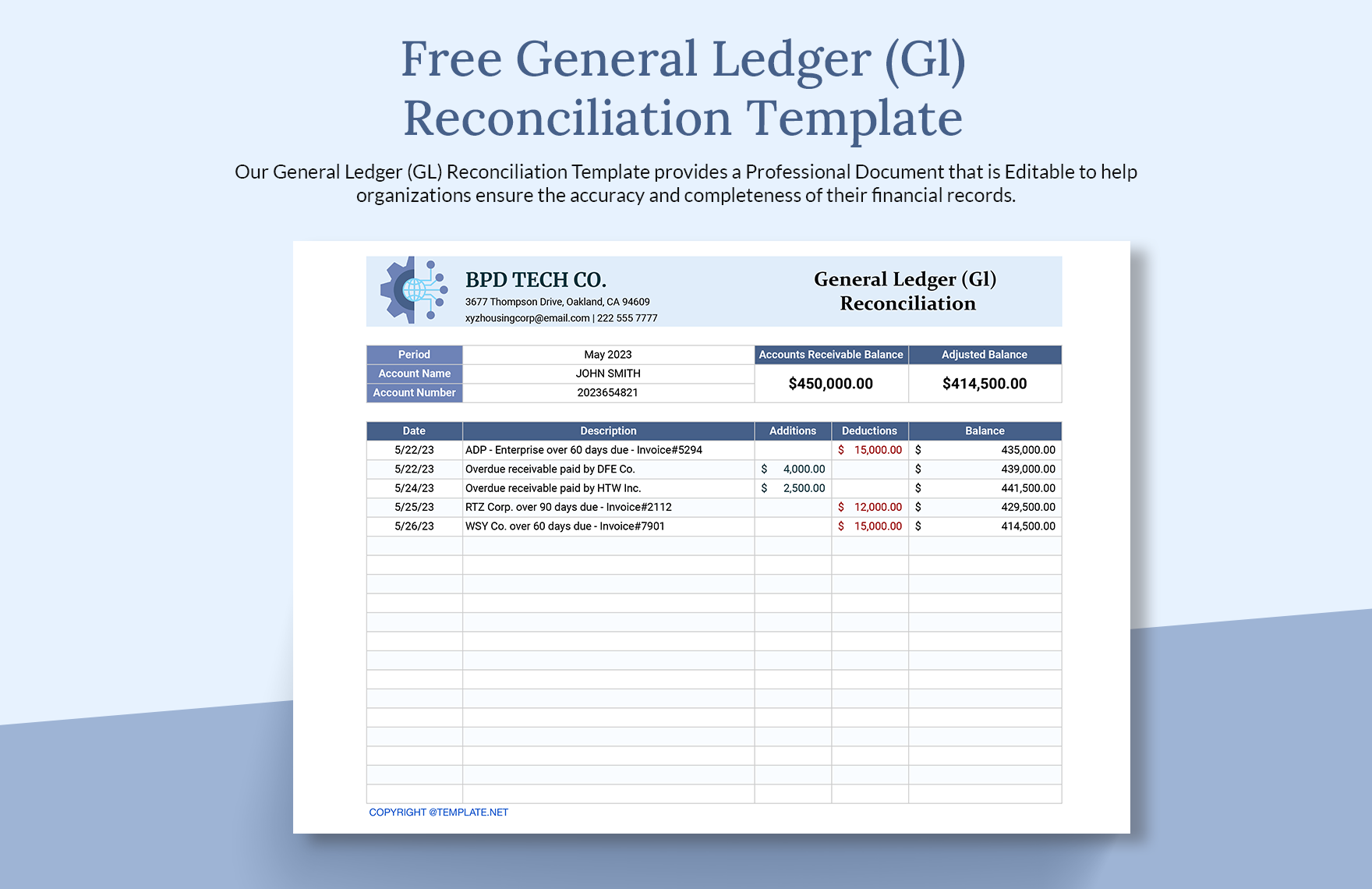

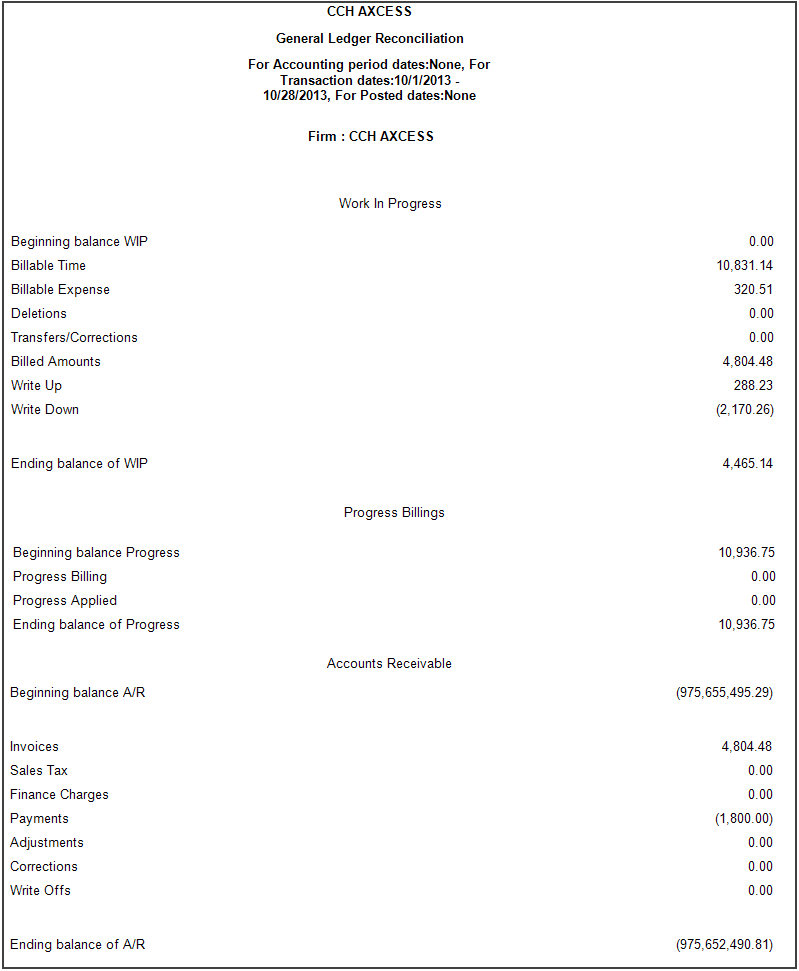

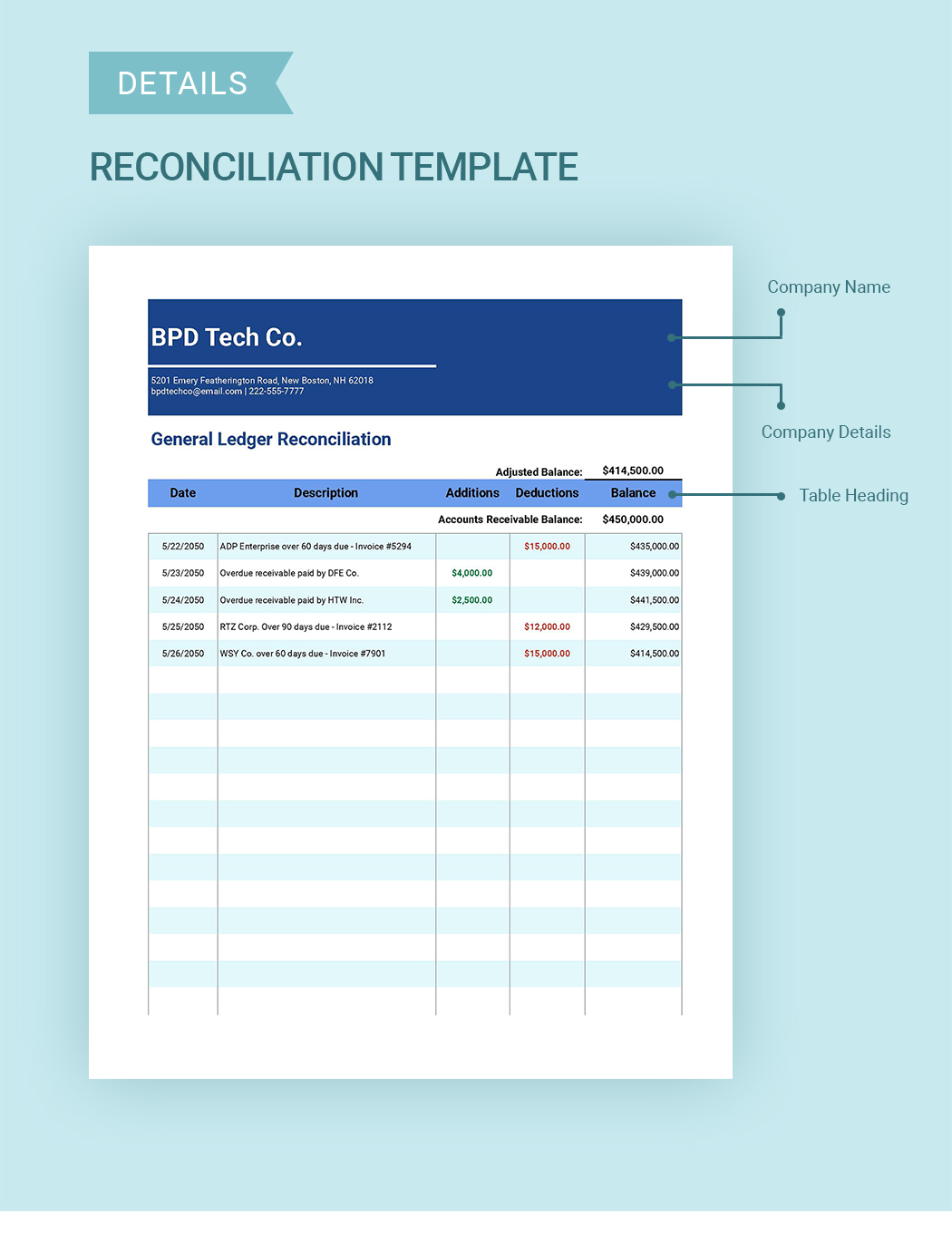

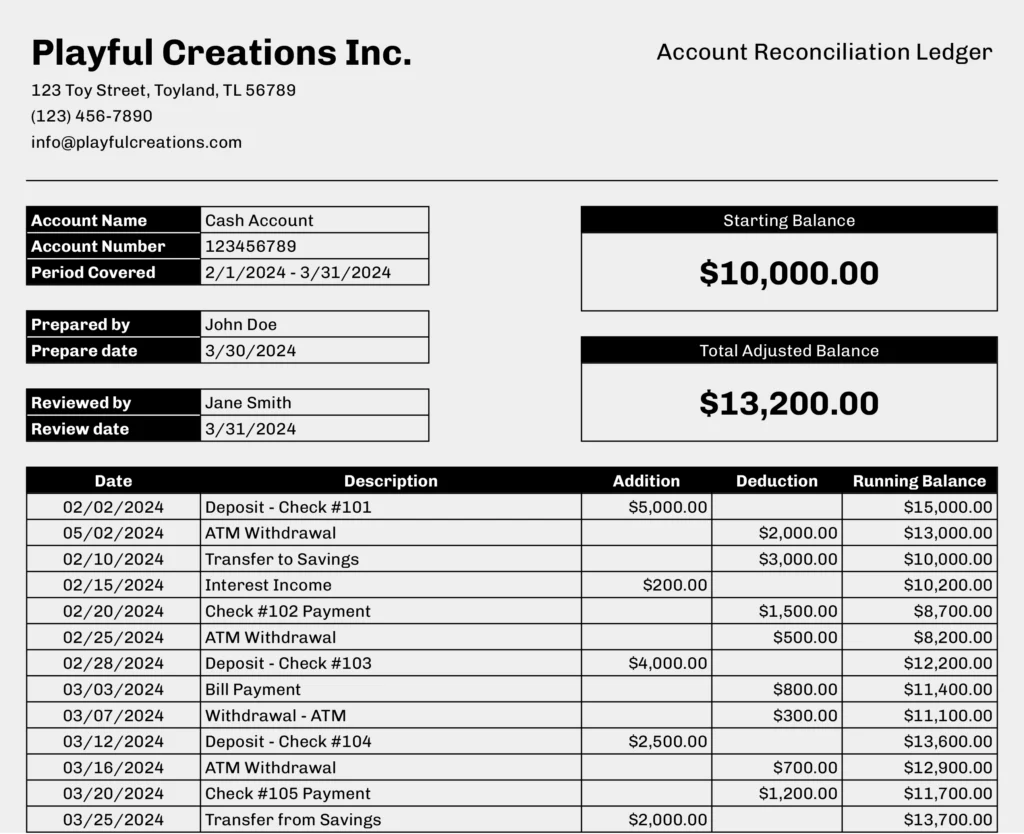

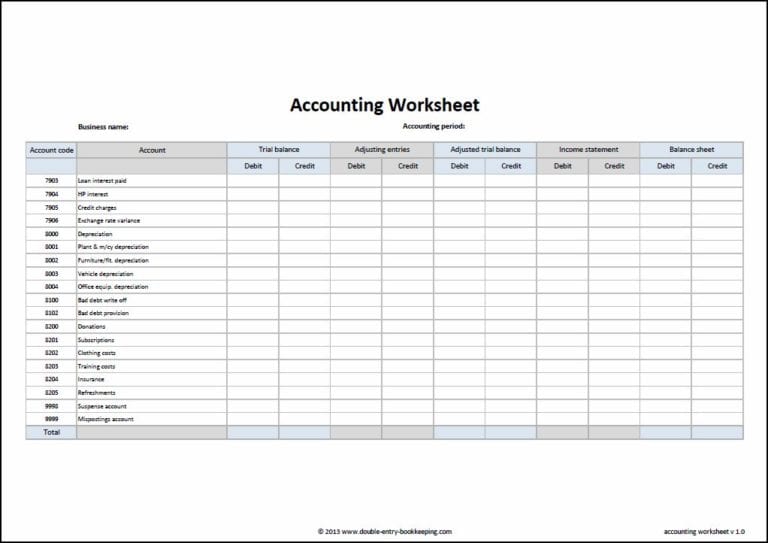

General Ledger Account Reconciliation Template - General ledger reconciliation template bank name date outstanding checks adjusted balance deposits not recorded deposits in transit checks/electronic transfers not recorded total. Use this general ledger reconciliation template to record your company’s financial data and reconcile all accounts. It involves verifying that the balances in the general ledger accounts are correctly reflected in the balance sheet. Column a has a function to get the account number which. Any business needs to reconcile balance sheets at the end of a fiscal year to preview the outstanding payments, revenue, assets, and find out the net liabilities. General ledger account reconciliation lets you identify and correct discrepancies in your financial data that are essential for accurate reports and statements. Companies or individuals can use this general ledger (gl) reconciliation template for bank reconciliation. These templates include customizable columns for transaction dates,. It applies to accounts such as accounts payable,. Slideteam's commitment to excellence is evident in the superior quality of their. It applies to accounts such as accounts payable,. These templates include essential components like balance sheet. Reconciling items arise when general ledger balances differ from external records like bank statements or vendor reports. Excel is a versatile tool. Along with your bank statement, you'll need your own financial records: S then used for a vlookup form. There are two key aspects where slideteam truly stands out: • clearly call out discrepancies on the balance sheet by documenting variances. Summary worksheet of the template. Companies or individuals can use this general ledger (gl) reconciliation template for bank reconciliation. Excel can be used for. Add or delete rows as. These templates include customizable columns for transaction dates,. Creating a general ledger in excel might seem like a big task, especially if you’re new to using spreadsheets for financial management. It applies to accounts such as accounts payable,. Excel can be used for. How do you reconcile a ledger in excel? You need to strike a. This general ledger reconciliation template in excel enables finance and accounting teams at tech companies to: Businesses can also use it for reconciling balance sheet accounts,. You’d typically access it via a. You need to strike a. This template enables you to enter the balance from your. These templates include essential components like balance sheet. Companies or individuals can use this general ledger (gl) reconciliation template for bank reconciliation. These templates include customizable columns for transaction dates,. This template enables you to enter the balance from your. Reconciling items arise when general ledger balances differ from external records like bank statements or vendor reports. What is accounts payable reconciliation? Along with your bank statement, you'll need your own financial records: Below are a variety of reconciliation templates, examples, and instructions, most of which are specific to a gl or gl group and may need to be modified for your specific agency needs. Add or delete rows as. Businesses can also use it for reconciling balance sheet accounts,. These templates include customizable columns for transaction dates,. Along with your bank statement,. You’d typically access it via a. Creating a general ledger in excel might seem like a big task, especially if you’re new to using spreadsheets for financial management. Excel can be used for. These discrepancies typically result from timing. Reconciliation is a key process in accounting and treasury management that involves comparing two sets of records to make sure they. It involves verifying that the balances in the general ledger accounts are correctly reflected in the balance sheet. Download this free account reconciliation ledger template today and experience a new level of financial clarity and efficiency. Add or delete rows as. These templates include essential components like balance sheet. • clearly call out discrepancies on the balance sheet by documenting. With a general ledger account reconciliation template, you can track account balances, identify differences between your general ledger and supporting documents, document adjustments,. Reconciling items arise when general ledger balances differ from external records like bank statements or vendor reports. You’d typically access it via a. Add or delete rows as. It applies to accounts such as accounts payable,. Download this free account reconciliation ledger template today and experience a new level of financial clarity and efficiency. S then used for a vlookup form. Below are a variety of reconciliation templates, examples, and instructions, most of which are specific to a gl or gl group and may need to be modified for your specific agency needs. Companies or individuals. You’d typically access it via a. Accounts payable is the purview of an organization’s general ledger, which includes all payments owed to vendors and other. In today's digital age, using an excel template can simplify and streamline this. How do you reconcile a ledger in excel? Summary worksheet of the template. Businesses can also use it for reconciling balance sheet accounts,. These templates include essential components like balance sheet. Companies or individuals can use this general ledger (gl) reconciliation template for bank reconciliation. This post explains how to perform a general ledger reconciliation, including a detailed outline of the gl reconciliation process, best practices, and a practical example to guide you through. A gl account reconciliation excel template is a standardized spreadsheet used to reconcile general ledger accounts, ensuring account balances match supporting documentation and. It involves verifying that the balances in the general ledger accounts are correctly reflected in the balance sheet. Account reconciliation compares internal financial records against external statements to ensure account balances are accurate. Reconciliation is a key process in accounting and treasury management that involves comparing two sets of records to make sure they match. Below are a variety of reconciliation templates, examples, and instructions, most of which are specific to a gl or gl group and may need to be modified for your specific agency needs. This general ledger reconciliation template in excel enables finance and accounting teams at tech companies to: These discrepancies typically result from timing.General Ledger Reconciliation Template Excel

General Ledger Account Reconciliation Template

General Ledger Reconciliation Template Excel

Reconciliation Templates Excel Format, Free, Download

Gl Reconciliation Template 50 Bank Reconciliation Examples Templates

General Ledger Account Reconciliation Template

General Ledger (Gl) Reconciliation Template Google Sheets, Excel

Free Account Reconciliation Ledger Template for Easy FP&A

General Ledger Account Reconciliation Template —

Column A Has A Function To Get The Account Number Which.

Use This General Ledger Reconciliation Template To Record Your Company’s Financial Data And Reconcile All Accounts.

This Template Enables You To Enter The Balance From Your.

You Need To Strike A.

Related Post: