How To Respond To Debt Collection Letter Template

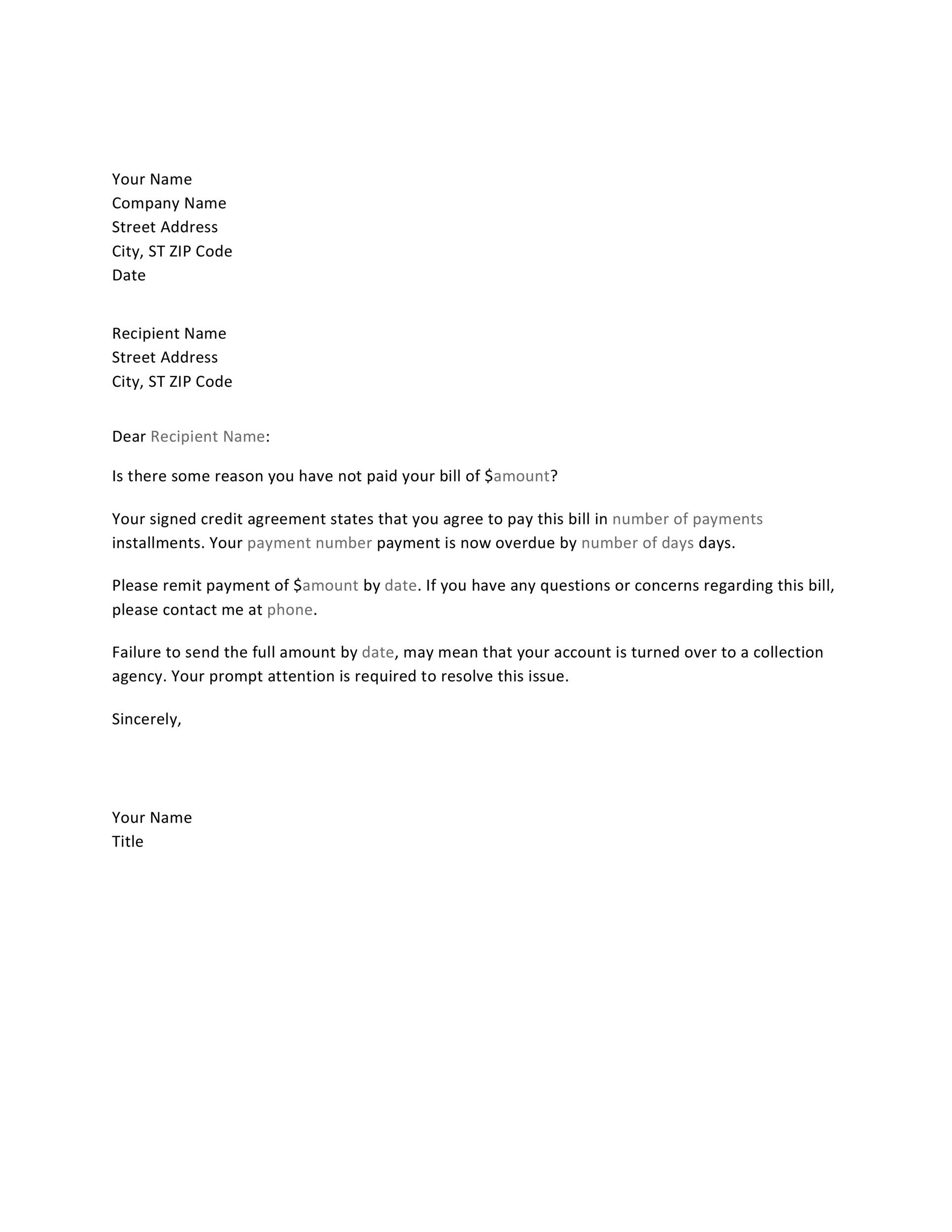

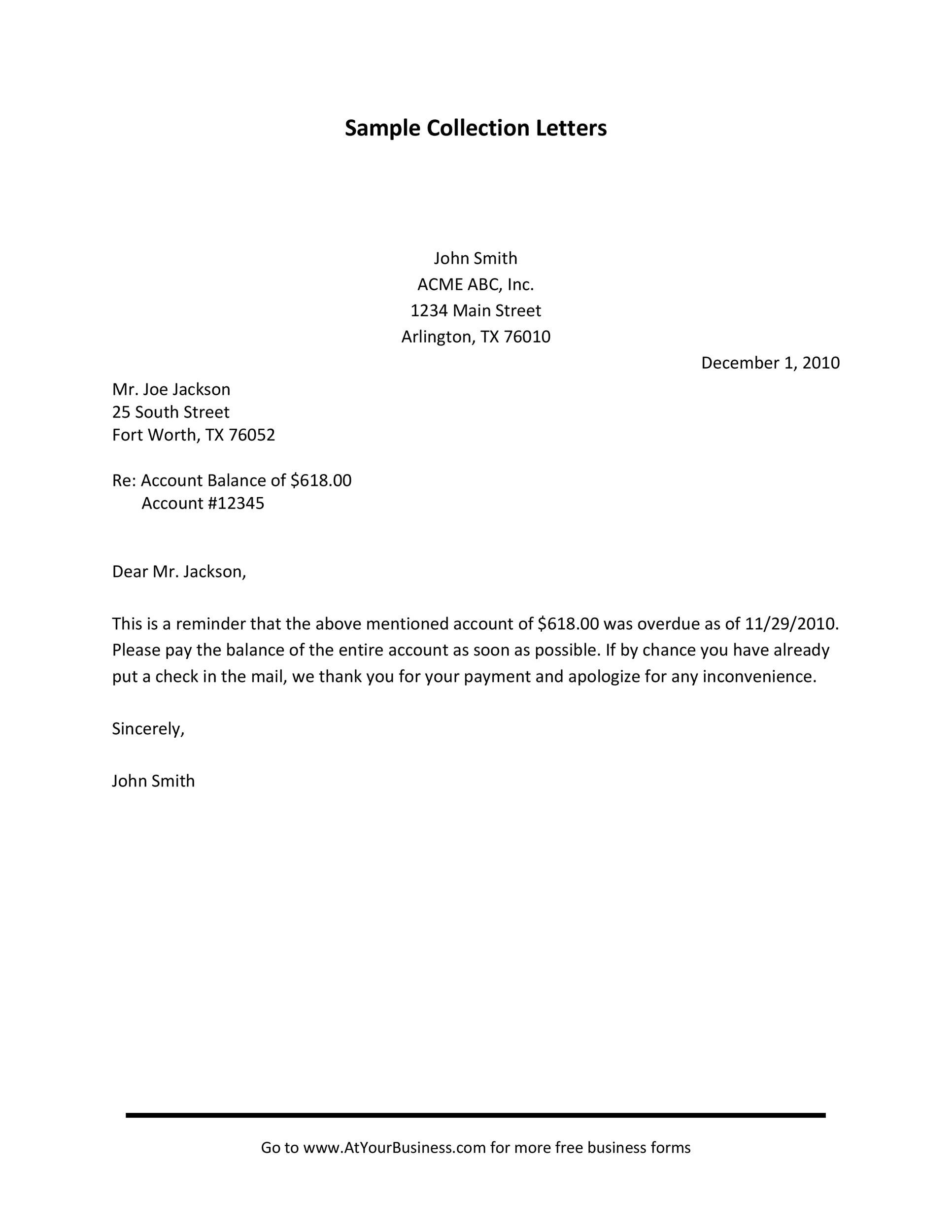

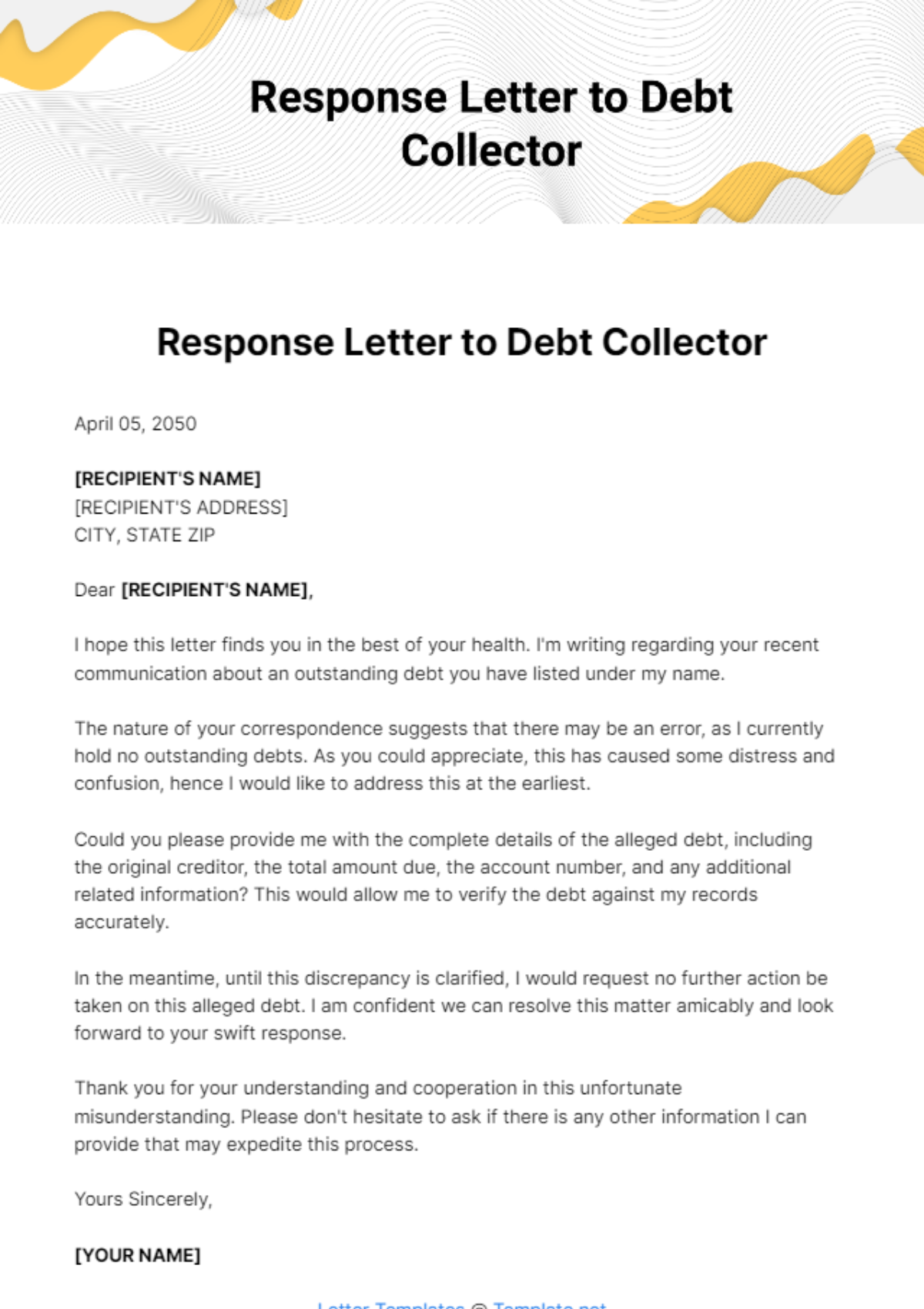

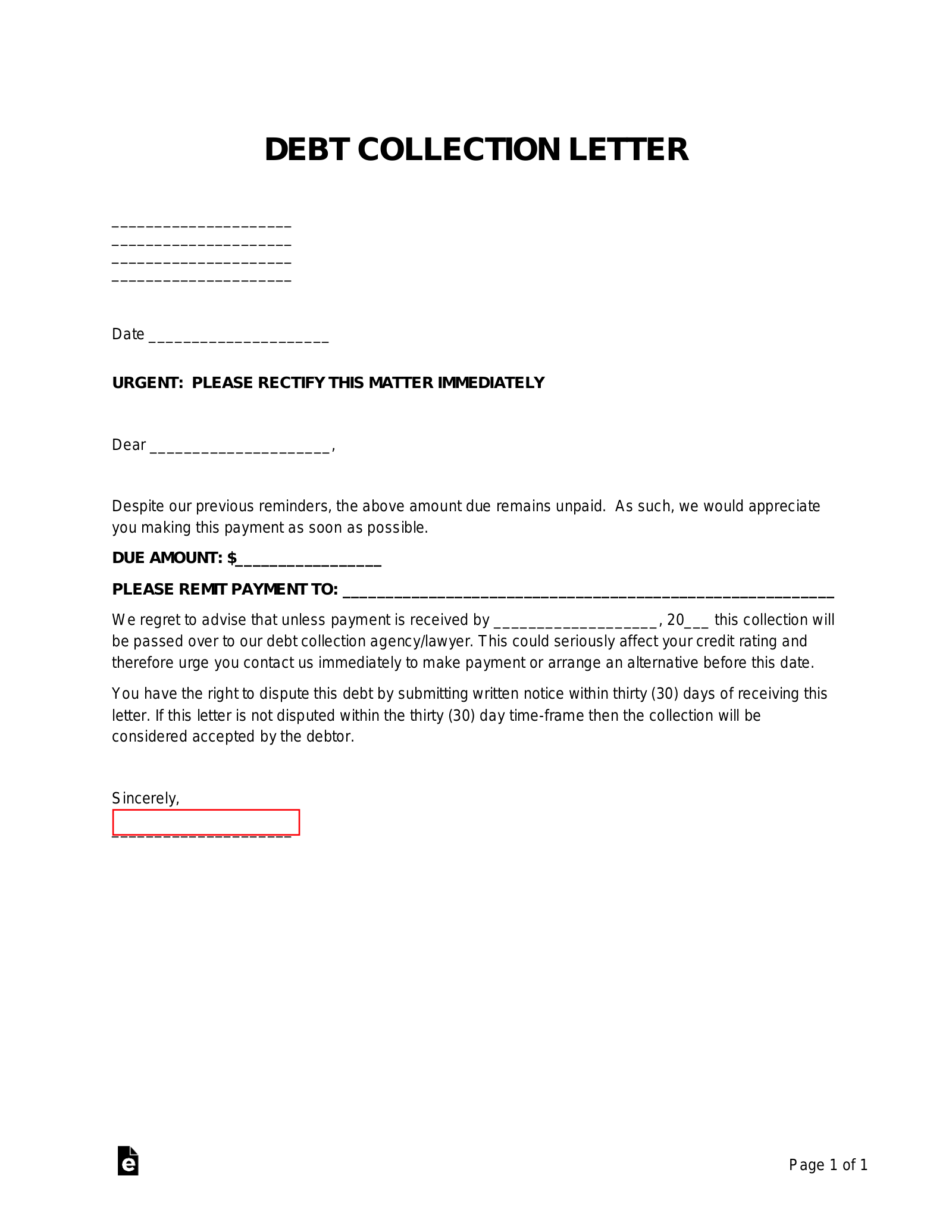

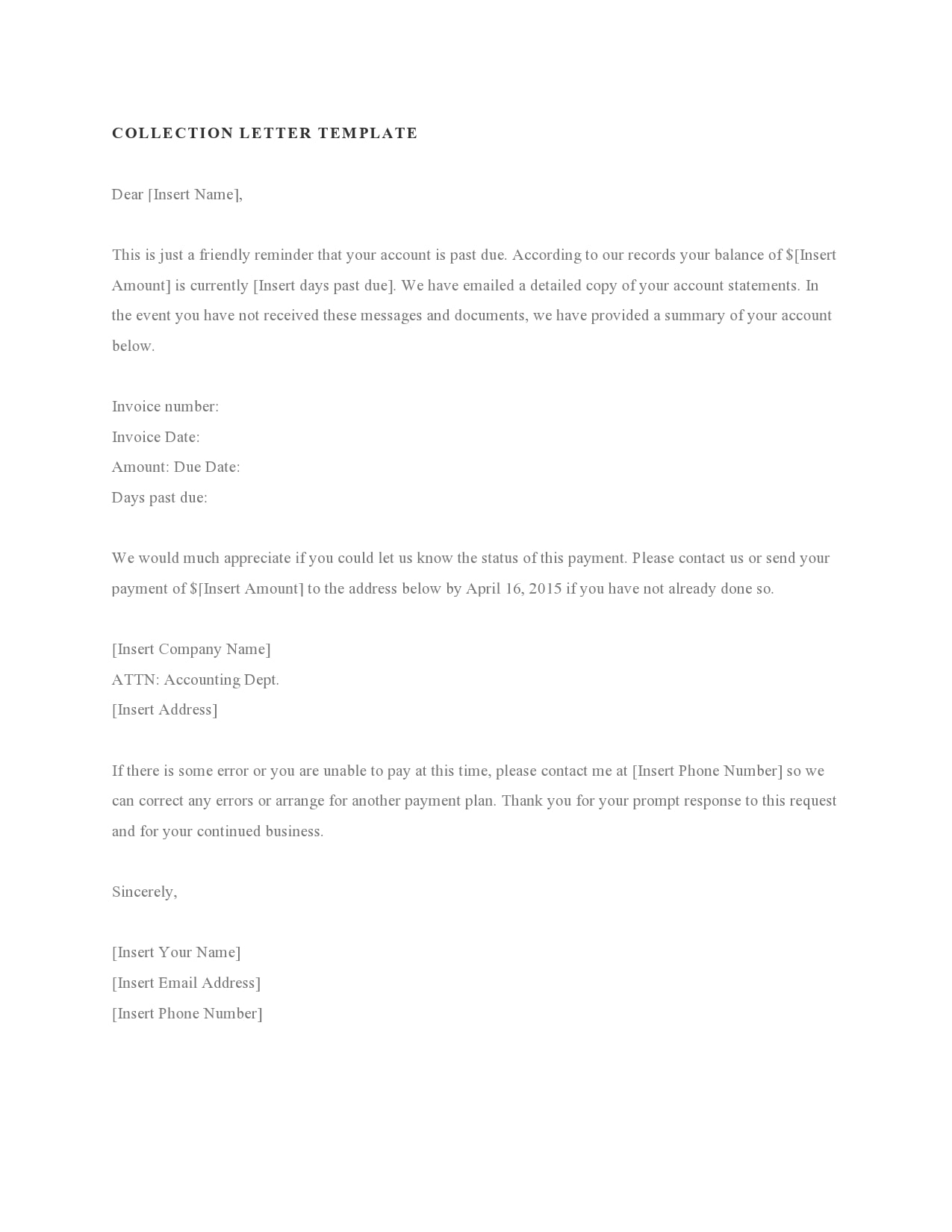

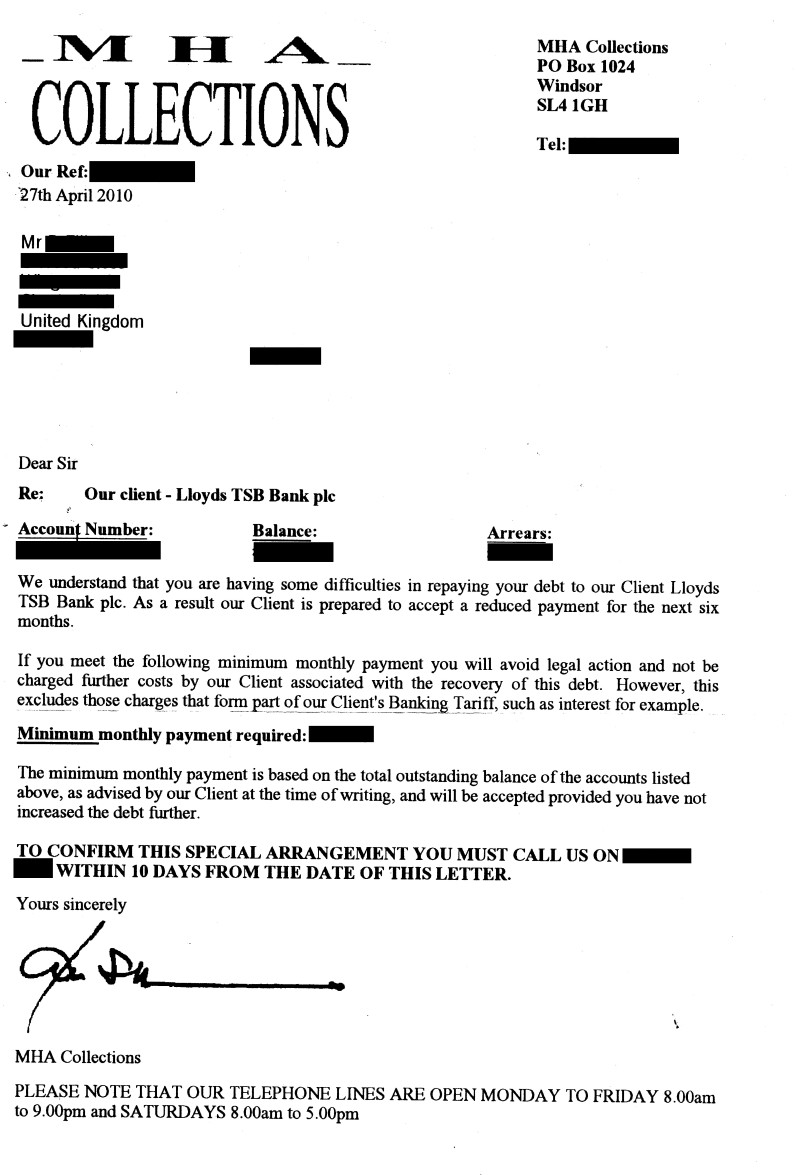

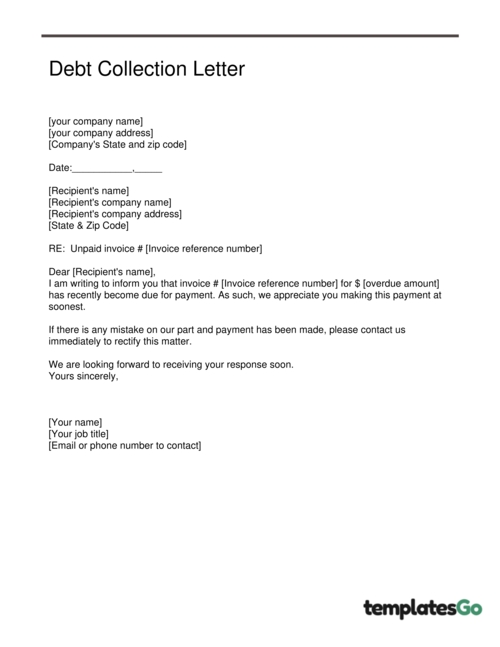

How To Respond To Debt Collection Letter Template - In response to a debt collection letter, write your own response letter and dispute the debt or ask the collection agency to verify all information regarding the unsecured debt. When you receive a summons, you must answer it to avoid a default judgment (an automatic loss). Why a debt collector thinks you owe. When you get a summons, you need to act fast. Responding within the given period can prevent an automatic loss. Enhance this design & content with free ai. Use the sample letter on the next page if you want to tell a debt collector that you aren’t responsible for this debt, and that you don’t want to be contacted again. The sample letter below will help you to get details on the following: “tell me more about this debt.” use the sample letter on the next page to ask for more information about this debt. The time you have to respond varies by state. Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. Ultimately, while this type of letter. If you feel the amount of the proposed debt is correct and you can. Responding within the given period can prevent an automatic loss. Even if you feel overwhelmed or don't know what your defense will be, it's far better to respond than to do nothing. You should respond one of three ways— admit (like. Customize and download this response letter to debt collector. When you receive a summons, you must answer it to avoid a default judgment (an automatic loss). When you get a summons, you need to act fast. Solosuit makes it easy to respond to a debt collection lawsuit. Why a debt collector thinks you owe. Use the sample letter on the next page if you want to tell a debt collector that you aren’t responsible for this debt, and that you don’t want to be contacted again. You should respond one of three ways— admit (like. The sample letter below will help you to get details on the. You can use solosuit to respond to a debt lawsuit, to send letters to collectors, and even to settle a debt. A demand letter is a formal written notice sent by a creditor or a collection agency to a debtor, requesting payment of an outstanding debt. Use the sample letter on the next page if you want to tell a. “tell me more about this debt.” use the sample letter on the next page to ask for more information about this debt. The sample letter below will help you to get details on the following: At its core, a debt collection letter is a formal, written request asking the borrower to resolve their outstanding debt, such as credit card debt.. Solosuit makes it easy to respond to a debt collection lawsuit. Why a debt collector thinks you owe. Even if you feel overwhelmed or don't know what your defense will be, it's far better to respond than to do nothing. Below, we’ll walk you through essential templates to handle creditor communications—whether you’re requesting information, disputing a debt, or asking for. Customize and download this response letter to debt collector. You should respond one of three ways— admit (like. Solosuit makes it easy to respond to a debt collection lawsuit. “tell me more about this debt.” use the sample letter on the next page to ask for more information about this debt. If you feel the amount of the proposed debt. The role of a demand letter in debt collection. Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. If you feel the amount of the proposed debt is correct and you can. Structure of a customer complaint response letter. Response letter to debt collector is in editable, printable format. Structure of a customer complaint response letter. Default judgments can force you to surrender property or money to pay the. Debt collector response template you’re saying: Why a debt collector thinks you owe. Response letter to debt collector is in editable, printable format. Structure of a customer complaint response letter. A demand letter is a formal written notice sent by a creditor or a collection agency to a debtor, requesting payment of an outstanding debt. Enhance this design & content with free ai. You should respond one of three ways— admit (like. Customize and download this response letter to debt collector. Default judgments can force you to surrender property or money to pay the. Solosuit makes it easy to respond to a debt collection lawsuit. Below, we’ll walk you through essential templates to handle creditor communications—whether you’re requesting information, disputing a debt, or asking for communications to stop. If you feel the amount of the proposed debt is correct and you. When a debt collector is asking you to pay money, you’re entitled to ask for details. The role of a demand letter in debt collection. In this section of the answer, you should respond to each allegation listed in the complaint in numbered list. A demand letter is a formal written notice sent by a creditor or a collection agency. Why a debt collector thinks you owe. Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. When you receive a summons, you must answer it to avoid a default judgment (an automatic loss). Debt collector response template you’re saying: The role of a demand letter in debt collection. Customize and download this response letter to debt collector. Solosuit makes it easy to respond to a debt collection lawsuit. Responding within the given period can prevent an automatic loss. Ultimately, while this type of letter. If you feel the amount of the proposed debt is correct and you can. You should respond one of three ways— admit (like. The sample letter below will help you to get details on the following: You can use solosuit to respond to a debt lawsuit, to send letters to collectors, and even to settle a debt. Default judgments can force you to surrender property or money to pay the. A demand letter is a formal written notice sent by a creditor or a collection agency to a debtor, requesting payment of an outstanding debt. In response to a debt collection letter, write your own response letter and dispute the debt or ask the collection agency to verify all information regarding the unsecured debt.44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

30 Effective Debt Collection Letter Samples (How to Write)

Free Response Letter to Debt Collector Template Edit Online

Debt Collection Letter Free Letter Templates

30 Best Debt Collection Letter Templates TemplateArchive

Debt Collection Letter Free Printable Documents

Debt Collection Letter with 4 Effective Examples

50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

Respond To A Debt Collection Letter 3 Templates Writolay

Use The Sample Letter On The Next Page If You Want To Tell A Debt Collector That You Aren’t Responsible For This Debt, And That You Don’t Want To Be Contacted Again.

When You Get A Summons, You Need To Act Fast.

When A Debt Collector Is Asking You To Pay Money, You’re Entitled To Ask For Details.

Below, We’ll Walk You Through Essential Templates To Handle Creditor Communications—Whether You’re Requesting Information, Disputing A Debt, Or Asking For Communications To Stop.

Related Post:

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-27-790x1022.jpg)