Irr Template

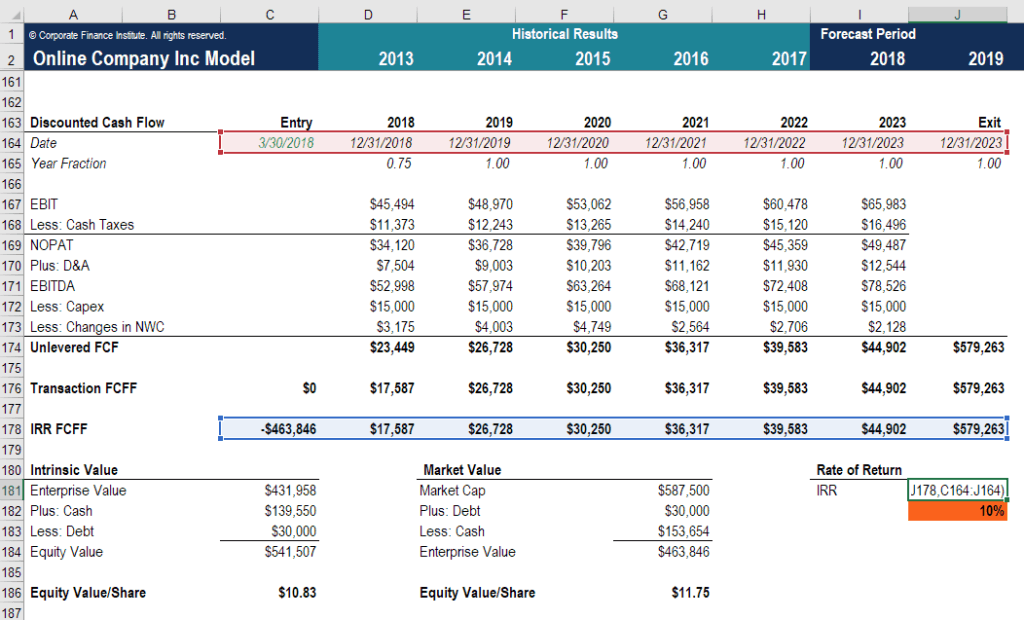

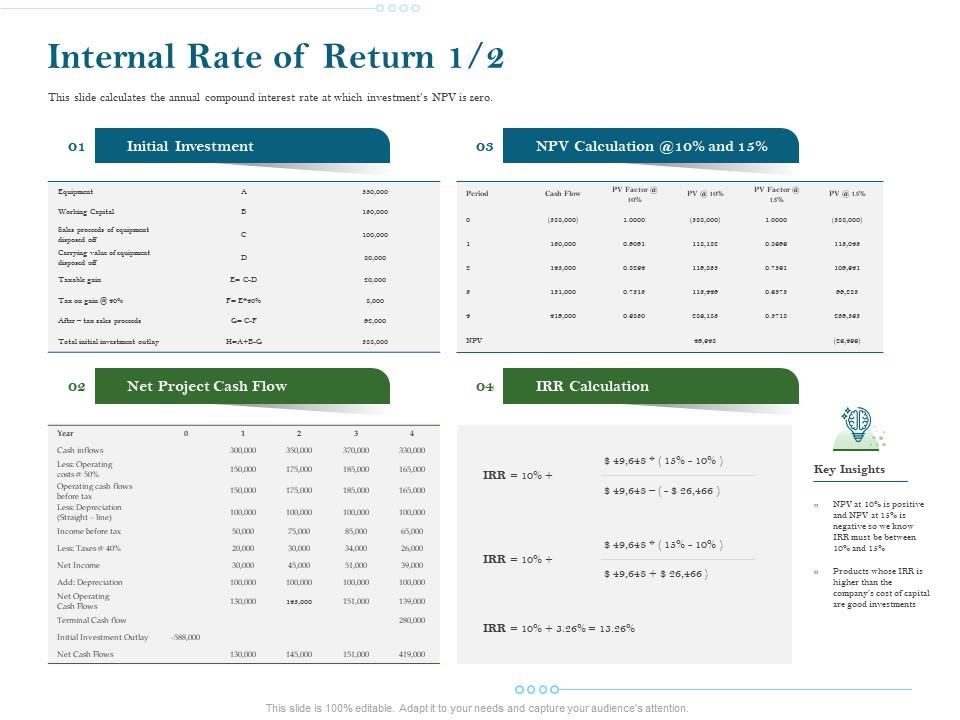

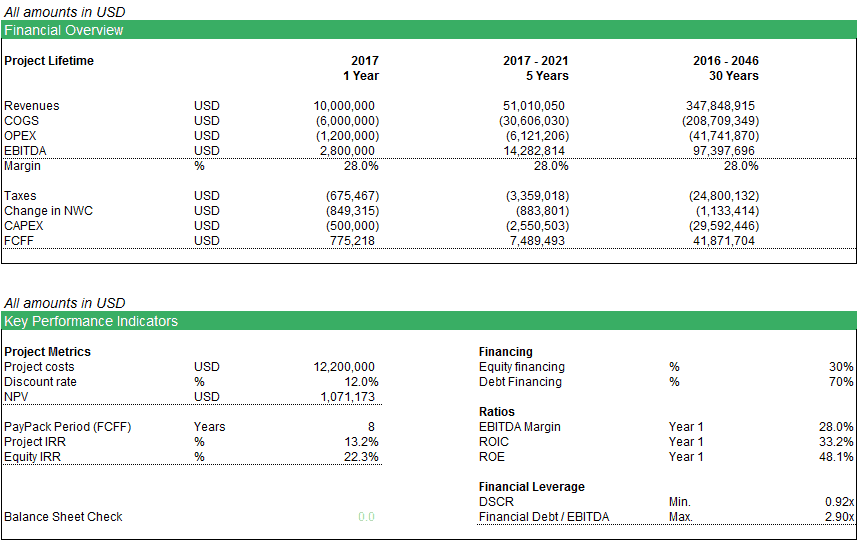

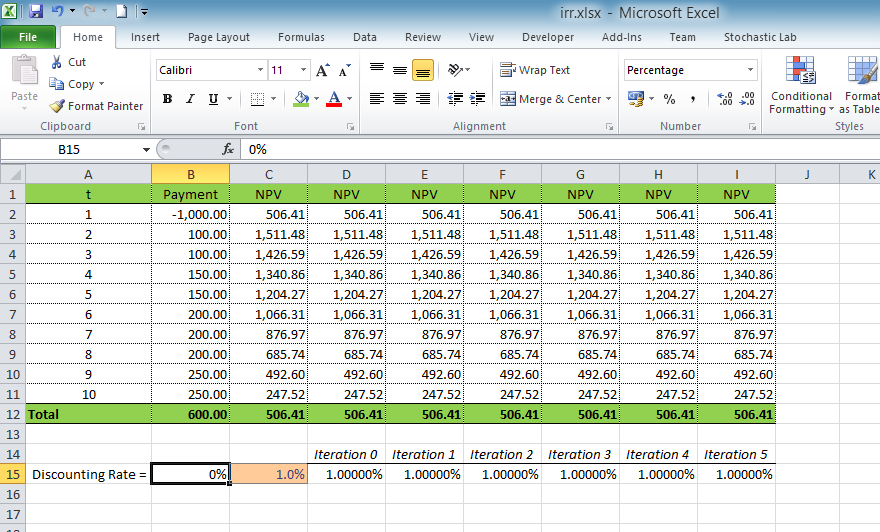

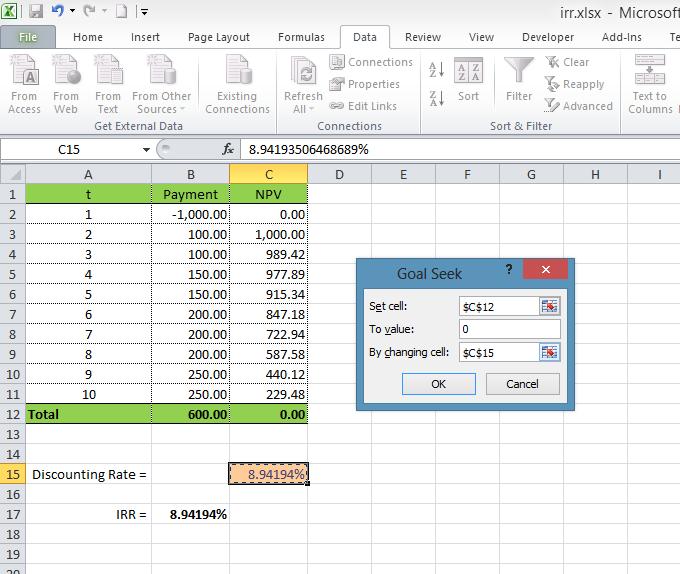

Irr Template - It also explains how irr is different from the net present value. This suggests a decent return rate, exceeding the 8% discount rate. Our irr template will calculate. We are not a big fan of the irr, but we explain what it is all about here. Guide to calculate irr in excel. The npv and irr template for excel calculates the net present value (npv) and internal rate of return (irr) percentages for regular period cash flows. This article teaches you the basics of irr, and how the irr function may be used to calculate irr in excel. The irr is used to make the npv of cash. This free irr calculator can be used by a business to calculate irr and evaluate up to five projects with ten year cash flows. We also provide an excel template where you can perform your own calculations. The irr is used to make the npv of cash. These templates calculate irr = npv(rate, values) = 0. What is the internal rate of return (irr)? This xirr vs irr template allows you to differentiate between the use of irr and xirr functions to compute the internal rate of return. The internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. The internal rate of return (irr) measures an investment's profitability, taking into account the time value of money. It also explains how irr is different from the net present value. The npv and irr template for excel calculates the net present value (npv) and internal rate of return (irr) percentages for regular period cash flows. The internal rate of return is the discount rate which. Irr tells you the return that you’re making on an. These templates calculate irr = npv(rate, values) = 0. This article teaches you the basics of irr, and how the irr function may be used to calculate irr in excel. The internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. What is the internal rate of return (irr)? Our. In this post, i’ll build off that worksheet and show you how you can calculate the internal rate of return (irr) in excel. These templates calculate irr = npv(rate, values) = 0. This xirr vs irr template allows you to differentiate between the use of irr and xirr functions to compute the internal rate of return. We also provide an. The irr is used to make the npv of cash. This suggests a decent return rate, exceeding the 8% discount rate. The internal rate of return (irr) measures an investment's profitability, taking into account the time value of money. These templates calculate irr = npv(rate, values) = 0. Irr tells you the return that you’re making on an. Our irr template will calculate. =irr(b1:b6) the irr comes out to be around 14.5%. This free irr calculator can be used by a business to calculate irr and evaluate up to five projects with ten year cash flows. The npv and irr template for excel calculates the net present value (npv) and internal rate of return (irr) percentages for regular. We also provide an excel template where you can perform your own calculations. =irr(b1:b6) the irr comes out to be around 14.5%. What is the internal rate of return (irr)? The irr is used to make the npv of cash. This suggests a decent return rate, exceeding the 8% discount rate. This xirr vs irr template allows you to differentiate between the use of irr and xirr functions to compute the internal rate of return. Guide to calculate irr in excel. This article teaches you the basics of irr, and how the irr function may be used to calculate irr in excel. The internal rate of return (irr) is a discount. This suggests a decent return rate, exceeding the 8% discount rate. We also provide an excel template where you can perform your own calculations. =irr(b1:b6) the irr comes out to be around 14.5%. The internal rate of return (irr) measures an investment's profitability, taking into account the time value of money. The irr is used to make the npv of. What is the internal rate of return (irr)? In this post, i’ll build off that worksheet and show you how you can calculate the internal rate of return (irr) in excel. Our irr template will calculate. This article teaches you the basics of irr, and how the irr function may be used to calculate irr in excel. Irr tells you. We also provide an excel template where you can perform your own calculations. The internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. We discuss the irr formula and function's use in excel, calculation, examples, and downloadable templates. The internal rate of return (irr) measures an investment's profitability, taking. We discuss the irr formula and function's use in excel, calculation, examples, and downloadable templates. The internal rate of return (irr) measures an investment's profitability, taking into account the time value of money. In this post, i’ll build off that worksheet and show you how you can calculate the internal rate of return (irr) in excel. This free irr calculator. Our irr template will calculate. This suggests a decent return rate, exceeding the 8% discount rate. What is the internal rate of return (irr)? In this post, i’ll build off that worksheet and show you how you can calculate the internal rate of return (irr) in excel. This free irr calculator can be used by a business to calculate irr and evaluate up to five projects with ten year cash flows. Guide to calculate irr in excel. The internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. We are not a big fan of the irr, but we explain what it is all about here. The npv and irr template for excel calculates the net present value (npv) and internal rate of return (irr) percentages for regular period cash flows. We discuss the irr formula and function's use in excel, calculation, examples, and downloadable templates. The irr is used to make the npv of cash. The internal rate of return is the discount rate which. It also explains how irr is different from the net present value. The internal rate of return (irr) measures an investment's profitability, taking into account the time value of money. We also provide an excel template where you can perform your own calculations. This xirr vs irr template allows you to differentiate between the use of irr and xirr functions to compute the internal rate of return.Internal Rate of Return (IRR) How to use the IRR Formula

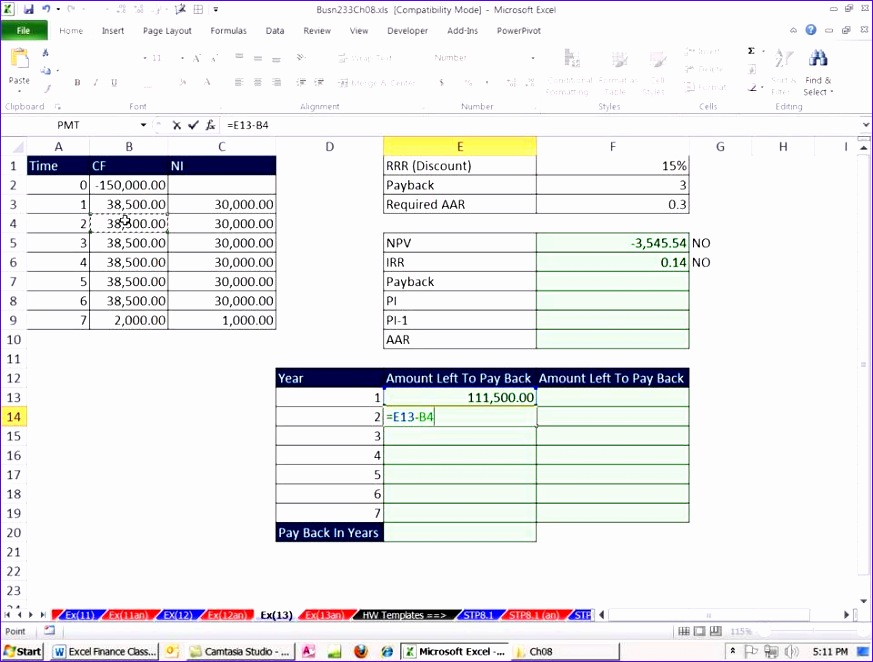

Excel Irr Template

Internal Rate of Return Examples IRR Calculation Form eFinancialModels

12 Internal Rate Of Return Excel Template Excel Templates Excel

Internal Rate of Return (IRR) Excel Template • 365 Financial Analyst

7 Excel Irr Template Excel Templates Excel Templates

Calculating Internal Rate of Return (IRR) using Excel Excel VBA Templates

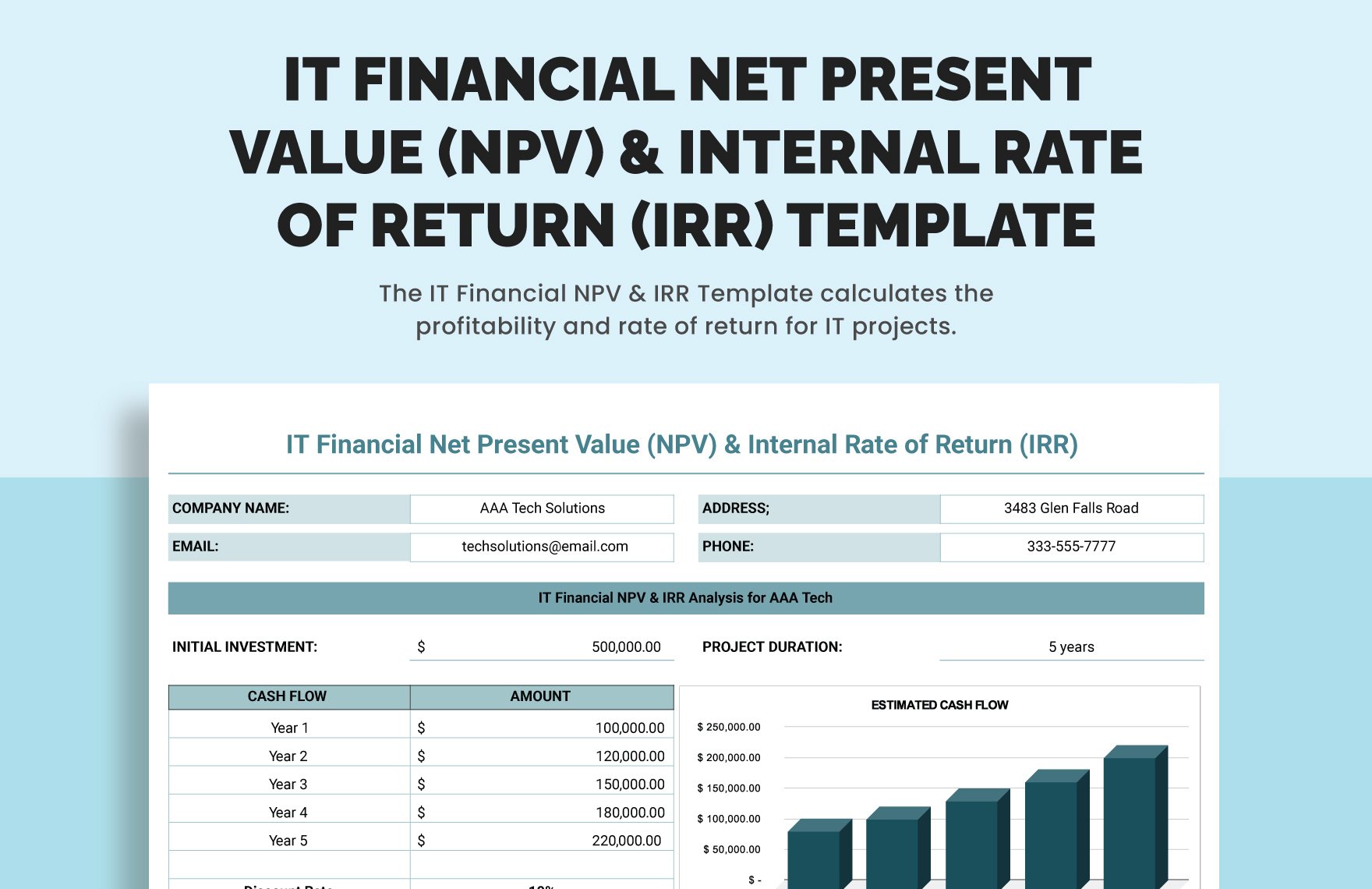

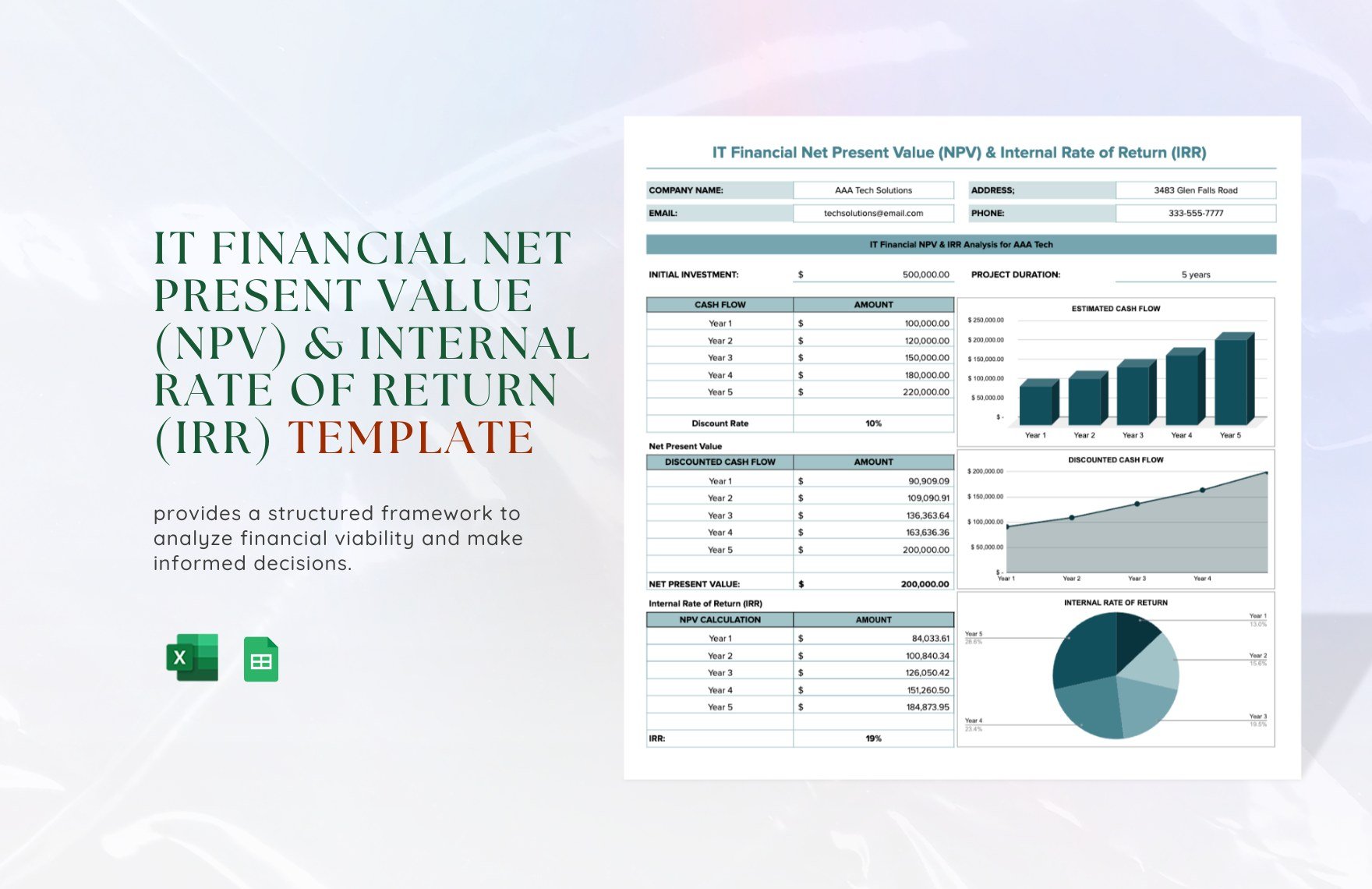

IT Financial Net Present Value (NPV) & Internal Rate of Return (IRR

Calculating Internal Rate of Return (IRR) using Excel Excel VBA Templates

IT Financial Net Present Value (NPV) & Internal Rate of Return (IRR

This Article Teaches You The Basics Of Irr, And How The Irr Function May Be Used To Calculate Irr In Excel.

=Irr(B1:B6) The Irr Comes Out To Be Around 14.5%.

These Templates Calculate Irr = Npv(Rate, Values) = 0.

Irr Tells You The Return That You’re Making On An.

Related Post: