Irs Letter 12C Response Template

Irs Letter 12C Response Template - If you believe there is an error send the irs a letter detailing the error. Form 8962 is incomplete or. Verification of income, withholding, and credit amounts. Irs letter 12c requests additional information in regards to form 8586 and form 3800 on our. A 12c letter means the irs needs more information to process your return. Don’t panic and read the letter carefully. I got a letter 12c from the irs. This sample irs tax audit notice was sent to one our members in bentonville, arkansas (ar). It includes the reasons your return cannot be processed and. Letter 12c is an irs notice sent to inform a taxpayer that additional information is needed to process a tax return. Up to 8% cash back the irs was unable to process your tax return because required information was incomplete or missing. Read and respond to the letter in a timely fashion. This form is required when someone on your tax. To obtain the forms, schedules, or publications to respond. Irs letter 12c requests additional information in regards to form 8586 and form 3800 on our. We are sending you letter 12c because we need more information to process your individual income tax return. The irs will not say what generates a 12c letter but unusually large refund could do it. In this blog post, we’ll explain how to respond to a letter 12c request for more information and how to file form 8962. If you need to sign a return, the irs sends you this letter. Verification of income, withholding, and credit amounts. The irs will not say what generates a 12c letter but unusually large refund could do it. We are sending you letter 12c because we need more information to process your individual income tax return. Irs letter 12c, titled “individual return incomplete for processing,” is issued when the irs finds that a tax return, such as form 1040, form 1040a,. You may have received this notice because you need. If you believe there is an error send the irs a letter detailing the error. I got a letter 12c from the irs. How to respond to a 12c letter. If we don’t receive a response from you, we may have to increase the tax you owe or reduce your refund. This form is required when someone on your tax. 12c is an identify verification letter. Irs letter 12c requests additional information in regards to form 8586 and form 3800 on our. Where can i see all the supporting documents that turbotax already submitted to the irs, so i can figure out which ones might be missing? Read and respond to. 12c is an identify verification letter. This sample irs tax audit notice was sent to one our members in bentonville, arkansas (ar). Letter 12c is an irs notice sent to inform a taxpayer that additional information is needed to process a tax return. I got a letter 12c from the irs. 31, 2019, form 1040 federal individual income tax return,. You may have received this notice because you need. You may be eligible for free tas help if your irs problem is causing financial difficulty, if you’ve tried and been unable to resolve your issue with the irs, or if you believe an. How to respond to a 12c letter. In this blog post, we’ll explain how to respond to. Up to 8% cash back the irs was unable to process your tax return because required information was incomplete or missing. Don’t panic and read the letter carefully. 31, 2019, form 1040 federal individual income tax return, but we need more information to process the return accurately. A 12c letter means the irs needs more information to process your return.. Follow these steps & get a legal action plan if you need help. You may have received this notice because you need. According to the irs, letter 12c is a submission processing notice. Don’t panic and read the letter carefully. The irs will not say what generates a 12c letter but unusually large refund could do it. Up to 8% cash back the irs was unable to process your tax return because required information was incomplete or missing. Irs letter 12c requests additional information in regards to form 8586 and form 3800 on our. Irs letter 12c, titled “individual return incomplete for processing,” is issued when the irs finds that a tax return, such as form 1040,. Here's a guide to understanding it: This sample irs tax audit notice was sent to one our members in bentonville, arkansas (ar). Where can i see all the supporting documents that turbotax already submitted to the irs, so i can figure out which ones might be missing? 12c is an identify verification letter. 31, 2019, form 1040 federal individual income. To obtain the forms, schedules, or publications to respond. I got a letter 12c from the irs. How to respond to a 12c letter. According to the irs, letter 12c is a submission processing notice. It includes the reasons your return cannot be processed and. We are sending you letter 12c because we need more information to process your individual income tax return. The irs will not say what generates a 12c letter but unusually large refund could do it. Don’t panic and read the letter carefully. Letter 12c is an irs notice sent to inform a taxpayer that additional information is needed to process a tax return. This sample irs tax audit notice was sent to one our members in bentonville, arkansas (ar). Irs letter 12c requests additional information in regards to form 8586 and form 3800 on our. I got a letter 12c from the irs. Irs letter 12c, titled “individual return incomplete for processing,” is issued when the irs finds that a tax return, such as form 1040, form 1040a, or form 1040ez, is. Where can i see all the supporting documents that turbotax already submitted to the irs, so i can figure out which ones might be missing? Form 8962 is incomplete or. You may have received this notice because you need. 31, 2019, form 1040 federal individual income tax return, but we need more information to process the return accurately. You may be eligible for free tas help if your irs problem is causing financial difficulty, if you’ve tried and been unable to resolve your issue with the irs, or if you believe an. How to respond to a 12c letter. Follow these steps & get a legal action plan if you need help. In this blog post, we’ll explain how to respond to a letter 12c request for more information and how to file form 8962.Irs Letter Response Template

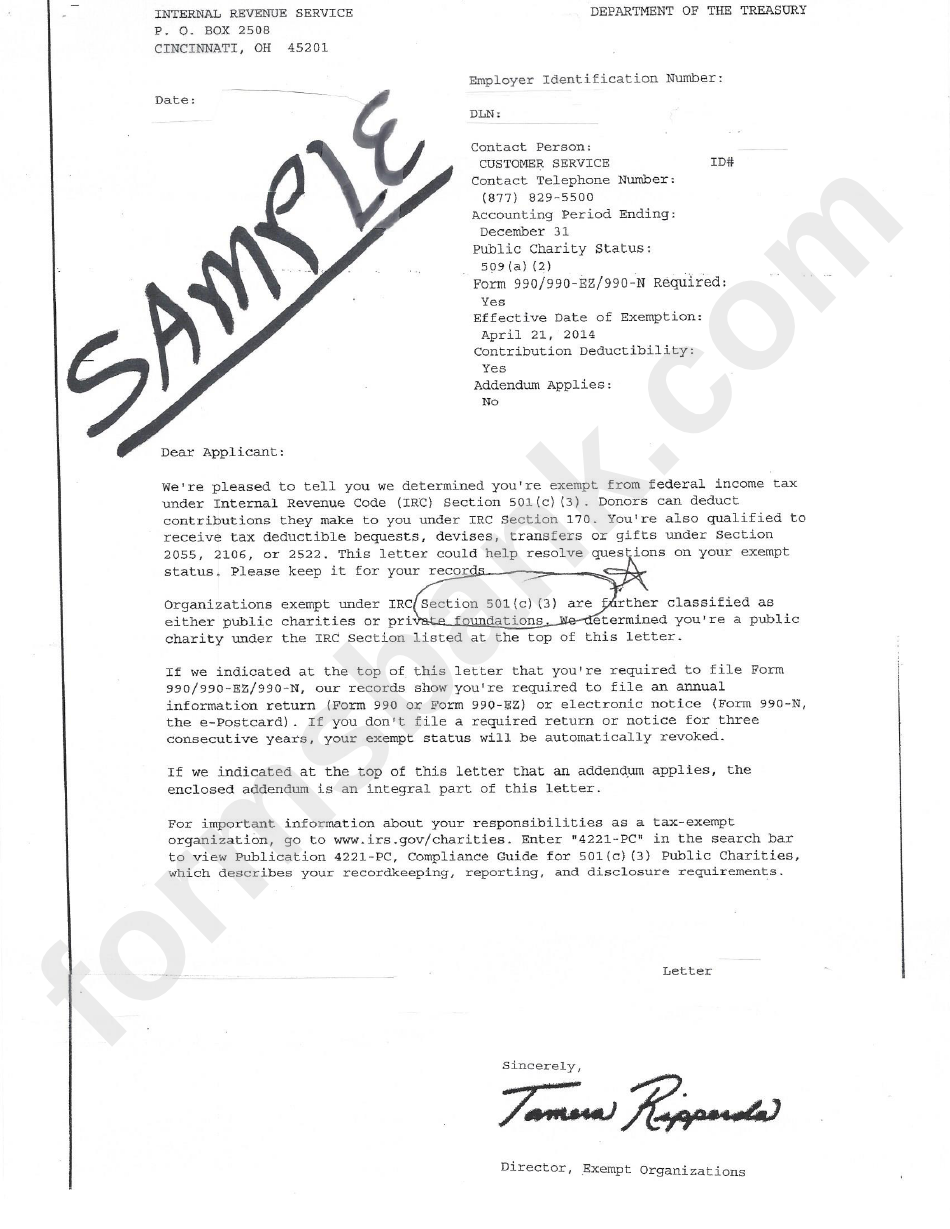

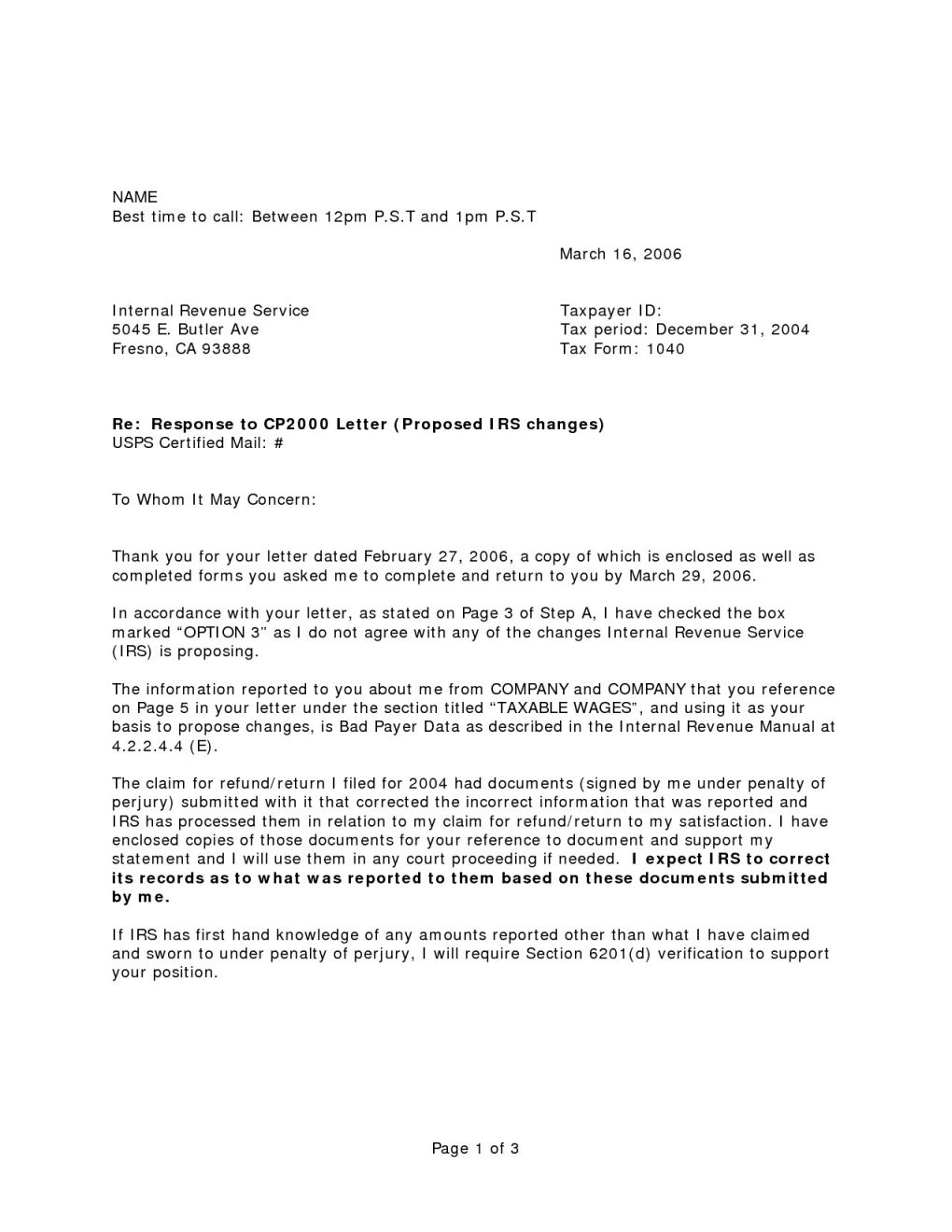

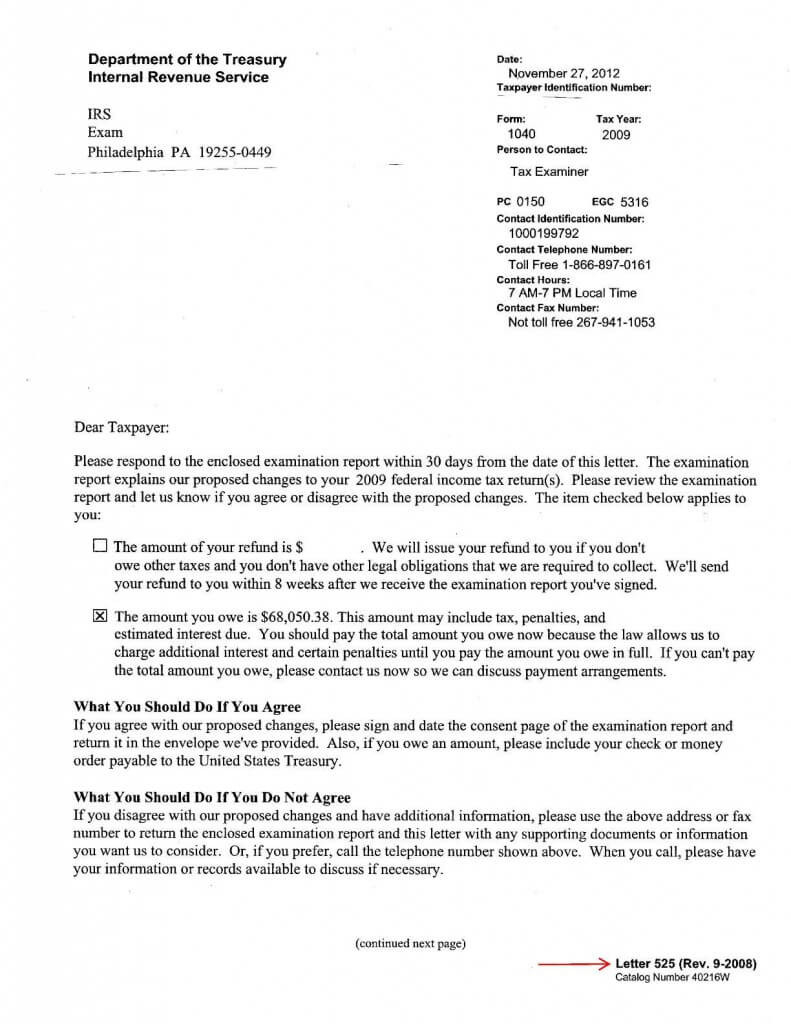

Irs Response Letter Template Samples Letter Template Collection

Irs Letter Response Template

Irs Letter 12c Response Template prntbl.concejomunicipaldechinu.gov.co

Sample Filled Form 12c Tax Fill Online, Printable, Fillable

Irs Audit Letter Sample Free Printable Documents

IRS Audit Letter 12C Sample 1

Irs letter 12c response template Fill out & sign online DocHub

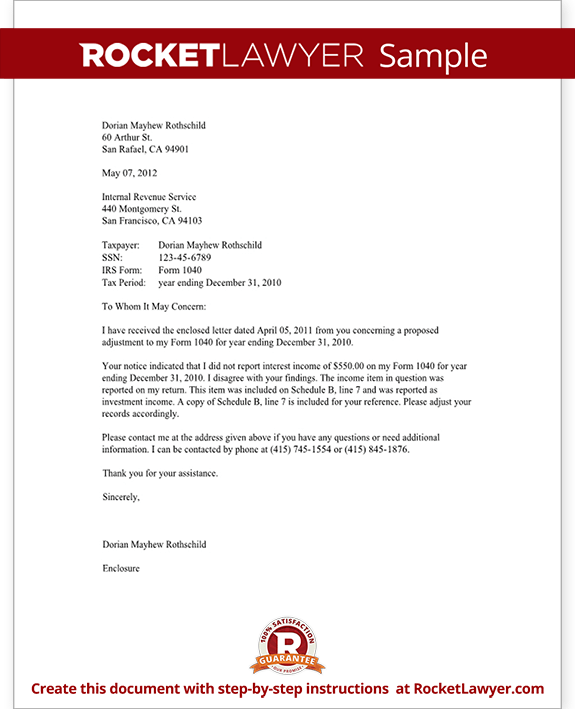

Letter to the IRS IRS Response Letter Form (with Sample)

Fillable Online IRS Letter 12C Reconciliation of Premium Tax Credit

If You Need To Sign A Return, The Irs Sends You This Letter.

Read And Respond To The Letter In A Timely Fashion.

The Letter Has Check Boxes To Indicate Information Needed To.

If We Don’t Receive A Response From You, We May Have To Increase The Tax You Owe Or Reduce Your Refund.

Related Post: