Loss Of Coverage Letter Template

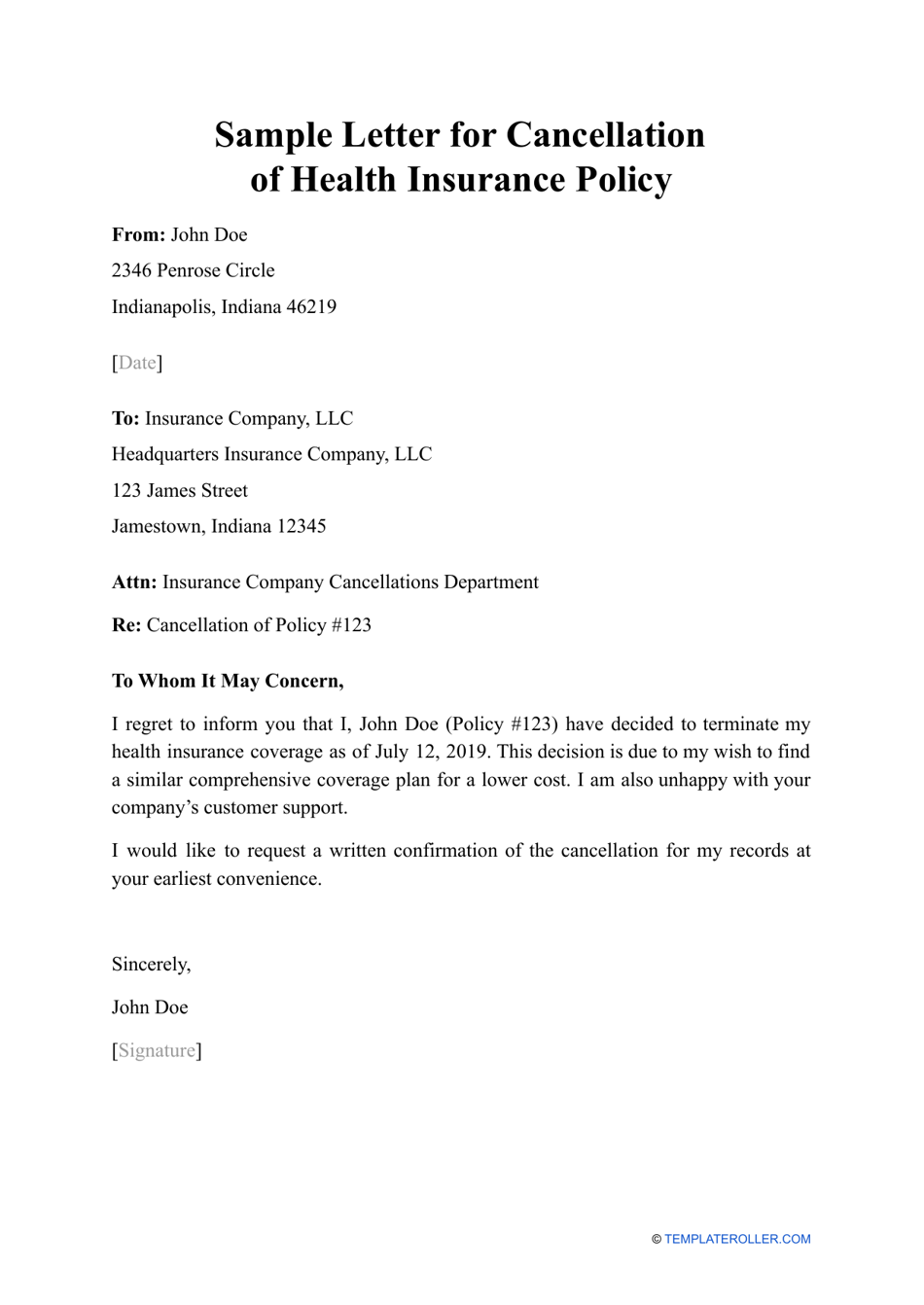

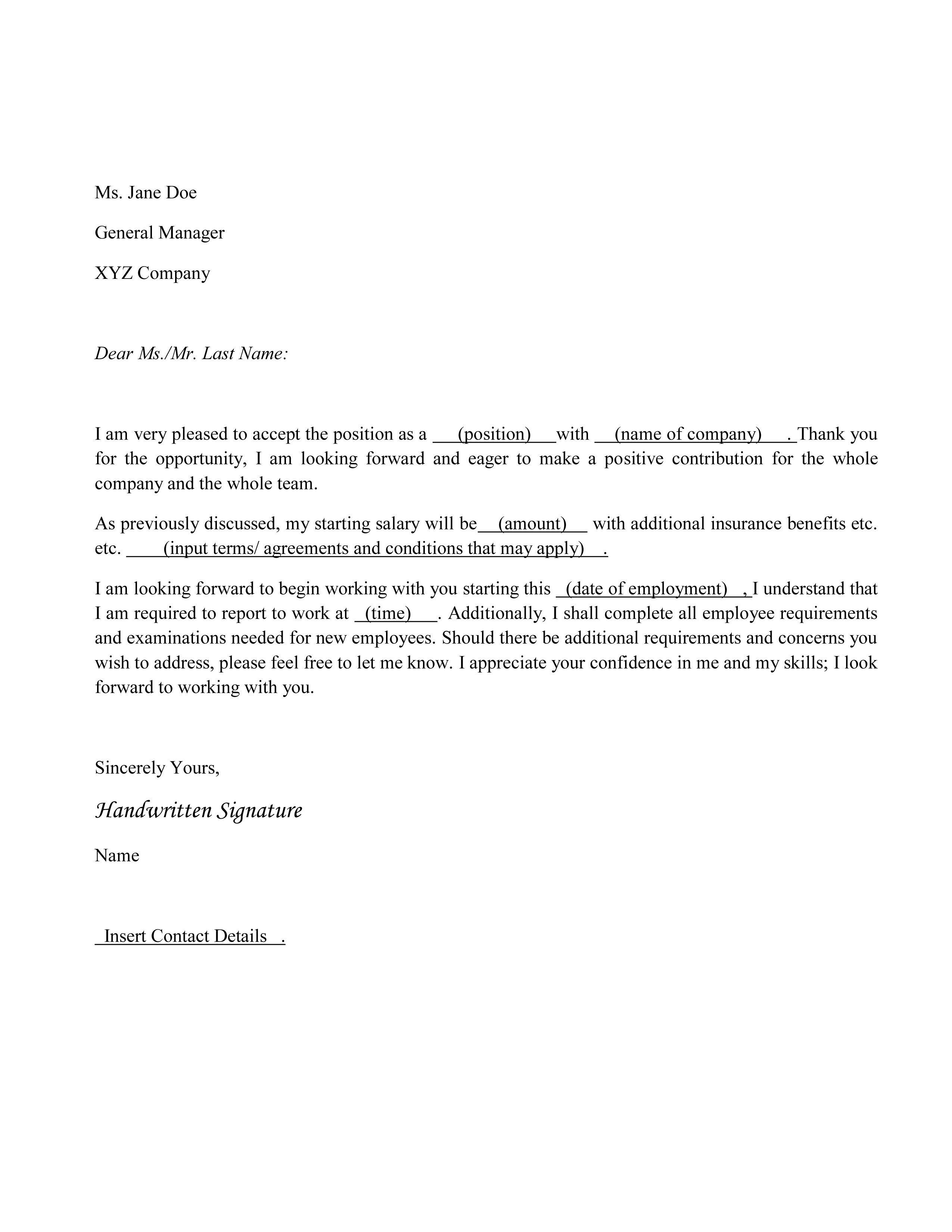

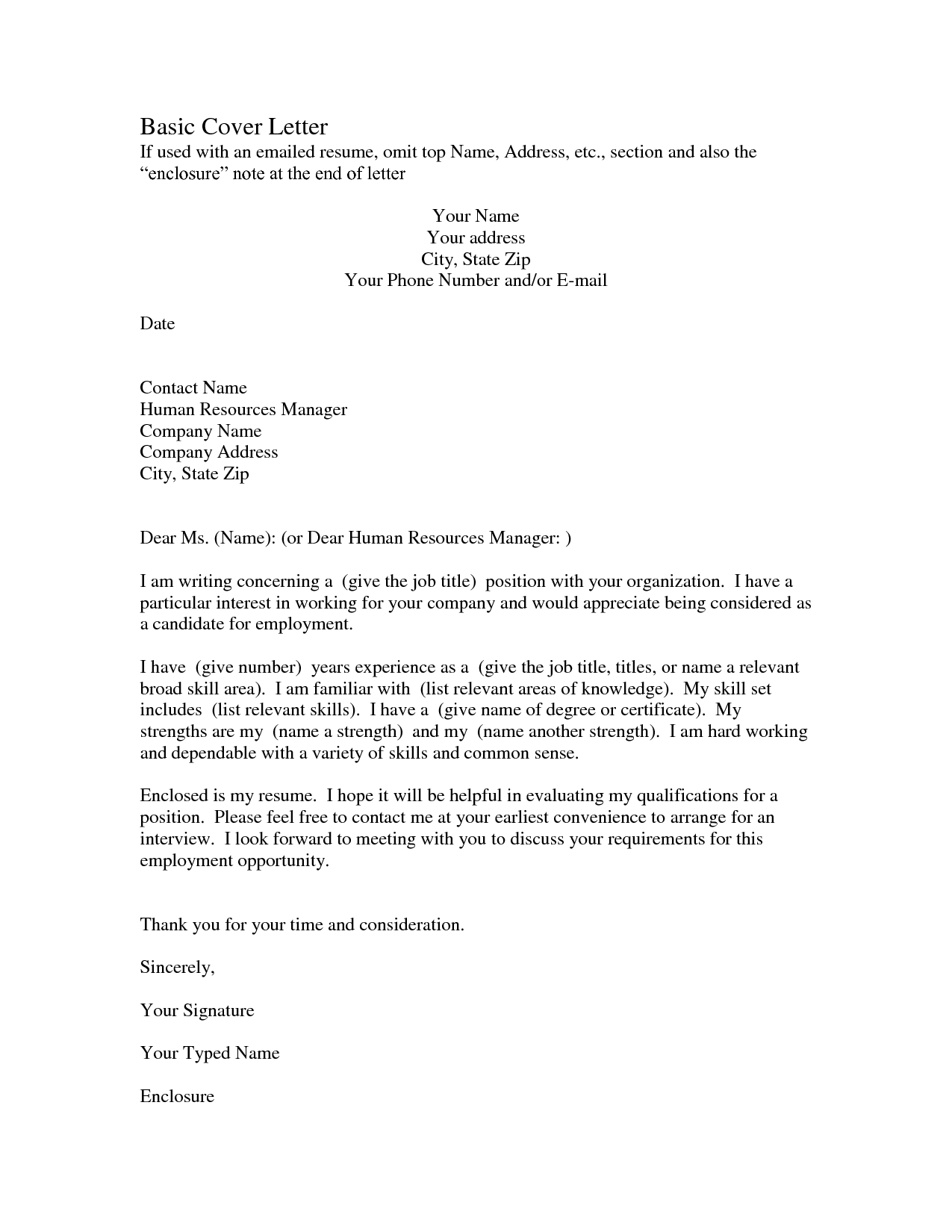

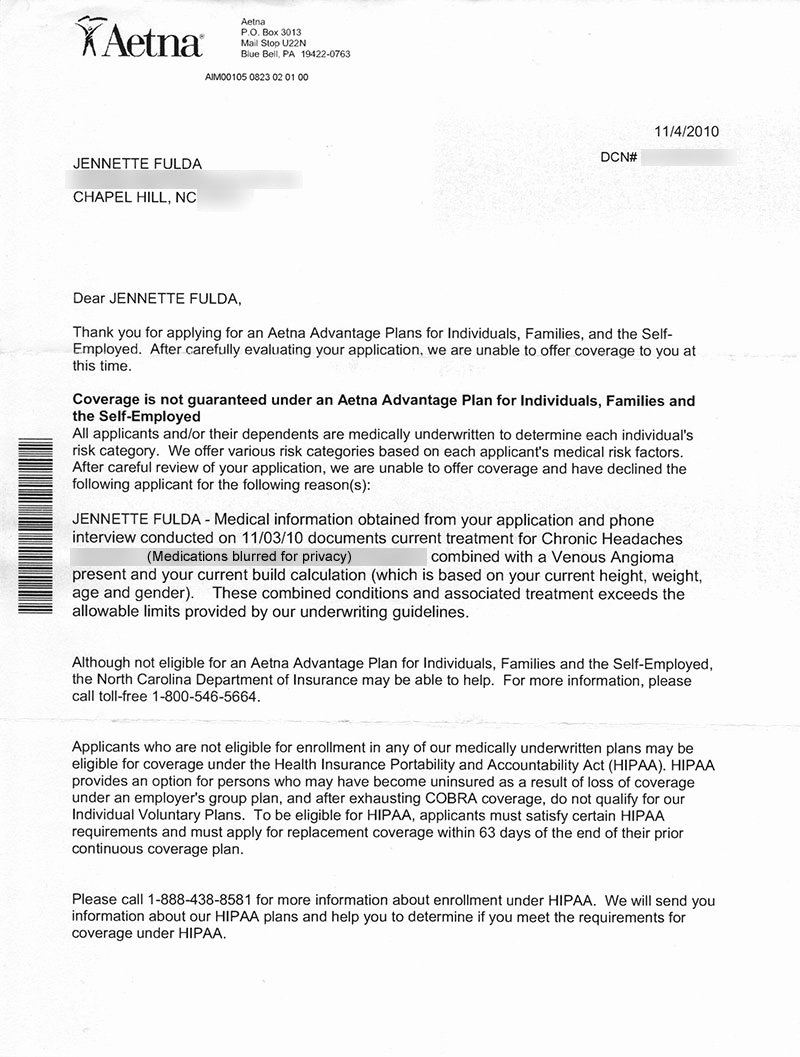

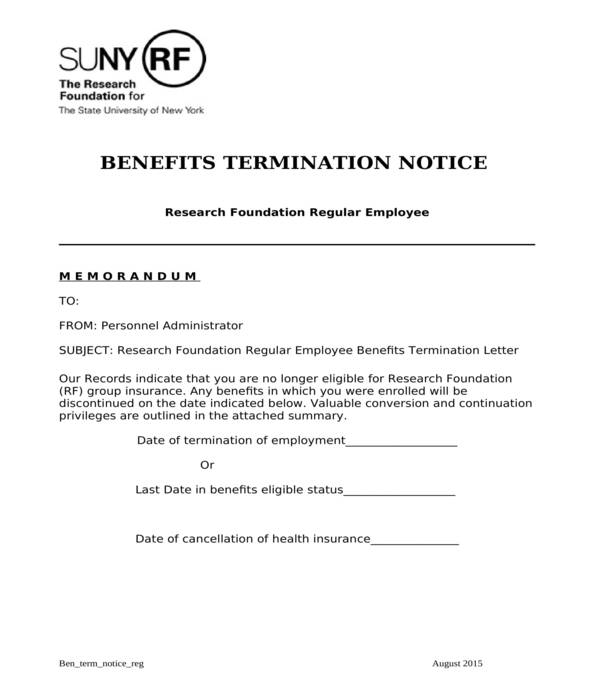

Loss Of Coverage Letter Template - Provide specifics of the insurance policy and coverage lost. Be prepared with our guide on what to include in the letter and how to communicate the changes to your staff. You received an end of health insurance coverage letter either because your policy is about to expire or it has already expired. Whether you’re an hr professional or a manager tasked with this responsibility, this guide will walk you through the steps to create an effective termination of benefits coverage letter, complete with a template to get you started. Learn how to write a letter about the loss of health insurance coverage. Learn about insurance loss of coverage letter and why you might receive one. A termination of benefits letter is an explanation from an employer to an employee of any major changes to a benefits package that will result in a loss of insurance coverage or certain. Why write a health insurance cancellation letter? Clearly state the purpose, like in a resignation letter. Send loss of coverage letter from employer via email, link, or fax. You received an end of health insurance coverage letter either because your policy is about to expire or it has already expired. It is usually sent by the insurance provider or employer to inform the recipient about the termination of their benefits plan. Download a blank version in pdf or word format for free. Letter for termination of benefits is needed when an employer or benefits administrator decides to terminate an employee's medical coverage. Here are some tips on how to structure such a letter. Send loss of coverage letter from employer via email, link, or fax. When enrolling in insurance coverage outside of open enrollment due to a loss of coverage, supporting documentation is required. Provide specifics of the insurance policy and coverage lost. It’s important to remember that you don’t have to accept this situation without a fight. Clearly state the purpose, like in a resignation letter. Policies may lapse after missed premium payments, typically within a grace period of 30 days. A letter stating loss of insurance coverage: Common scenarios include the end of employment, policy changes, or other circumstances outlined in. Why write a health insurance cancellation letter? Here are some tips on how to structure such a letter. Find a suitable template on the internet. Policies may lapse after missed premium payments, typically within a grace period of 30 days. An insurance termination letter, also known as a termination of benefits letter, is used by a company to notify an employee that their existing health insurance benefits package will be discontinued after a specified date. Learn about the. Easily cancel your health insurance policy with this sample letter. Download a blank version in pdf or word format for free. A termination of benefits letter is an explanation from an employer to an employee of any major changes to a benefits package that will result in a loss of insurance coverage or certain. The termination of benefits coverage letter. Learn about the loss of coverage letter from employer template that notifies employees about the termination of their health insurance plan. Provide specifics of the insurance policy and coverage lost. It’s important to remember that you don’t have to accept this situation without a fight. An employer would send a sample loss of health insurance coverage letter when an employee. Common scenarios include the end of employment, policy changes, or other circumstances outlined in. You can also download it, export it or print it out. Type text, add images, blackout confidential details, add comments, highlights and more. Use our sample letters to request appeal and continuation of benefits. The 25 sample letters below provide a broad overview of different scenarios. Find out what to do if your coverage is terminated and how to appeal the decision. Be prepared with our guide on what to include in the letter and how to communicate the changes to your staff. It’s important to remember that you don’t have to accept this situation without a fight. Sign it in a few clicks. Download a. Edit your loss of coverage letter online. Send loss of coverage letter from employer via email, link, or fax. Type text, add images, blackout confidential details, add comments, highlights and more. An insurance termination letter, also known as a termination of benefits letter, is used by a company to notify an employee that their existing health insurance benefits package will. An employer would send a sample loss of health insurance coverage letter when an employee is losing their health insurance benefits, either due to termination, the end of a contract, or other reasons. Easily cancel your health insurance policy with this sample letter. Why write a health insurance cancellation letter? Insurance policy lapses can lead to significant consequences for policyholders,. You can also download it, export it or print it out. Use our sample letters to request appeal and continuation of benefits. Clearly state the purpose, like in a resignation letter. A letter stating loss of insurance coverage: Easily cancel your health insurance policy with this sample letter. Use our sample letters to request appeal and continuation of benefits. Edit your loss of coverage letter online. Learn about the loss of coverage letter from employer template that notifies employees about the termination of their health insurance plan. Easily cancel your health insurance policy with this sample letter. Whether you’re an hr professional or a manager tasked with this. Sign it in a few clicks. Whether you’re an hr professional or a manager tasked with this responsibility, this guide will walk you through the steps to create an effective termination of benefits coverage letter, complete with a template to get you started. A letter stating loss of insurance coverage: Learn about insurance loss of coverage letter and why you might receive one. It is usually sent by the insurance provider or employer to inform the recipient about the termination of their benefits plan. Easily cancel your health insurance policy with this sample letter. It’s important to remember that you don’t have to accept this situation without a fight. Find out what to do if your coverage is terminated and how to appeal the decision. Here are some tips on how to structure such a letter. A termination of benefits letter is an explanation from an employer to an employee of any major changes to a benefits package that will result in a loss of insurance coverage or certain. Common scenarios include the end of employment, policy changes, or other circumstances outlined in. Understand the importance of maintaining insurance coverage to avoid financial risks. You received an end of health insurance coverage letter either because your policy is about to expire or it has already expired. The 25 sample letters below provide a broad overview of different scenarios where benefits termination might occur, providing you with a comprehensive understanding of how to draft a professional and considerate benefits termination letter. When enrolling in insurance coverage outside of open enrollment due to a loss of coverage, supporting documentation is required. Why write a health insurance cancellation letter?Sample Letter for Cancellation of Health Insurance Policy Fill Out

Employer Template Proof Of Loss Of Coverage Letter From Employer

Loss Of Insurance Coverage Letter From Employer Sample Free Demand

30 Loss Of Coverage Letter Template Example Document Template

Loss Of Health Insurance Coverage Letter From Employer Template

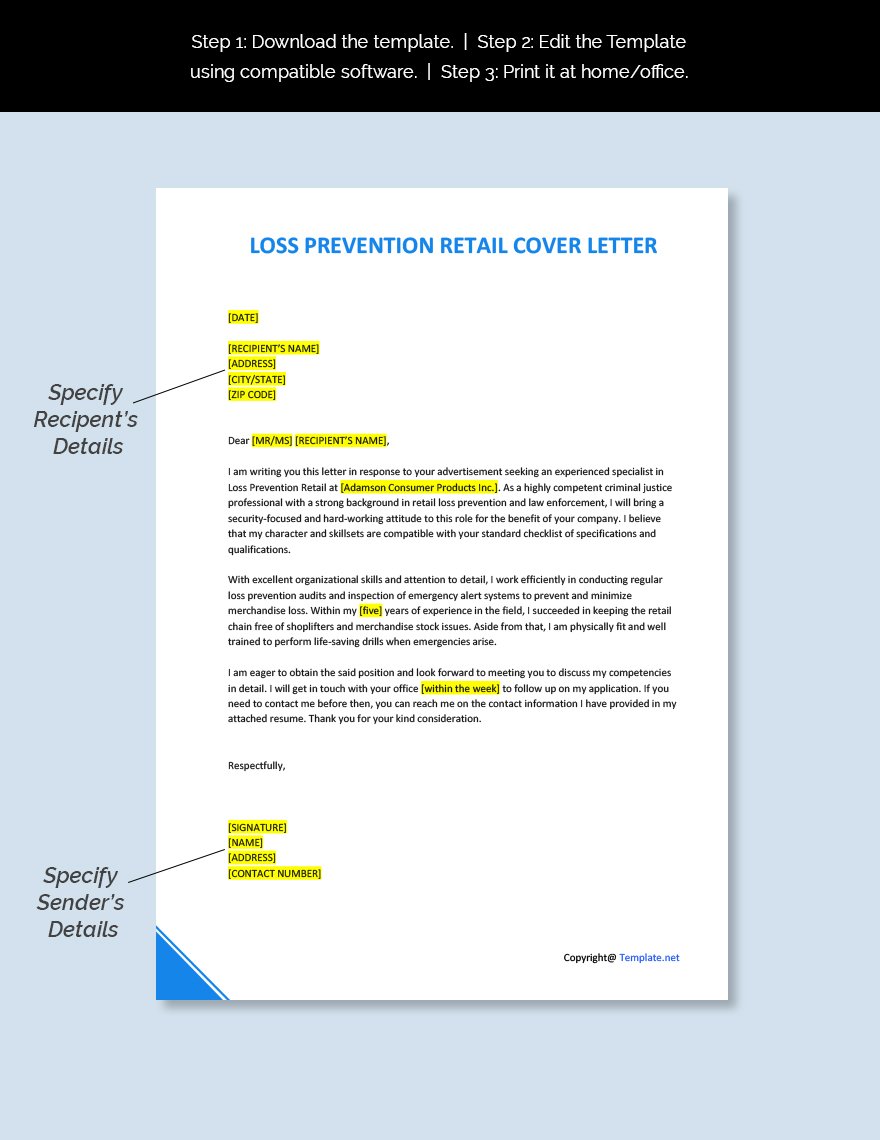

Loss Prevention Retail Cover Letter in Google Docs, Word, Pages, PDF

Benefits Loss of Coverage Letter customizable Template for HR Etsy

Employer Template Proof Of Loss Of Coverage Letter From Employer

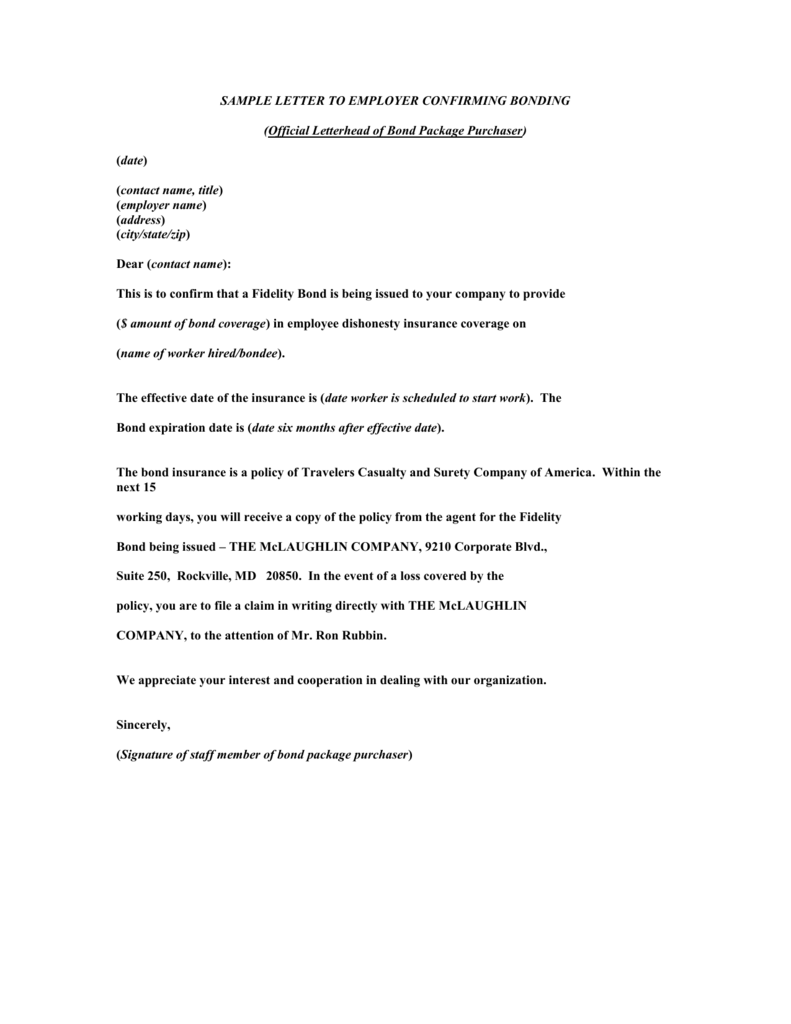

Sample Printable Cover Letter To Loss Mitigation Department 1 Forms

FREE 5+ Employment Termination Letters in PDF MS Word

You Can Also Download It, Export It Or Print It Out.

Find A Suitable Template On The Internet.

Learn How To Write A Letter About The Loss Of Health Insurance Coverage.

Policies May Lapse After Missed Premium Payments, Typically Within A Grace Period Of 30 Days.

Related Post: