Ma Integration Plan Template

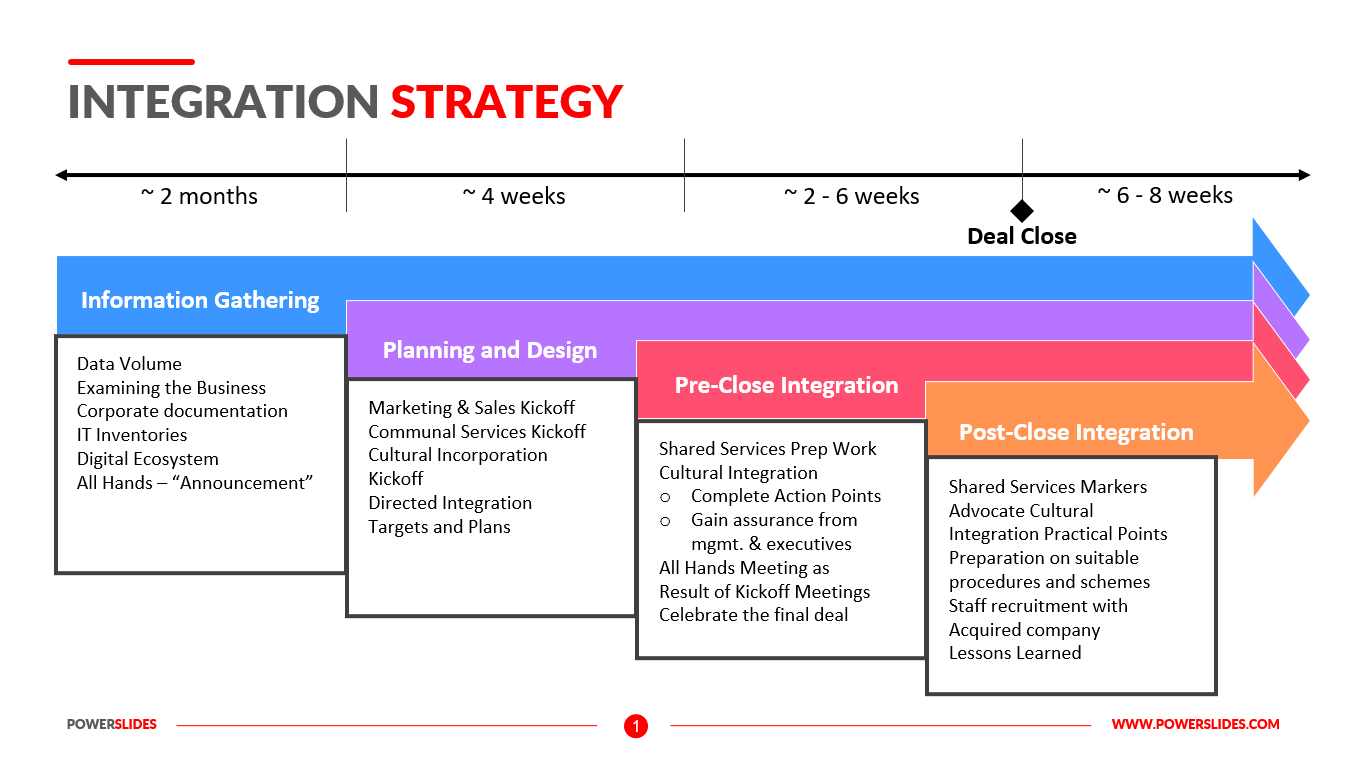

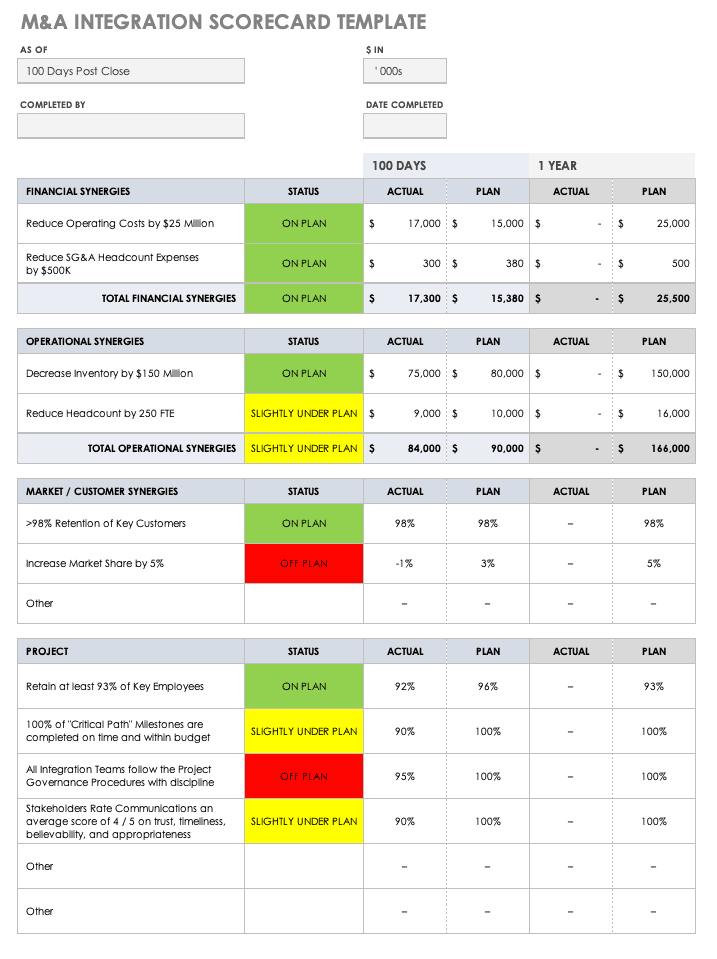

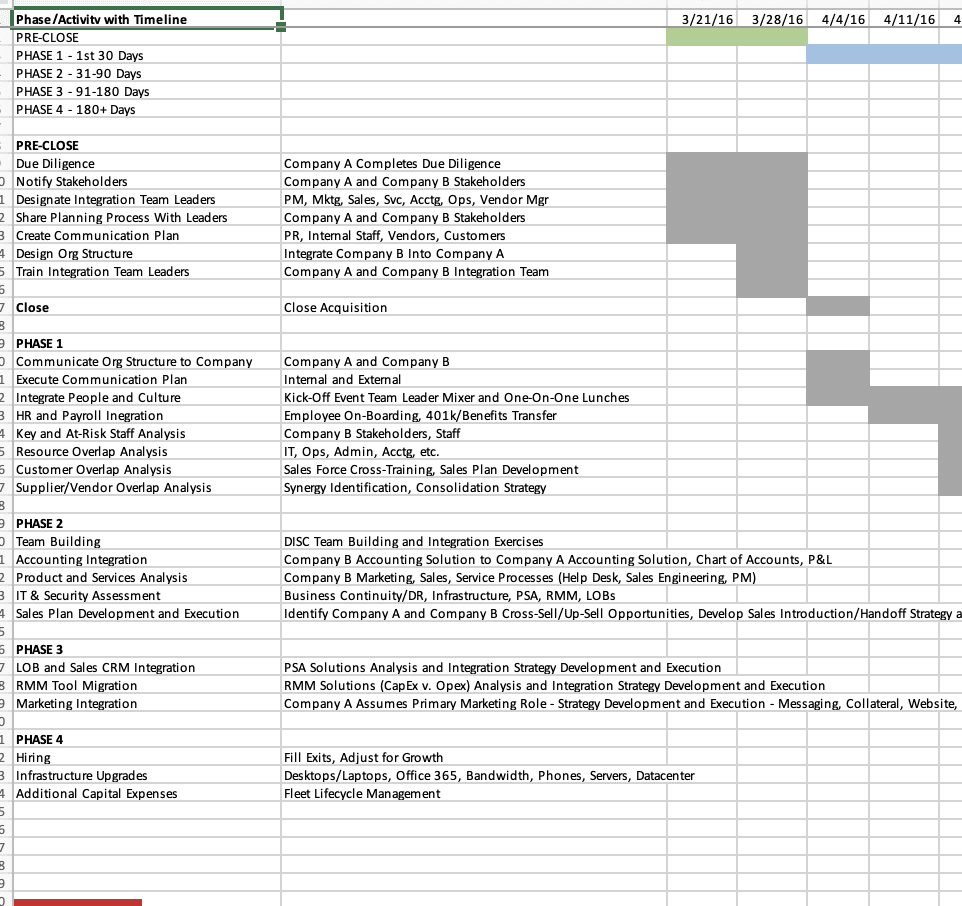

Ma Integration Plan Template - Choose from a variety of industries such as finance,. Use it to create an integration plan focused on. Develop a plan for how you will defend yourself against competitive strikes and exploit your competitive advantages. This template is designed to help organizations develop an effective integration plan that encompasses the core elements needed for a successful transition. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. To ensure successful m&a integration, having an m&a integration playbook is a valuable tool. Managing mergers & acquisitions can be daunting, but doing it effectively is critical to successful inorganic growth for an organization. It is with the mindset that teams can follow an integration playbook and that after 100 days, the integration should be at a certain point. This m&a playbook will guide your m&a. Acquisition / existing corporate strategy alignment b. This template is designed to help organizations develop an effective integration plan that encompasses the core elements needed for a successful transition. Exclusively focused on post merger integration and separation, gpmip delivers projects at greater efficiency than traditional consulting firms, maximizing capabilities, experience, and expertise. It is with the mindset that teams can follow an integration playbook and that after 100 days, the integration should be at a certain point. Value delivery objectives and targets Acquisition / existing corporate strategy alignment b. A merger integration plan is a comprehensive strategy for successfully integrating two businesses after a merger or acquisition. Develop a plan for how you will defend yourself against competitive strikes and exploit your competitive advantages. However, many teams are no longer following the traditional methodology of integration. This m&a playbook will guide your m&a. Communicate the vision to all stakeholders, ensuring alignment across leadership. However, many teams are no longer following the traditional methodology of integration. It is with the mindset that teams can follow an integration playbook and that after 100 days, the integration should be at a certain point. This m&a playbook will guide your m&a. This resource helps stakeholders stay aligned and provides a comprehensive. A strong deal thesis identifies the. This resource helps stakeholders stay aligned and provides a comprehensive. From this m&a integration experience, we’ve come up with the following best practices for you to follow. Communicate the vision to all stakeholders, ensuring alignment across leadership. A merger integration plan is a comprehensive strategy for successfully integrating two businesses after a merger or acquisition. Use it to create an. Choose from a variety of industries such as finance,. From this m&a integration experience, we’ve come up with the following best practices for you to follow. Dealroom’s library of free, premade m&a integration templates are designed to help teams streamline their workflows. Managing mergers & acquisitions can be daunting, but doing it effectively is critical to successful inorganic growth for. This resource helps stakeholders stay aligned and provides a comprehensive. 27 m&a integration playbooks including m&a integration playbooks on hr, it, finance, communications, legal, accounting, and sales in pdf and xls format. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Acquisition /. Acquisition / existing corporate strategy alignment b. Exclusively focused on post merger integration and separation, gpmip delivers projects at greater efficiency than traditional consulting firms, maximizing capabilities, experience, and expertise. Communicate the vision to all stakeholders, ensuring alignment across leadership. However, many teams are no longer following the traditional methodology of integration. Dealroom’s library of free, premade m&a integration templates. This resource helps stakeholders stay aligned and provides a comprehensive. It is with the mindset that teams can follow an integration playbook and that after 100 days, the integration should be at a certain point. Acquisition / existing corporate strategy alignment b. Let the deal thesis guide integration; 27 m&a integration playbooks including m&a integration playbooks on hr, it, finance,. This template is designed to help organizations develop an effective integration plan that encompasses the core elements needed for a successful transition. Managing mergers & acquisitions can be daunting, but doing it effectively is critical to successful inorganic growth for an organization. This m&a playbook will guide your m&a. It is with the mindset that teams can follow an integration. A merger integration plan is a comprehensive strategy for successfully integrating two businesses after a merger or acquisition. Managing mergers & acquisitions can be daunting, but doing it effectively is critical to successful inorganic growth for an organization. 27 m&a integration playbooks including m&a integration playbooks on hr, it, finance, communications, legal, accounting, and sales in pdf and xls format.. Develop a plan for how you will defend yourself against competitive strikes and exploit your competitive advantages. Value delivery objectives and targets It is with the mindset that teams can follow an integration playbook and that after 100 days, the integration should be at a certain point. Analyze and document marketplace conditions that may. Let the deal thesis guide integration; Acquisition / existing corporate strategy alignment b. Develop a plan for how you will defend yourself against competitive strikes and exploit your competitive advantages. A strong deal thesis identifies the strategic goals and potential value of an acquisition. This resource helps stakeholders stay aligned and provides a comprehensive. However, many teams are no longer following the traditional methodology of integration. This template is designed to help organizations develop an effective integration plan that encompasses the core elements needed for a successful transition. It is with the mindset that teams can follow an integration playbook and that after 100 days, the integration should be at a certain point. Let the deal thesis guide integration; Dealroom’s library of free, premade m&a integration templates are designed to help teams streamline their workflows. This m&a playbook will guide your m&a. A merger integration plan is a comprehensive strategy for successfully integrating two businesses after a merger or acquisition. Acquisition / existing corporate strategy alignment b. Analyze and document marketplace conditions that may. Choose from a variety of industries such as finance,. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Communicate the vision to all stakeholders, ensuring alignment across leadership. A strong deal thesis identifies the strategic goals and potential value of an acquisition. To ensure successful m&a integration, having an m&a integration playbook is a valuable tool. However, many teams are no longer following the traditional methodology of integration. Develop a plan for how you will defend yourself against competitive strikes and exploit your competitive advantages. This resource helps stakeholders stay aligned and provides a comprehensive.Integration Plan Template

M&A Integration Plan Template

Download Free M&A Templates Smartsheet

Streamlining Business Processes With MA Integration Plan Excel Template

M&A Integration Plan Template

Ma Integration Plan Template prntbl.concejomunicipaldechinu.gov.co

Integration Plan Template

Integration Plan Template

Free Integration Plan Templates For Google Sheets And Microsoft Excel

M&A Integration Plan Template

27 M&A Integration Playbooks Including M&A Integration Playbooks On Hr, It, Finance, Communications, Legal, Accounting, And Sales In Pdf And Xls Format.

Value Delivery Objectives And Targets

Exclusively Focused On Post Merger Integration And Separation, Gpmip Delivers Projects At Greater Efficiency Than Traditional Consulting Firms, Maximizing Capabilities, Experience, And Expertise.

From This M&A Integration Experience, We’ve Come Up With The Following Best Practices For You To Follow.

Related Post: