Payoff Statement Template

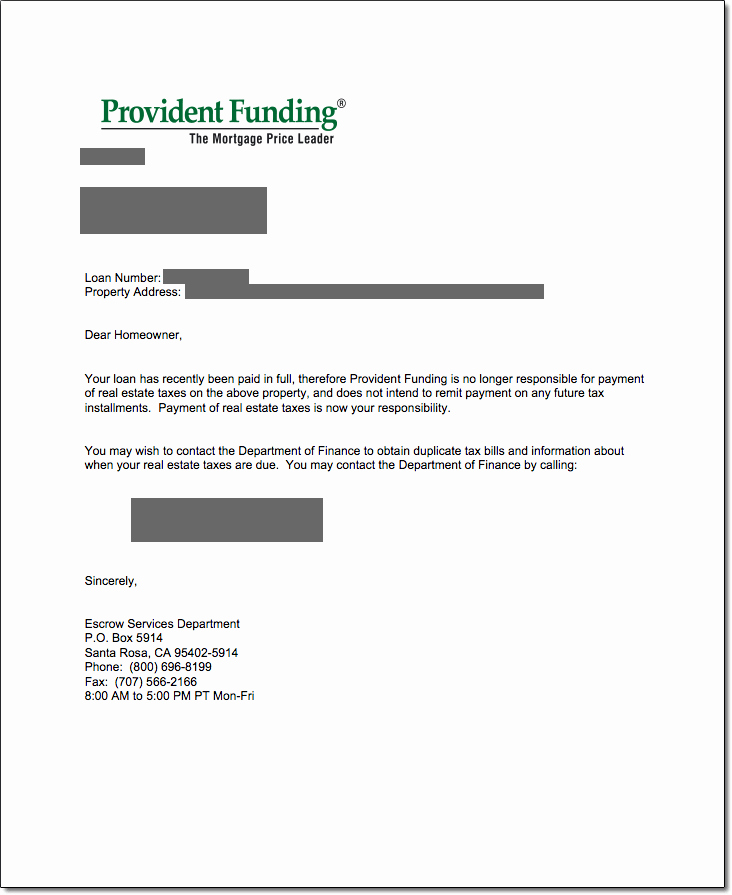

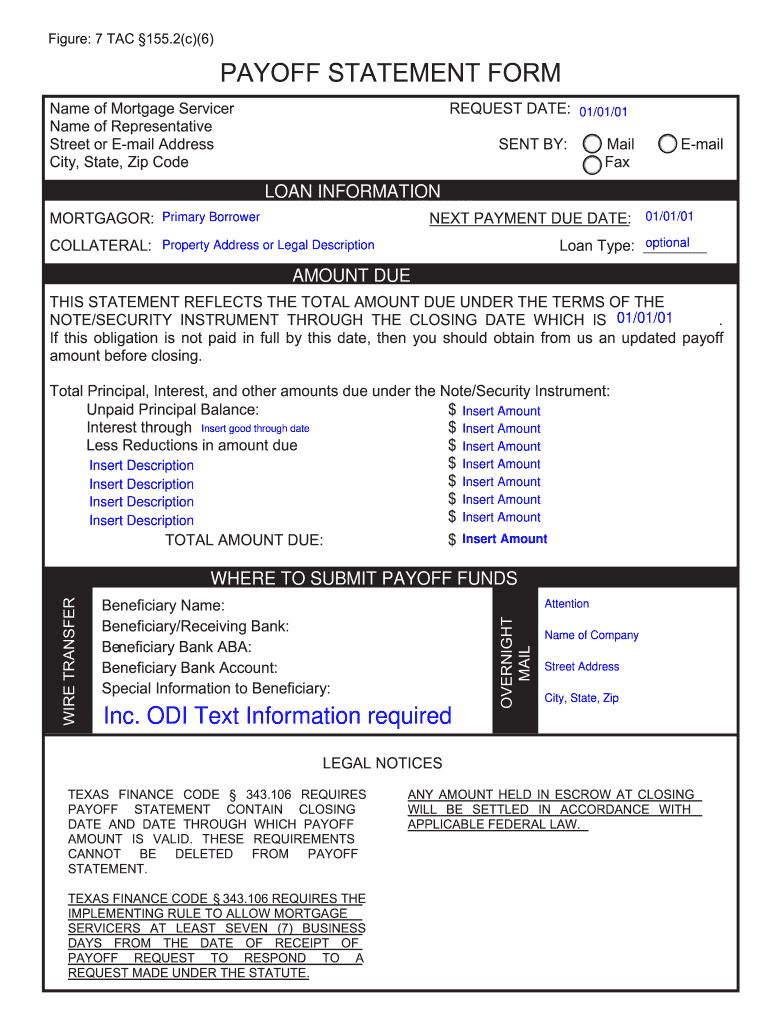

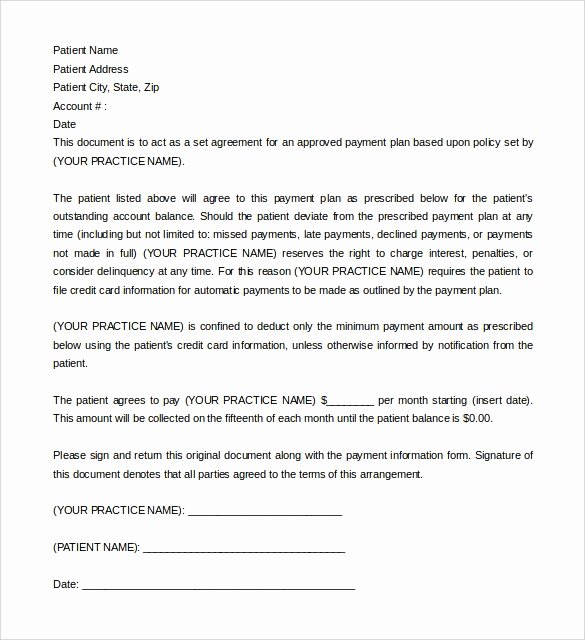

Payoff Statement Template - A payoff statement or a mortgage payoff letter that is prepared by the lender for the borrower mentioning the amount that the borrower has to pay back to close the loan. Easily generate a loan payoff letter with our free loan payoff letter template. A payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. Call or write to customer service or make the request online. A payoff statement is a document prepared by a lender that shows the payoff amount for a mortgage or other loan prepayment. To get a payoff letter, ask your lender for an official payoff statement. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date. A mortgage payoff letter, also called a payoff statement, is a formal document issued by your mortgage lender that shows the total outstanding balance on your home loan. A payoff statement or a mortgage payoff letter will usually show you the amount you need to pay to close your loan. A payoff statement request, typically required by borrowers, seeks to obtain the exact amount needed to pay off a loan, including interest and fees. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date. Call or write to customer service or make the request online. In order to know your balance amount, you need to acquire a loan payoff statement from your lender. This statement is crucial during refinancing procedures or property sales. A payoff statement is a document prepared by a lender that shows the payoff amount for a mortgage or other loan prepayment. It tells you the amount due, where to send the money, how to pay, and any additional charges due. A payoff statement request, typically required by borrowers, seeks to obtain the exact amount needed to pay off a loan, including interest and fees. A payoff letter is a document that provides detailed instructions on how to pay off a loan. To get a payoff letter, ask your lender for an official payoff statement. This includes the remaining principal, any accrued interest, and fees owed to fully pay off the loan. Do you plan to pay off your loan balance before its term period is over? A payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. A payoff statement request, typically required by borrowers, seeks to obtain the exact amount. Call or write to customer service or make the request online. It also contains the extra details like the rate of interest that the borrower has to pay when he does the repayment. The payoff amount isn’t just your outstanding balance; Easily generate a loan payoff letter with our free loan payoff letter template. A payoff statement for a mortgage,. A payoff statement request, typically required by borrowers, seeks to obtain the exact amount needed to pay off a loan, including interest and fees. It also encompasses any interest you owe and potential fees your lender might charge. A payoff statement or a mortgage payoff letter that is prepared by the lender for the borrower mentioning the amount that the. 13+ payoff statement templates in pdf. A payoff letter is a document that provides detailed instructions on how to pay off a loan. A payoff statement or a mortgage payoff letter will usually show you the amount you need to pay to close your loan. This statement is crucial during refinancing procedures or property sales. To get a payoff letter,. A payoff statement request, typically required by borrowers, seeks to obtain the exact amount needed to pay off a loan, including interest and fees. 13+ payoff statement templates in pdf. Call or write to customer service or make the request online. Easily generate a loan payoff letter with our free loan payoff letter template. If you have the funds to. Do you plan to pay off your loan balance before its term period is over? While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date. A payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount. Do you plan to pay off your loan balance before its term period is over? This statement is crucial during refinancing procedures or property sales. This includes the remaining principal, any accrued interest, and fees owed to fully pay off the loan. A payoff letter is a document that provides detailed instructions on how to pay off a loan. If. A payoff statement or a mortgage payoff letter will usually show you the amount you need to pay to close your loan. This statement is crucial during refinancing procedures or property sales. In order to know your balance amount, you need to acquire a loan payoff statement from your lender. To get a payoff letter, ask your lender for an. 13+ payoff statement templates in pdf. This article will show you what a loan payoff statement looks like and how it is used. A payoff statement or a mortgage payoff letter that is prepared by the lender for the borrower mentioning the amount that the borrower has to pay back to close the loan. To get a payoff letter, ask. A payoff statement is a document prepared by a lender that shows the payoff amount for a mortgage or other loan prepayment. Easily generate a loan payoff letter with our free loan payoff letter template. Do you plan to pay off your loan balance before its term period is over? A payoff letter is a document that provides detailed instructions. This article will show you what a loan payoff statement looks like and how it is used. The payoff amount isn’t just your outstanding balance; A payoff statement or a mortgage payoff letter will usually show you the amount you need to pay to close your loan. It also contains the extra details like the rate of interest that the borrower has to pay when he does the repayment. A payoff statement or a mortgage payoff letter that is prepared by the lender for the borrower mentioning the amount that the borrower has to pay back to close the loan. In order to know your balance amount, you need to acquire a loan payoff statement from your lender. To get a payoff letter, ask your lender for an official payoff statement. It tells you the amount due, where to send the money, how to pay, and any additional charges due. 13+ payoff statement templates in pdf. Easily generate a loan payoff letter with our free loan payoff letter template. A payoff letter is a document that provides detailed instructions on how to pay off a loan. Call or write to customer service or make the request online. It also encompasses any interest you owe and potential fees your lender might charge. A payoff statement is a document prepared by a lender that shows the payoff amount for a mortgage or other loan prepayment. A payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. This includes the remaining principal, any accrued interest, and fees owed to fully pay off the loan.Payoff Statement Template Word

Payoff Statement Template Word

Payoff Statement Template Word

Payoff Statement Template Word

Payoff Statement Template Word Printable Word Searches

Payoff Statement Template Word Printable Word Searches

Payoff Statement Template

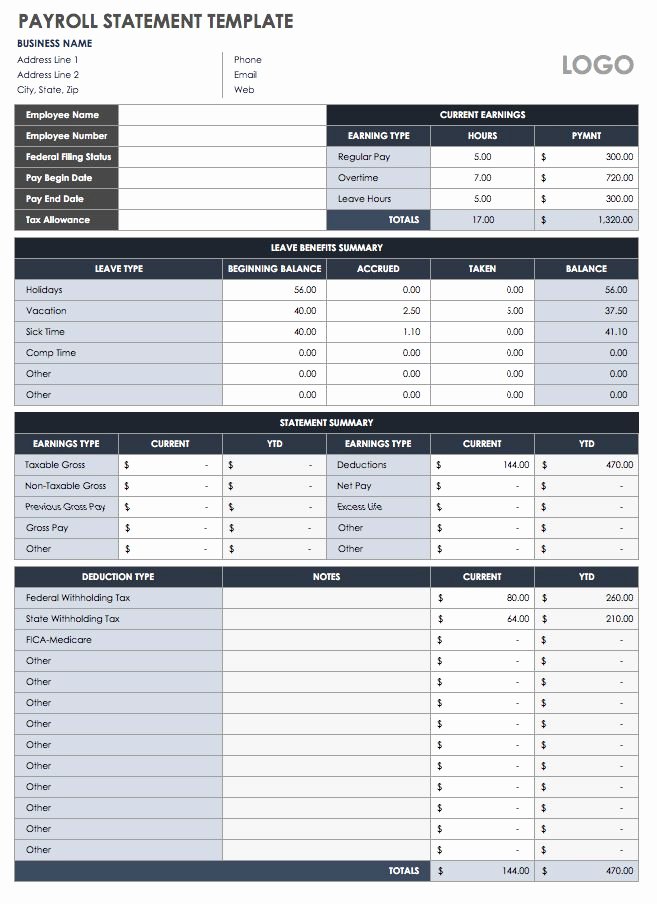

Blank Pay Stub Template Word

Payoff Statement Template Word

Loan Payoff Letter Template Database Letter Template Collection

If You Have The Funds To Pay Off An Installment Loan Early, Request A Payoff Letter From Your Lender.

Do You Plan To Pay Off Your Loan Balance Before Its Term Period Is Over?

To Do So, You Can Choose One Of Our Excellent Templates Listed Above.

While Logged Into Your Account, Look For Options To Request Or Calculate A Payoff Amount, And Provide Details Such As Your Desired Payoff Date.

Related Post: