Payroll Deduction Form Template

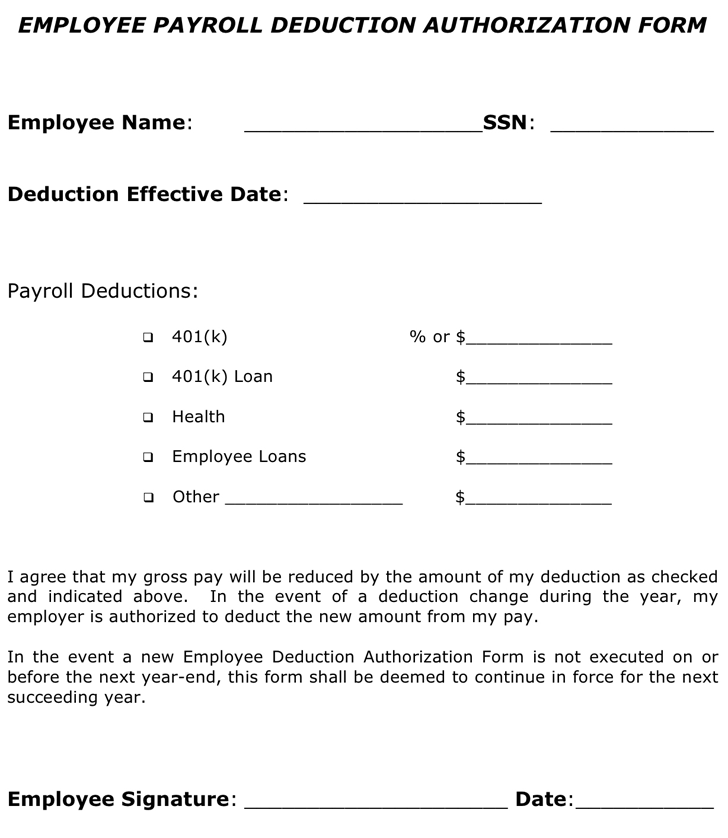

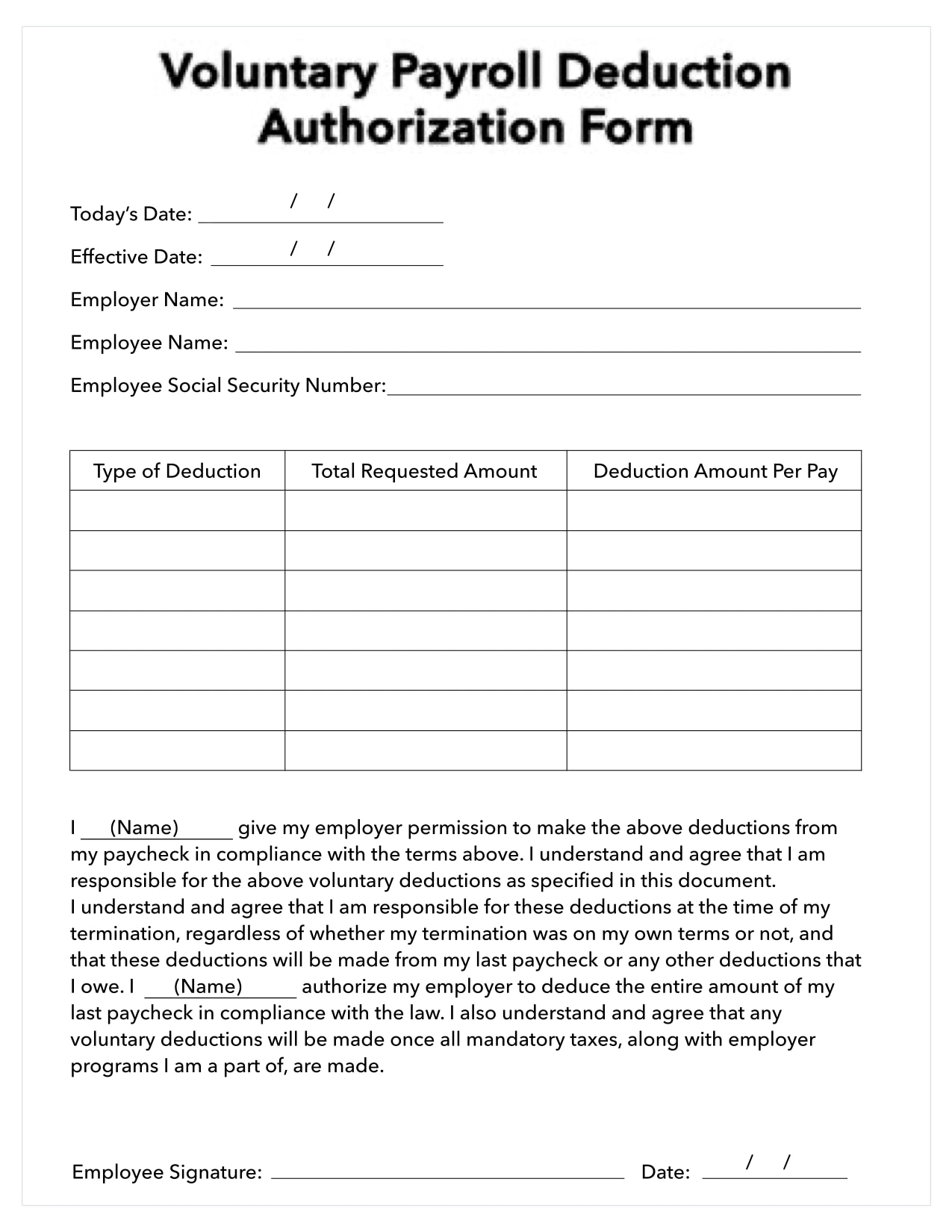

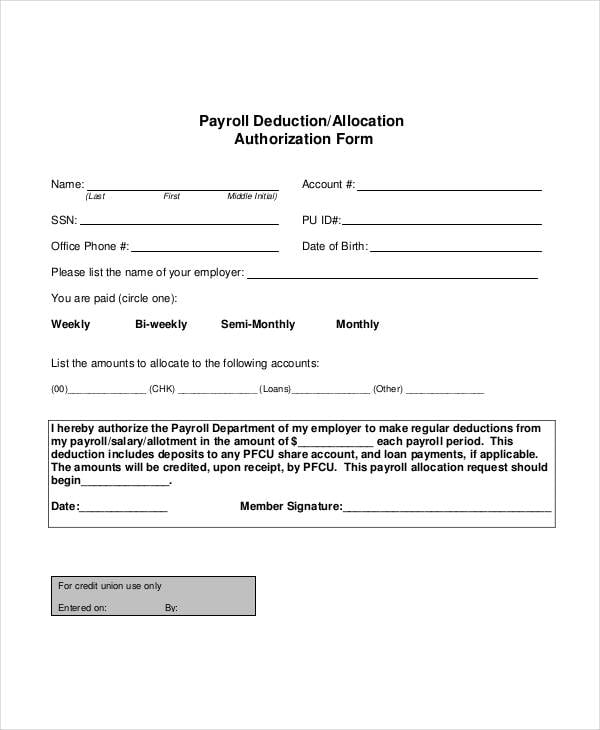

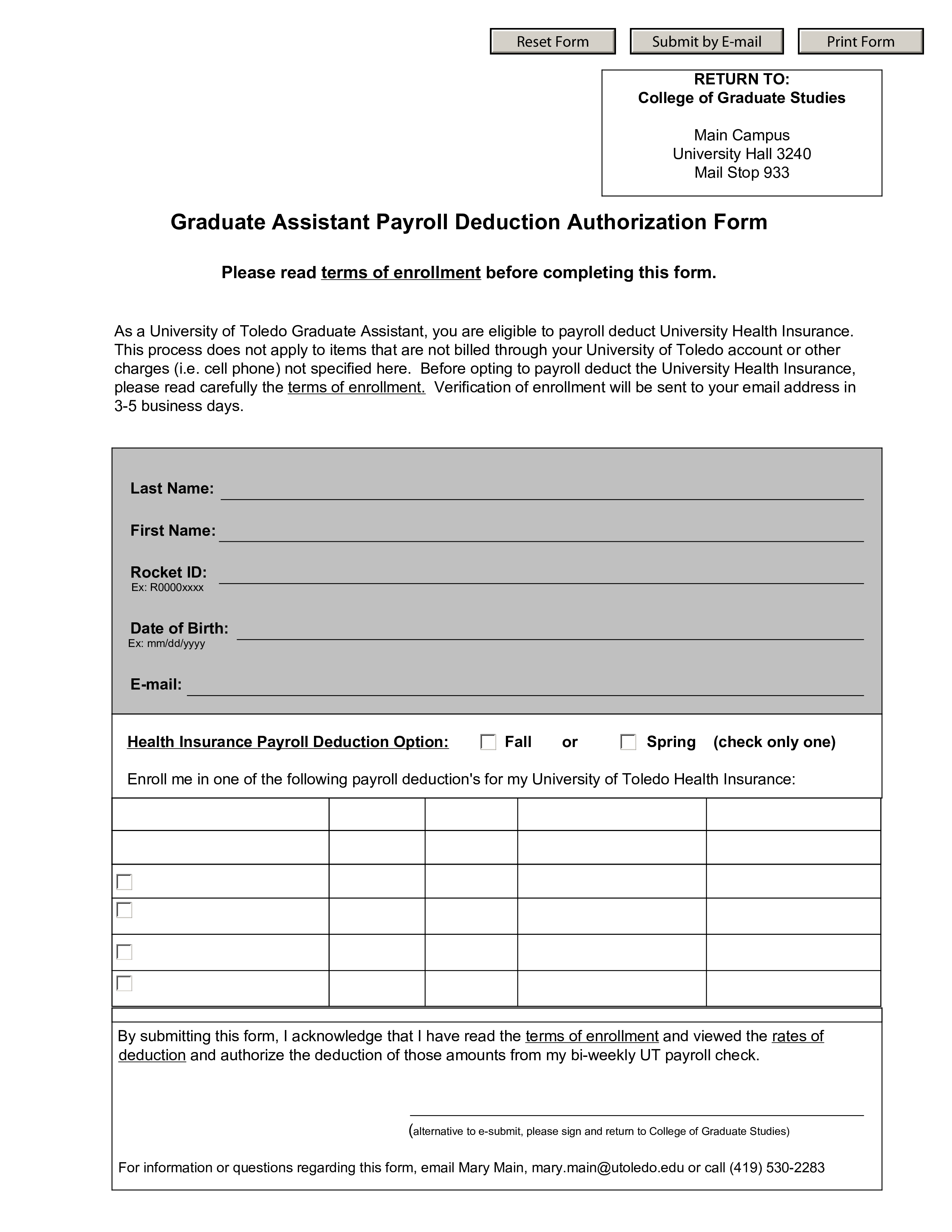

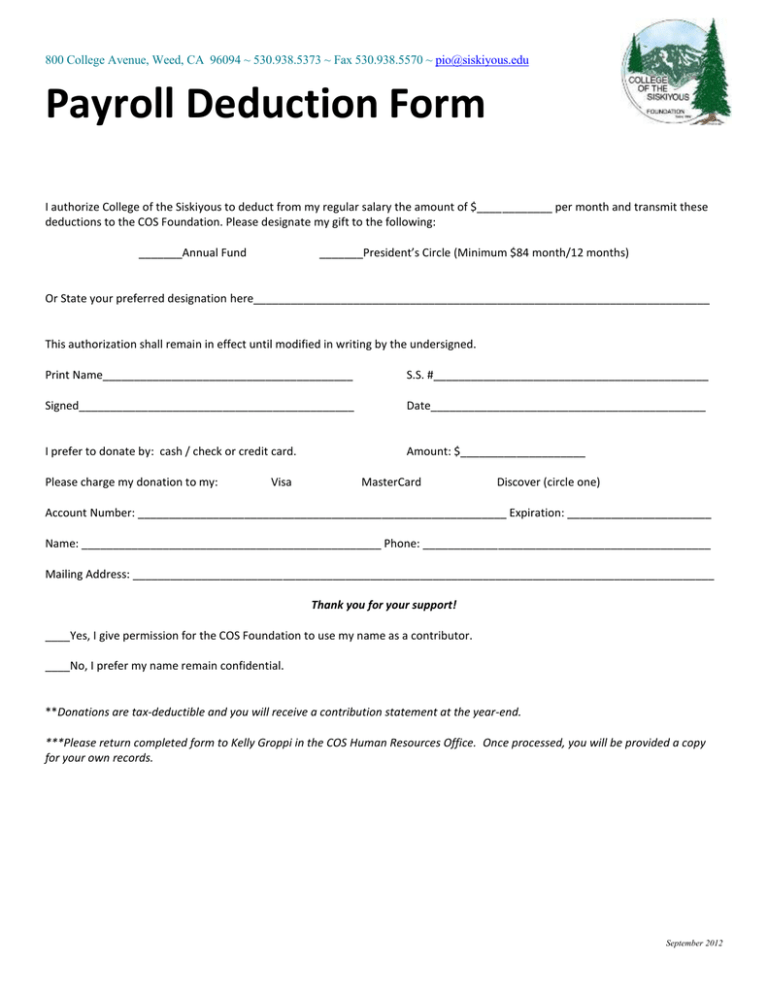

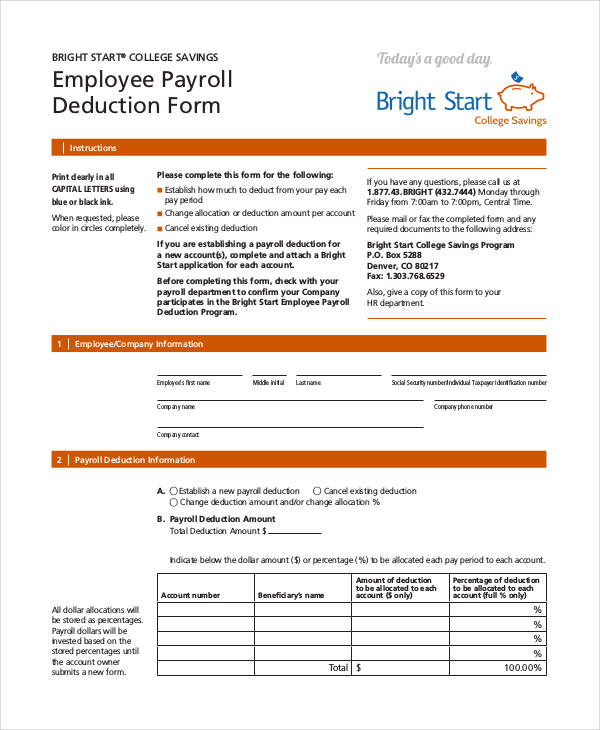

Payroll Deduction Form Template - Keep both the employee and the employer up to date on current pay rates by tracking overall compensations and deductions on a weekly, monthly, or yearly basis. You can also download a petty cash receipt template and a rent receipt template , among others. Document all payments to ensure each employee is properly compensated for their work, and so tax documents are accurate come year end. You can edit the fine print to match your policies and legal requirements; I hereby authorize the payroll department of my employer to make regular deductions each payroll period from my payroll / salary / allotment in the amount of: Choose from a variety of payroll stub template options. Pk !€ªt”‹ [ [content_types].xml ¢ ( ´•ikã0.ï…þ £k‰•ôpj‰“c—c h ½*òø õ†4ùþ}gyl)i\šäb°4ï½oc4î —fgs q9[°^þe xéjeë‚}œ. My employer is authorized to deduct a different amount should there be a deduction change throughout the year. Employees then provide signatures to authorize the deductions. ( enter amount, above ) ( last name ) You can edit the fine print to match your policies and legal requirements; This payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care savings. Payroll deduction authorization form if you want your employer to automatically deduct a certain amount of money from your regular paycheck, use this form to make the request. Employees then provide signatures to authorize the deductions. Document all payments to ensure each employee is properly compensated for their work, and so tax documents are accurate come year end. Keep both the employee and the employer up to date on current pay rates by tracking overall compensations and deductions on a weekly, monthly, or yearly basis. I hereby authorize the payroll department of my employer to make regular deductions each payroll period from my payroll / salary / allotment in the amount of: Ss tax deduction s o s o s o s o s o s o s o s o s o s o s o s o total hours rate of pay gross amount earned no. ( enter amount, above ) ( last name ) Choose from a variety of payroll stub template options. My employer is authorized to deduct a different amount should there be a deduction change throughout the year. Choose from a variety of payroll stub template options. Pk !€ªt”‹ [ [content_types].xml ¢ ( ´•ikã0.ï…þ £k‰•ôpj‰“c—c h ½*òø õ†4ùþ}gyl)i\šäb°4ï½oc4î —fgs q9[°^þe xéjeë‚}œ. You can edit the fine print to match your policies and legal requirements; Included on this page, you’ll find. You can also download a petty cash receipt template and a rent receipt template , among others. Keep both the employee and the employer up to date on current pay rates by tracking overall compensations and deductions on a weekly, monthly, or yearly basis. This payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care. Keep both the employee and the employer up to date on current pay rates by tracking overall compensations and deductions on a weekly, monthly, or yearly basis. Included on this page, you’ll find a simple receipt template, a cash receipt template, and a payment receipt template. Pk !€ªt”‹ [ [content_types].xml ¢ ( ´•ikã0.ï…þ £k‰•ôpj‰“c—c h ½*òø õ†4ùþ}gyl)i\šäb°4ï½oc4î —fgs q9[°^þe xéjeë‚}œ.. Choose from a variety of payroll stub template options. Document all payments to ensure each employee is properly compensated for their work, and so tax documents are accurate come year end. Download free pay stub templates for excel, word, and pdf. Employees then provide signatures to authorize the deductions. I hereby authorize the payroll department of my employer to make. I hereby authorize the payroll department of my employer to make regular deductions each payroll period from my payroll / salary / allotment in the amount of: Document all payments to ensure each employee is properly compensated for their work, and so tax documents are accurate come year end. ( enter amount, above ) ( last name ) My employer. You can edit the fine print to match your policies and legal requirements; Payroll deduction authorization form if you want your employer to automatically deduct a certain amount of money from your regular paycheck, use this form to make the request. Document all payments to ensure each employee is properly compensated for their work, and so tax documents are accurate. I hereby authorize the payroll department of my employer to make regular deductions each payroll period from my payroll / salary / allotment in the amount of: Keep both the employee and the employer up to date on current pay rates by tracking overall compensations and deductions on a weekly, monthly, or yearly basis. Download free pay stub templates for. Included on this page, you’ll find a simple receipt template, a cash receipt template, and a payment receipt template. Download free pay stub templates for excel, word, and pdf. Payroll deduction authorization form if you want your employer to automatically deduct a certain amount of money from your regular paycheck, use this form to make the request. Employees then provide. Keep both the employee and the employer up to date on current pay rates by tracking overall compensations and deductions on a weekly, monthly, or yearly basis. Included on this page, you’ll find a simple receipt template, a cash receipt template, and a payment receipt template. This payroll deduction form is designed for authorizing voluntary deductions such as retirement or. Download free pay stub templates for excel, word, and pdf. Choose from a variety of payroll stub template options. Document all payments to ensure each employee is properly compensated for their work, and so tax documents are accurate come year end. Employees then provide signatures to authorize the deductions. You can also download a petty cash receipt template and a. Employees then provide signatures to authorize the deductions. Payroll deduction authorization form if you want your employer to automatically deduct a certain amount of money from your regular paycheck, use this form to make the request. Choose from a variety of payroll stub template options. Keep both the employee and the employer up to date on current pay rates by tracking overall compensations and deductions on a weekly, monthly, or yearly basis. This payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care savings. You can also download a petty cash receipt template and a rent receipt template , among others. Pk !€ªt”‹ [ [content_types].xml ¢ ( ´•ikã0.ï…þ £k‰•ôpj‰“c—c h ½*òø õ†4ùþ}gyl)i\šäb°4ï½oc4î —fgs q9[°^þe xéjeë‚}œ. Download free pay stub templates for excel, word, and pdf. Ss tax deduction s o s o s o s o s o s o s o s o s o s o s o s o total hours rate of pay gross amount earned no. ( enter amount, above ) ( last name ) You can edit the fine print to match your policies and legal requirements; Document all payments to ensure each employee is properly compensated for their work, and so tax documents are accurate come year end.Payroll Deduction Form

Payroll Deduction Authorization Form Template Free

Payroll Deduction Authorization Form Template Free Employees Can Use

Payroll Deduction Template Free Web A Payroll Deduction Form Is A

Payroll Deduction Form Template

Voluntary Payroll Deduction Form How to create a Voluntary Payroll

Payroll Deduction Form Template 14+ Sample, Example, Format

Assistant Payroll Deduction Form Templates at

What Is Staff Association Deduction at Wendy Seay blog

Payroll Deduction Form Template 14+ Sample, Example, Format

I Hereby Authorize The Payroll Department Of My Employer To Make Regular Deductions Each Payroll Period From My Payroll / Salary / Allotment In The Amount Of:

My Employer Is Authorized To Deduct A Different Amount Should There Be A Deduction Change Throughout The Year.

Included On This Page, You’ll Find A Simple Receipt Template, A Cash Receipt Template, And A Payment Receipt Template.

Related Post: