Template For Charitable Donation Receipt

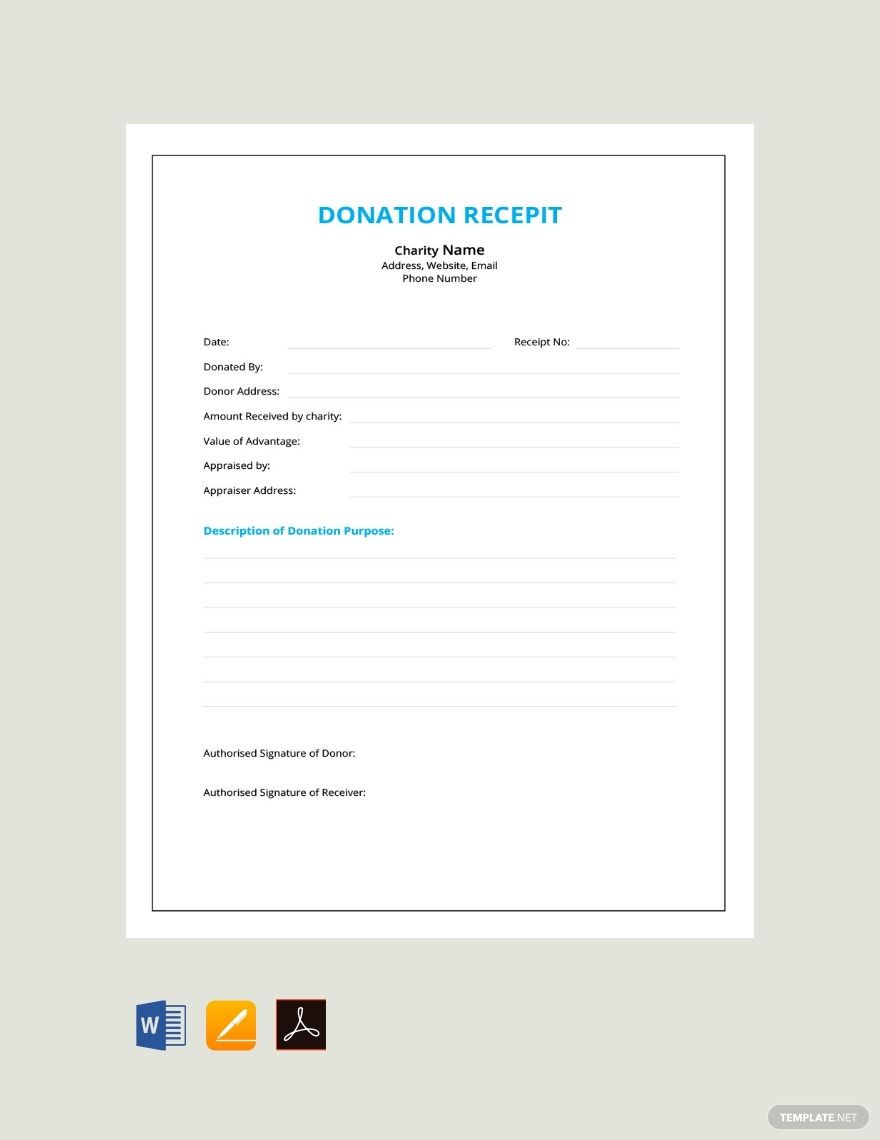

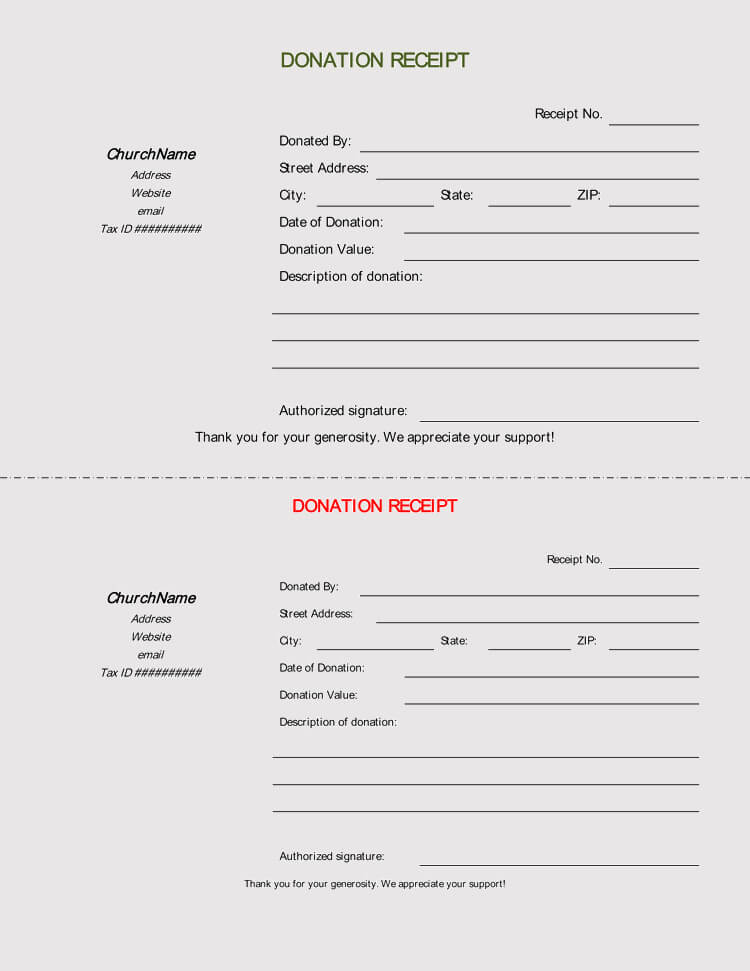

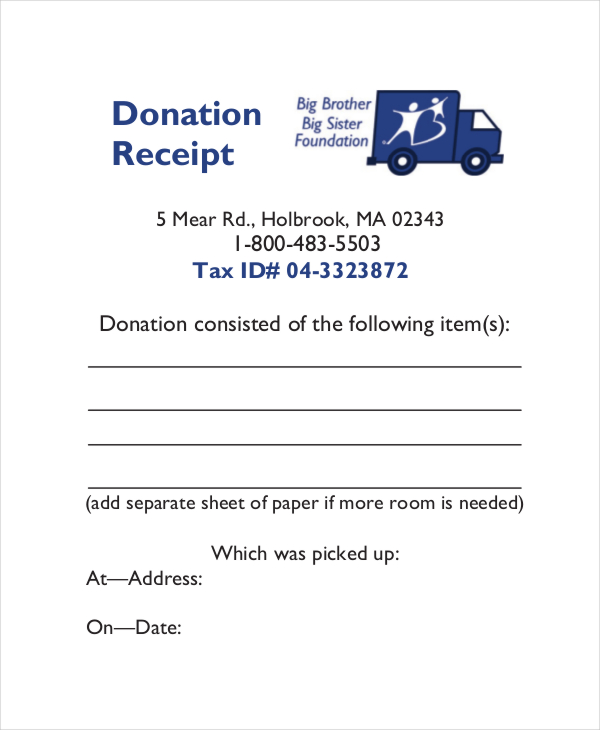

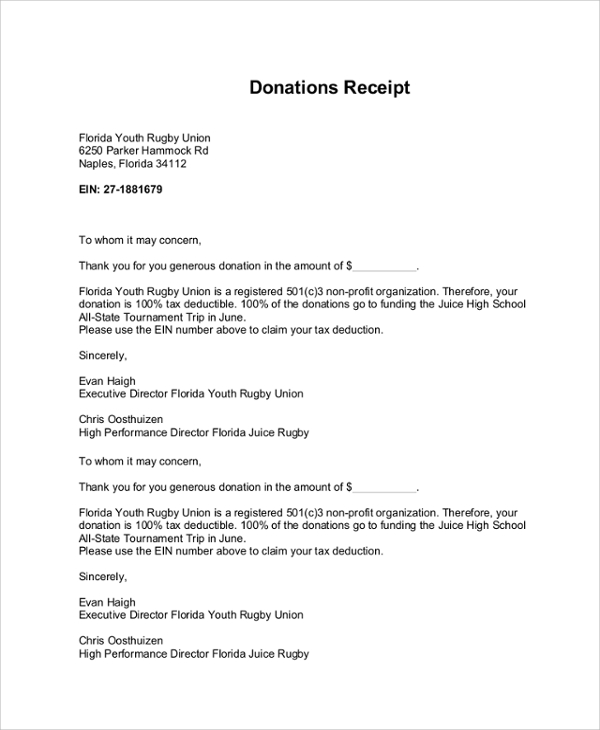

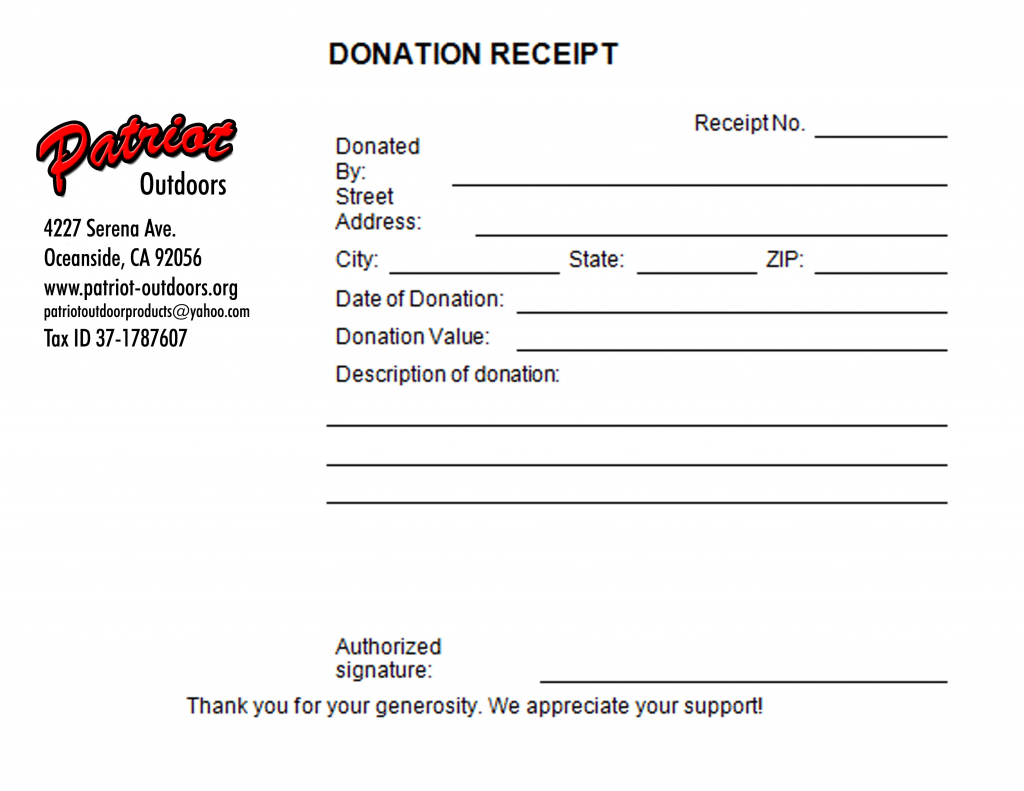

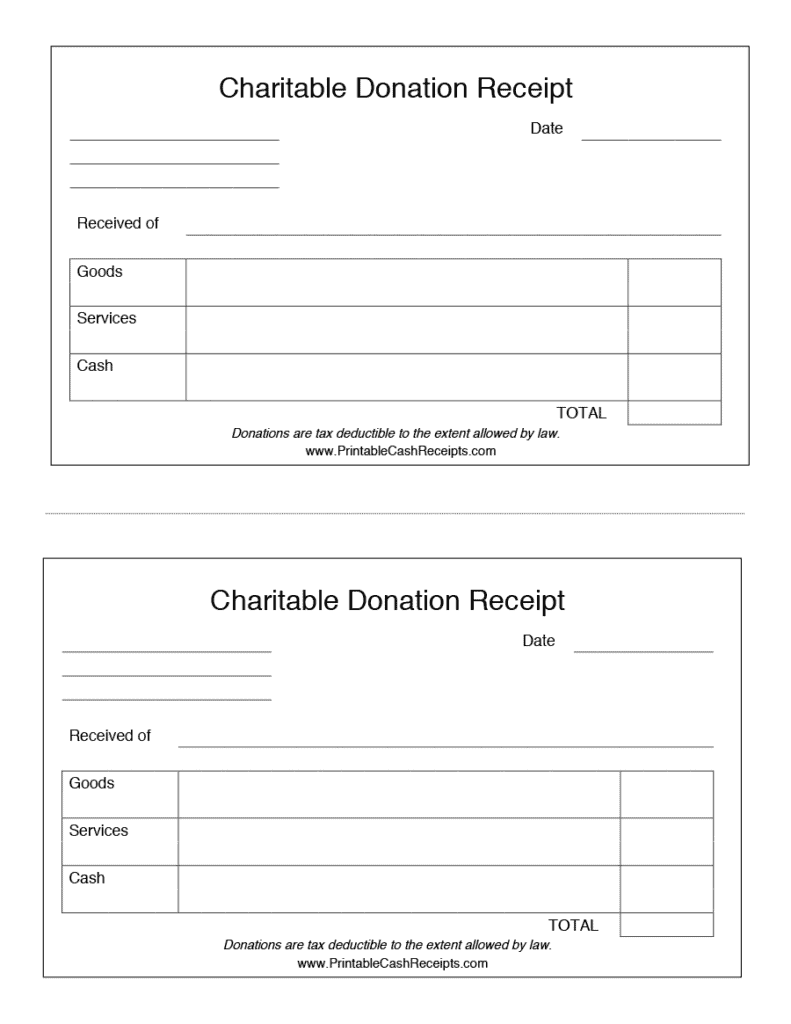

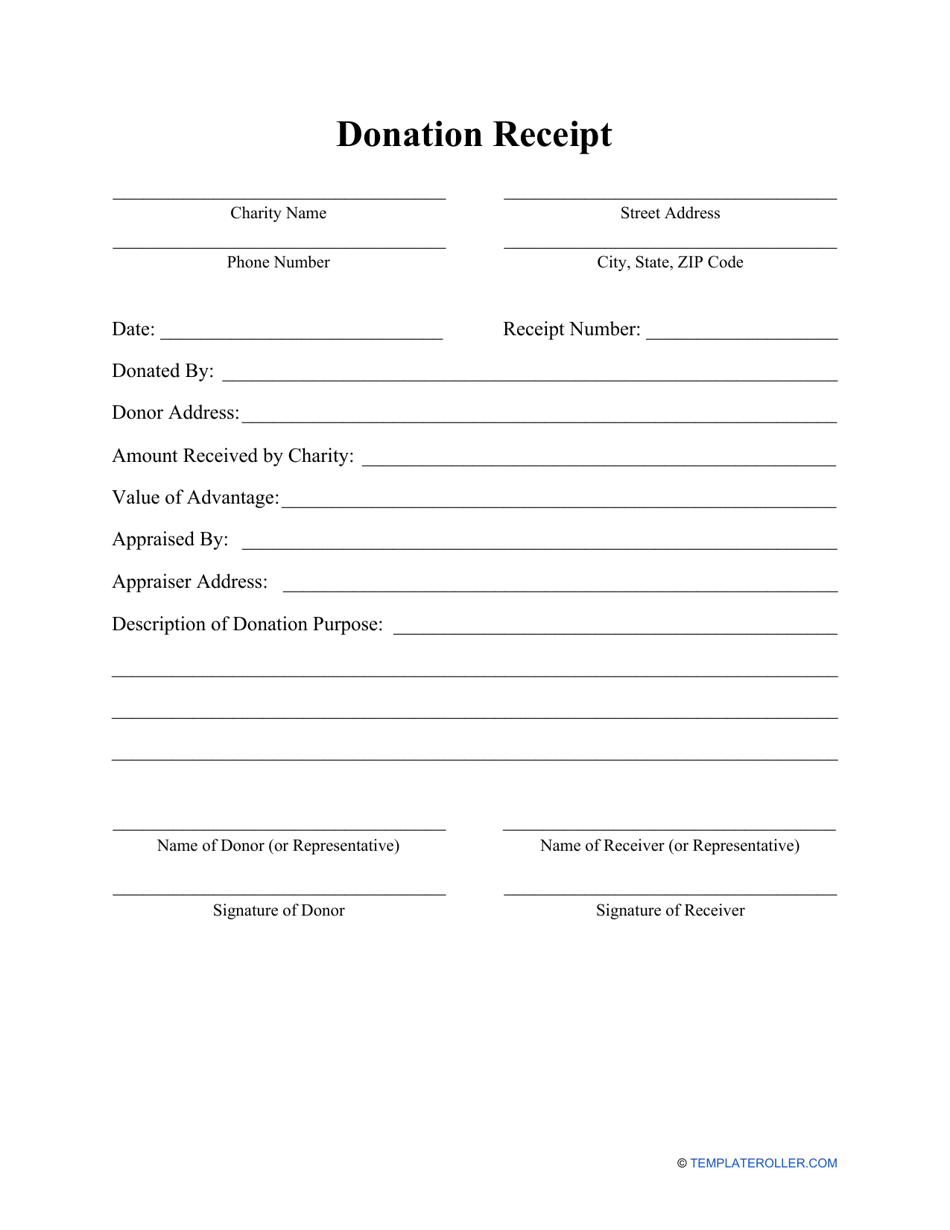

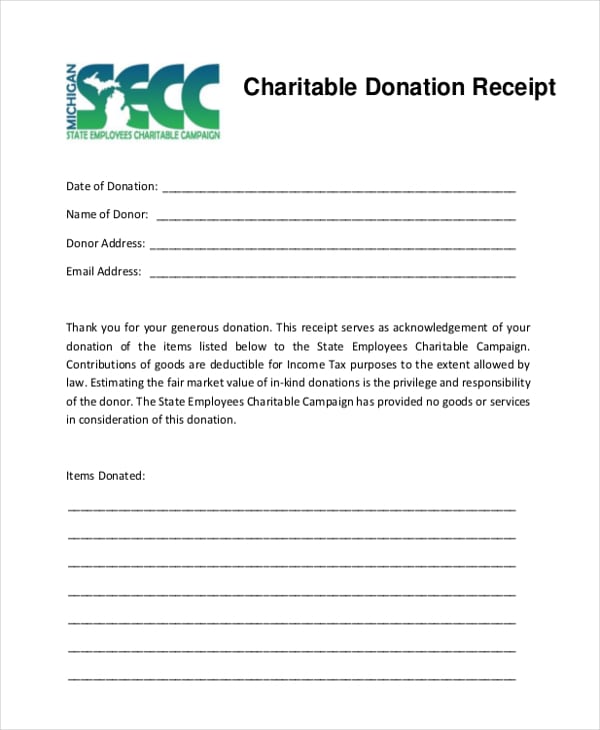

Template For Charitable Donation Receipt - Get a free nonprofit donation receipt template for every giving scenario. If an individual has made substantial contributions (in excess of $250) in cash and has not received. A donation receipt form should. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that you can customize and make your own. A pledge or promise to pay does not count. Given below are donation receipt templates: All 501(c)(3) organizations must be approved by. Here are some free 501(c)(3) donation receipt templates for you to. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. A written donation receipt can be used to track your organization’s revenue and accounting purposes for the irs. Made to meet us & canada requirements. Nonprofits and charitable organizations use these to acknowledge and record. It is typically provided by. All 501(c)(3) organizations must be approved by. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. When donating in cash, individuals should endeavor to receive a receipt. In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that you can customize and make your own. Donation receipt templates are essential tools for any organization involved in charitable activities. Given below are donation receipt templates: Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. When you make a charitable. Here are some free 501(c)(3) donation receipt templates for you to. Get a free nonprofit donation receipt template for every giving scenario. Made to meet us & canada requirements. In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that you can customize and make your own. A pledge or promise to pay does not count. Here’s our collection of donation receipt templates. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant. It is typically provided by. Here are some free 501(c)(3) donation receipt templates for you to. Here’s our collection of donation receipt templates. When you make a charitable. Get a free nonprofit donation receipt template for every giving scenario. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. A pledge or promise to pay does not count. If an individual has made substantial contributions (in excess of $250) in cash and has not received. Here’s our collection of donation. It is typically provided by. A written donation receipt can be used to track your organization’s revenue and accounting purposes for the irs. Made to meet us & canada requirements. Donation receipt templates are essential tools for any organization involved in charitable activities. A pledge or promise to pay does not count. Feel free to download, modify and use any you like. All 501(c)(3) organizations must be approved by. Here are some free 501(c)(3) donation receipt templates for you to. Donation receipt templates are essential tools for any organization involved in charitable activities. A donation receipt form should. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. Made to meet us & canada requirements. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. Feel free to download, modify and use any you like. Here are some free. If an individual has made substantial contributions (in excess of $250) in cash and has not received. Here’s our collection of donation receipt templates. For more templates, refer to our main receipt templates page here. A donation receipt form should. All 501(c)(3) organizations must be approved by. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. All 501(c)(3) organizations must be approved by. Donation receipt templates are essential tools for any organization involved in charitable activities. When donating in. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. A donation receipt form should. A written donation receipt can be used to track your organization’s revenue and accounting purposes for the irs. Even though the irs does not have a form for charitable contributions less than $500, they do. A pledge or promise to pay does not count. In this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt templates that you can customize and make your own. It is typically provided by. Even though the irs does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. Given below are donation receipt templates: Here’s our collection of donation receipt templates. A charity should issue a donation receipt once it receives a donation. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. Here are some free 501(c)(3) donation receipt templates for you to. Donation receipt templates are essential tools for any organization involved in charitable activities. Get a free nonprofit donation receipt template for every giving scenario. Nonprofits and charitable organizations use these to acknowledge and record. For more templates, refer to our main receipt templates page here. All 501(c)(3) organizations must be approved by. If an individual has made substantial contributions (in excess of $250) in cash and has not received. Feel free to download, modify and use any you like.46 Free Donation Receipt Templates (501c3, NonProfit)

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

Free Salvation Army Donation Receipt PDF Word eForms

5 Charitable Donation Receipt Templates formats, Examples in Word Excel

6+ Free Donation Receipt Templates

Free Printable Donation Receipt Template Printable Templates Your Go

5 Charitable Donation Receipt Templates Free Sample Templates

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Donation Receipt Template in Excel, Word, PDF, Pages Download

A Donation Receipt Form Should.

When You Make A Charitable.

A Written Donation Receipt Can Be Used To Track Your Organization’s Revenue And Accounting Purposes For The Irs.

When Donating In Cash, Individuals Should Endeavor To Receive A Receipt.

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-27.jpg)