Template For Living Trust

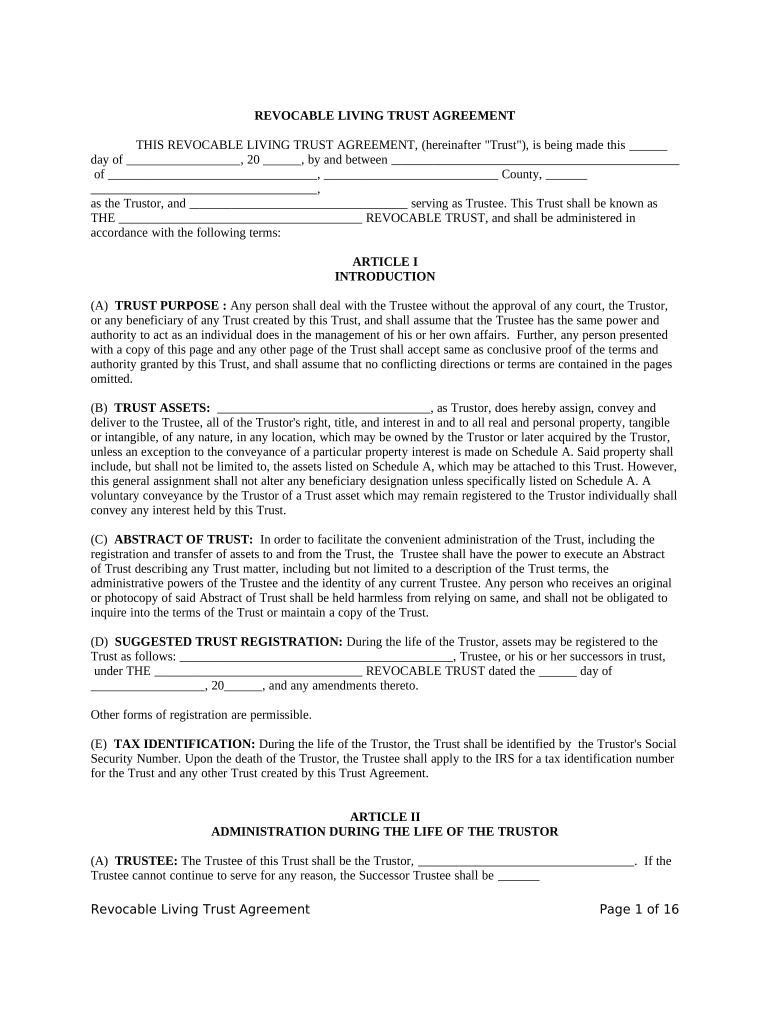

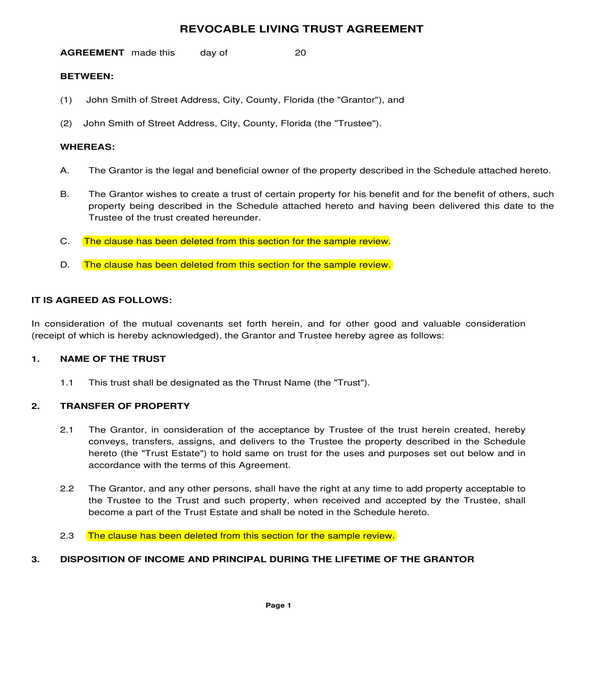

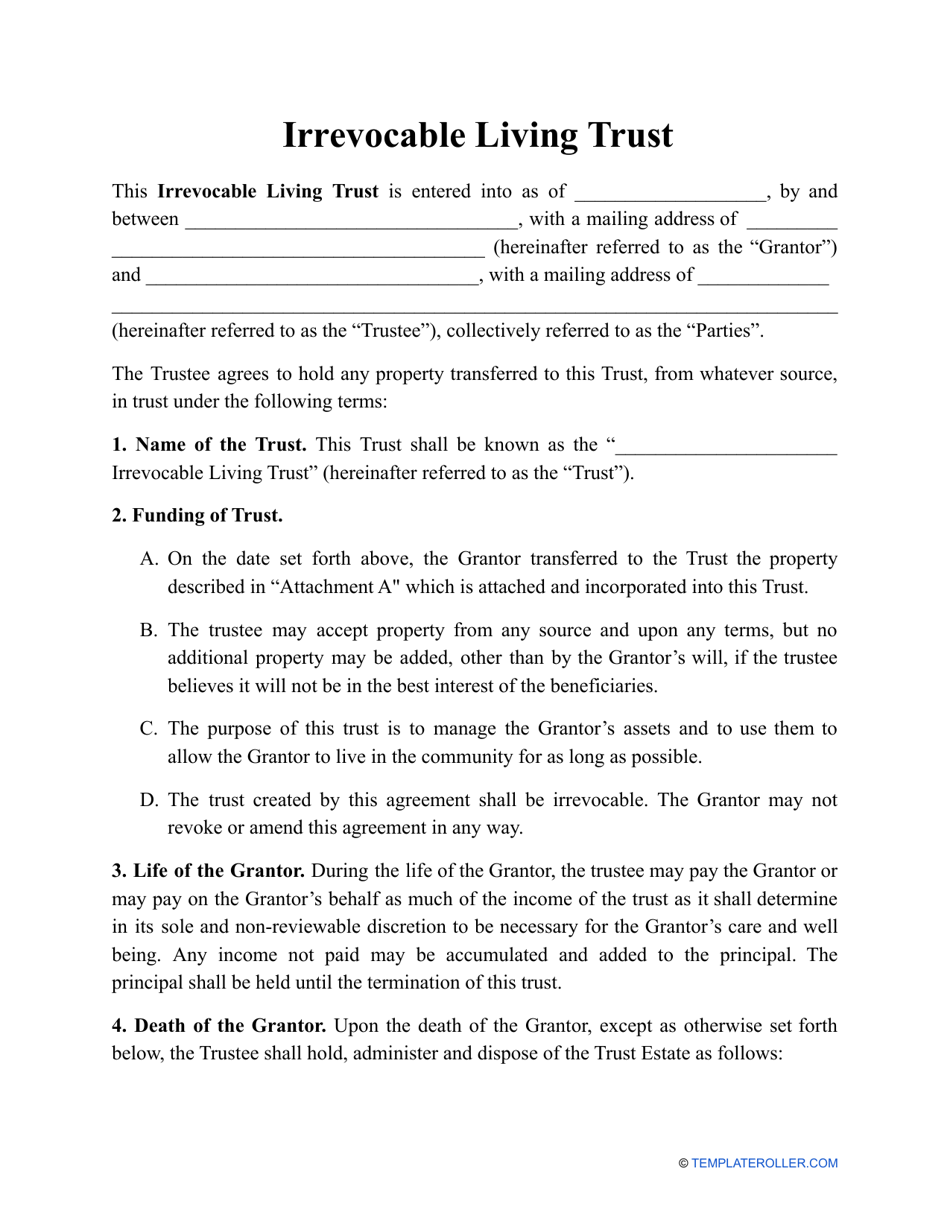

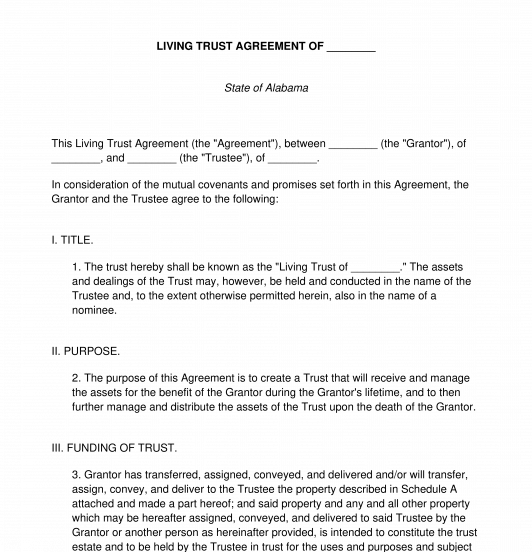

Template For Living Trust - Living trust forms can help you execute a will or revocable living trust. Living trusts and revocable trusts can offer you ways to manage and distribute your assets while avoiding probate. Not only do these documents allow you to dictate who will receive your estate at your death, but it gives your. During the life of the settlor, the trustee shall hold, manage, sell, exchange, invest, and reinvest the trust property, collect all income, and, after deducting such expenses as are properly. A revocable living trust (sometimes referred to simply as a “living trust”) is a legal arrangement wherein assets are placed under. A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the management of a trustee, who can be the grantor or. A free printable living trust form pdf provides an. Why use 360 legal forms for your revocable living trust? Introduction to revocable living trusts. The _____ revocable living trust. Ensure you know exactly who will receive your assets after you pass away and who will be in. There are also free printable living trust forms available. During the life of the settlor, the trustee shall hold, manage, sell, exchange, invest, and reinvest the trust property, collect all income, and, after deducting such expenses as are properly. Living trusts and revocable trusts can offer you ways to manage and distribute your assets while avoiding probate. Download our living trust form free template to create your legal document. I, _____ (the “grantor”), of _____ [city/state], being of sound mind and legal age, and not under undue influence or. Not only do these documents allow you to dictate who will receive your estate at your death, but it gives your. A free printable living trust form pdf provides an. A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the management of a trustee, who can be the grantor or. The _____ revocable living trust. When considering a living trust, you may find it helpful to explore a sample living trust or use a living trust template. A revocable living trust (sometimes referred to simply as a “living trust”) is a legal arrangement wherein assets are placed under. I, _____ (the “grantor”), of _____ [city/state], being of sound mind and legal age, and not under. A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the management of a trustee, who can be the grantor or. Page 7 supervision of any court, shall hold or distribute such property (subsequently referred to in this paragraph as the “protected property”) in accordance. Why use 360 legal forms for. A revocable living trust form is a legal document used in estate planning that enables you to retain control over your assets during your lifetime and determine how they'll. Not only do these documents allow you to dictate who will receive your estate at your death, but it gives your. A living trust (or inter vivos trust) is a legal. Living trust templates provide a structured framework and guidelines for individuals to create their own customized living trusts. When considering a living trust, you may find it helpful to explore a sample living trust or use a living trust template. A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the. Much like a legal form, this template simplifies the process of managing assets and specifying how they will be distributed upon death. A revocable living trust form is a legal document used in estate planning that enables you to retain control over your assets during your lifetime and determine how they'll. Living trust templates provide a structured framework and guidelines. Ensure you know exactly who will receive your assets after you pass away and who will be in. A living trust and a will both distribute assets, but they cover different aspects of your estate. Download our living trust form free template to create your legal document. Page 7 supervision of any court, shall hold or distribute such property (subsequently. Living trusts and revocable trusts can offer you ways to manage and distribute your assets while avoiding probate. Introduction to revocable living trusts. Living trust forms are crucial as far as the welfare of beneficiaries are concerned because that is the reason grantors draw up living trusts in the first place. Page 7 supervision of any court, shall hold or. A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the management of a trustee, who can be the grantor or. During the life of the settlor, the trustee shall hold, manage, sell, exchange, invest, and reinvest the trust property, collect all income, and, after deducting such expenses as are properly.. A living trust and a will both distribute assets, but they cover different aspects of your estate. Much like a legal form, this template simplifies the process of managing assets and specifying how they will be distributed upon death. Living trust forms can help you execute a will or revocable living trust. The _____ revocable living trust. A free printable. Ensure you know exactly who will receive your assets after you pass away and who will be in. The _____ revocable living trust. Much like a legal form, this template simplifies the process of managing assets and specifying how they will be distributed upon death. When considering a living trust, you may find it helpful to explore a sample living. The sample revocable living trust: There are also free printable living trust forms available. Manages only the assets placed in the trust, such as property, bank. A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the management of a trustee, who can be the grantor or. A living trust and a will both distribute assets, but they cover different aspects of your estate. I, _____ (the “grantor”), of _____ [city/state], being of sound mind and legal age, and not under undue influence or. Introduction to revocable living trusts. A revocable living trust (sometimes referred to simply as a “living trust”) is a legal arrangement wherein assets are placed under. Not only do these documents allow you to dictate who will receive your estate at your death, but it gives your. Download our living trust form free template to create your legal document. Living trust forms are crucial as far as the welfare of beneficiaries are concerned because that is the reason grantors draw up living trusts in the first place. During the life of the settlor, the trustee shall hold, manage, sell, exchange, invest, and reinvest the trust property, collect all income, and, after deducting such expenses as are properly. Living trust forms can help you execute a will or revocable living trust. Page 7 supervision of any court, shall hold or distribute such property (subsequently referred to in this paragraph as the “protected property”) in accordance. Ensure you know exactly who will receive your assets after you pass away and who will be in. A revocable living trust form is a legal document used in estate planning that enables you to retain control over your assets during your lifetime and determine how they'll.FREE 10+ Sample Living Trust Form Templates in PDF Word

34 Free Living Trust Forms ( & Documents) ᐅ TemplateLab

FREE 6+ Revocable Living Trust Forms in PDF MS Word

Irrevocable Living Trust Template Fill Out, Sign Online and Download

Free Printable Living Trust Templates [PDF] Irrevocable

Free Printable Living Trust Templates [PDF] Irrevocable

Free Printable Living Trust Templates [PDF] Irrevocable

Living Trust Agreement FREE Template Word and PDF

Free Printable Living Trust Templates [PDF] Irrevocable

Revocable Living Trust Template

Living Trusts And Revocable Trusts Can Offer You Ways To Manage And Distribute Your Assets While Avoiding Probate.

The _____ Revocable Living Trust.

Why Use 360 Legal Forms For Your Revocable Living Trust?

Much Like A Legal Form, This Template Simplifies The Process Of Managing Assets And Specifying How They Will Be Distributed Upon Death.

Related Post:

![Free Printable Living Trust Templates [PDF] Irrevocable](https://www.typecalendar.com/wp-content/uploads/2023/06/Downloadable-Living-Trust-Template.jpg)

![Free Printable Living Trust Templates [PDF] Irrevocable](https://www.typecalendar.com/wp-content/uploads/2023/06/Free-Living-Trust-Form-in-PDF.jpg)

![Free Printable Living Trust Templates [PDF] Irrevocable](https://www.typecalendar.com/wp-content/uploads/2023/05/Living-Trust.jpg)

![Free Printable Living Trust Templates [PDF] Irrevocable](https://www.typecalendar.com/wp-content/uploads/2023/06/PDF-Living-Trust-Template.jpg)