Template To Report Unauthorized Charges To A Merchsnt

Template To Report Unauthorized Charges To A Merchsnt - Unauthorized charges on credit card statements can lead to financial discrepancies and distress. For example, if a unauthorized credit card charge of $150 occurs on january 15, 2023, the bank should look into the transaction history and account details, examining. The best solution is to write a dispute. Confirm whether it truly is a mistake or an. In this article, well guide you through a simple letter template to address. It could take some time, but donotpay can help. I am writing to formally dispute several unauthorized charges that have appeared on my credit card statement for the billing cycle of [statement date]. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. Consumers, like those using visa or mastercard, may notice unexpected transactions, often. However, a formal dispute letter can be much more. Unauthorized charges on credit card statements can lead to financial discrepancies and distress. Users must fill out necessary details like transaction information and reason for the dispute. It is also useful for reporting discrepancies related to transaction amounts or issues with merchandise. The charges in question are outlined. Complaint letter to bank about unauthorized charges template. Up to 24% cash back a fraudulent bank transaction dispute letter lets the bank know that there is unauthorized activity on your account, and that you shouldn't be liable for those. However, a formal dispute letter can be much more. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. Confirm whether it truly is a mistake or an. It could take some time, but donotpay can help. Unauthorized charges on credit card statements can lead to financial discrepancies and distress. In this article, well guide you through a simple letter template to. Confirm whether it truly is a mistake or an. I am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. Consumers, like those using visa. In this article, well guide you through a simple letter template to address. For example, if a unauthorized credit card charge of $150 occurs on january 15, 2023, the bank should look into the transaction history and account details, examining. Users must fill out necessary details like transaction information and reason for the dispute. The transaction dispute form allows cardholders. If you have suffered from an unauthorized transaction on a credit card, you can get it charged back. When you discover an error or unauthorized charge on your credit card, you may think a quick phone call will solve it. Navigating unauthorized charges can be daunting, but understanding how to dispute them can empower you as a consumer. It's crucial. It is also useful for reporting discrepancies related to transaction amounts or issues with merchandise. I am writing to formally dispute several unauthorized charges that have appeared on my credit card statement for the billing cycle of [statement date]. However, a formal dispute letter can be much more. Use this form whenever you detect unauthorized charges on your credit card. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. Were you charged without your permission for more than you agreed to pay, or for things you didn’t buy? Dealing with unauthorized charges can be confusing and frustrating, but taking action is essential to protect your. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. The charge is in error because [explain the problem briefly. The transaction dispute form allows cardholders to formally dispute unauthorized charges. Confirm whether it truly is a mistake or an. Were you charged without your permission. Dear [bank customer service], i am writing to report unauthorized charges on my account that have come to my attention. However, a formal dispute letter can be much more. Were you charged without your permission for more than you agreed to pay, or for things you didn’t buy? It's crucial to act swiftly and effectively to dispute these charges, ensuring. The charge is in error because [explain the problem briefly. I am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. In this article, well guide. For example, if a unauthorized credit card charge of $150 occurs on january 15, 2023, the bank should look into the transaction history and account details, examining. Navigating unauthorized charges can be daunting, but understanding how to dispute them can empower you as a consumer. I am writing to report an unauthorized transaction on my credit card account. In this. Unauthorized charges on credit card statements can lead to financial discrepancies and distress. Up to 24% cash back a fraudulent bank transaction dispute letter lets the bank know that there is unauthorized activity on your account, and that you shouldn't be liable for those. However, a formal dispute letter can be much more. In this article, we'll guide you through. When you discover an error or unauthorized charge on your credit card, you may think a quick phone call will solve it. Unauthorized charges on credit card statements can lead to financial discrepancies and distress. Navigating unauthorized charges can be daunting, but understanding how to dispute them can empower you as a consumer. Consumers, like those using visa or mastercard, may notice unexpected transactions, often. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. The charges in question are outlined. If you have suffered from an unauthorized transaction on a credit card, you can get it charged back. Up to 24% cash back a fraudulent bank transaction dispute letter lets the bank know that there is unauthorized activity on your account, and that you shouldn't be liable for those. The charge is in error because [explain the problem briefly. However, a formal dispute letter can be much more. In this article, well guide you through a simple letter template to address. Users must fill out necessary details like transaction information and reason for the dispute. I am writing to report an unauthorized transaction on my credit card account. It could take some time, but donotpay can help. Were you charged without your permission for more than you agreed to pay, or for things you didn’t buy? Dear [bank customer service], i am writing to report unauthorized charges on my account that have come to my attention.Timeshare Medical Hardship Letter Template Sample Template Samples

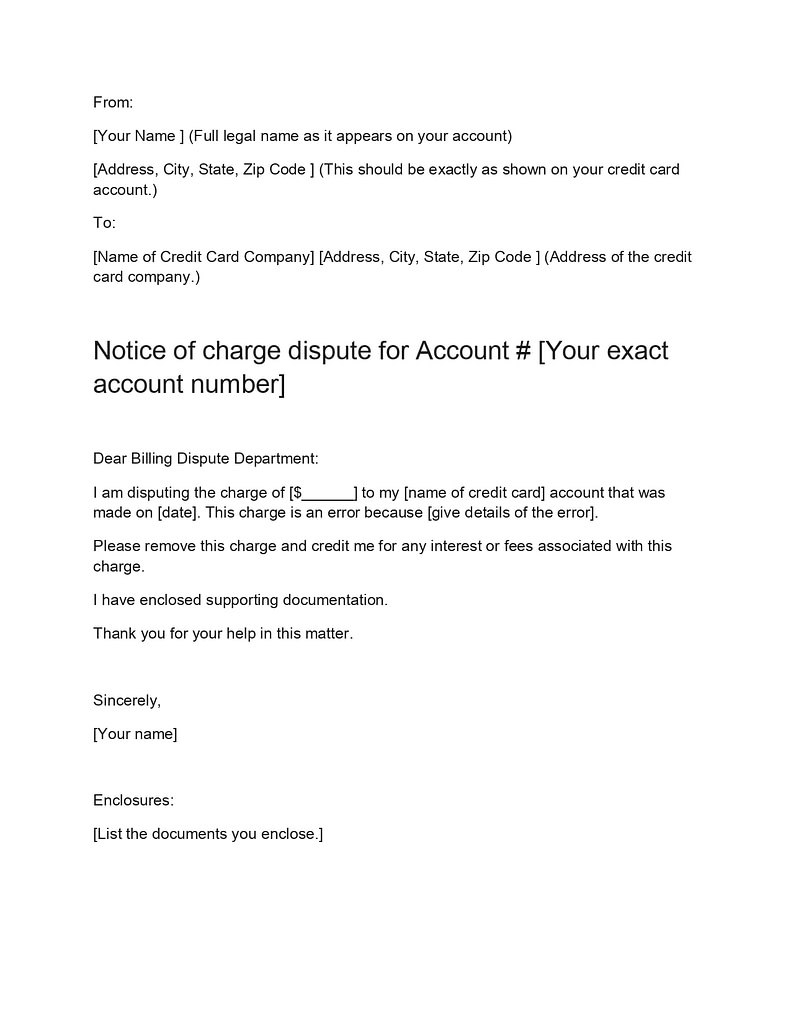

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

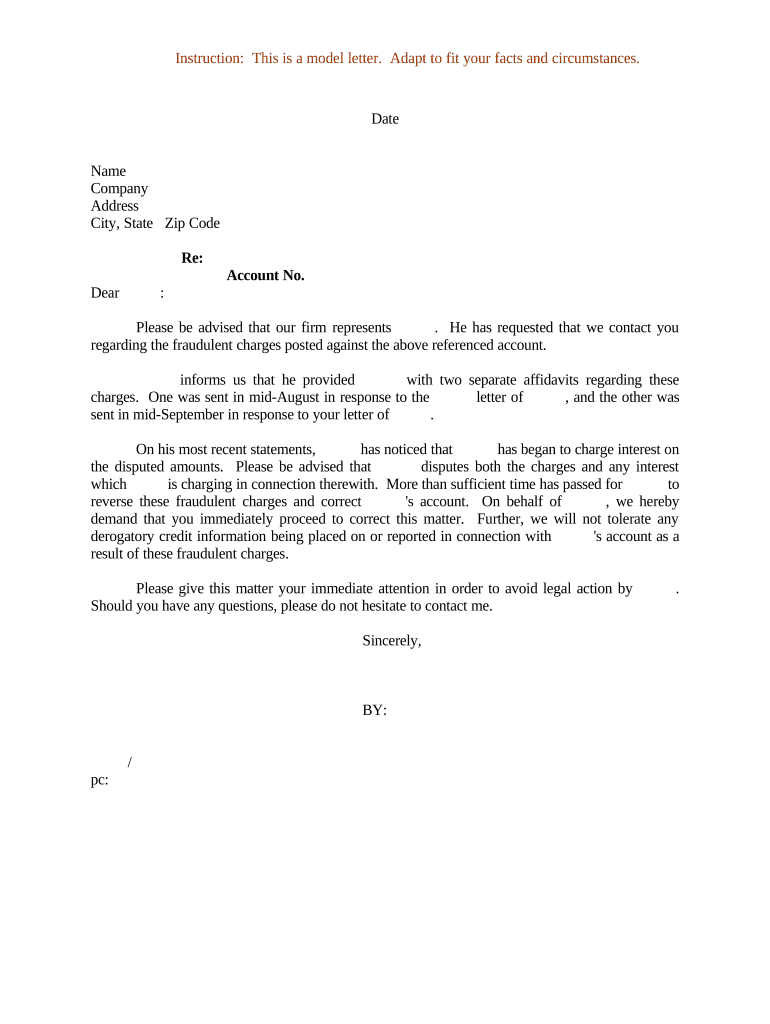

letter fraudulent charges Doc Template pdfFiller

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Dispute Fraudulent Credit Card Transaction Letter Check Credit Score

Fillable Online Credit Card Authorization Form Templates DownloadWho's

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

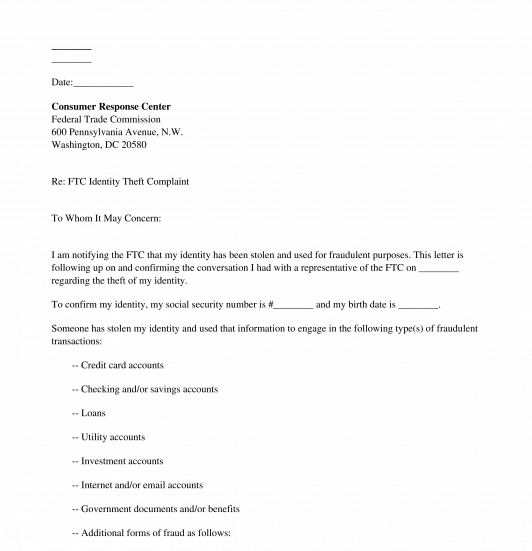

FTC Identity Theft Complaint Letter Sample, Template

Dispute Letter Unauthorized Transaction Sample [Word]

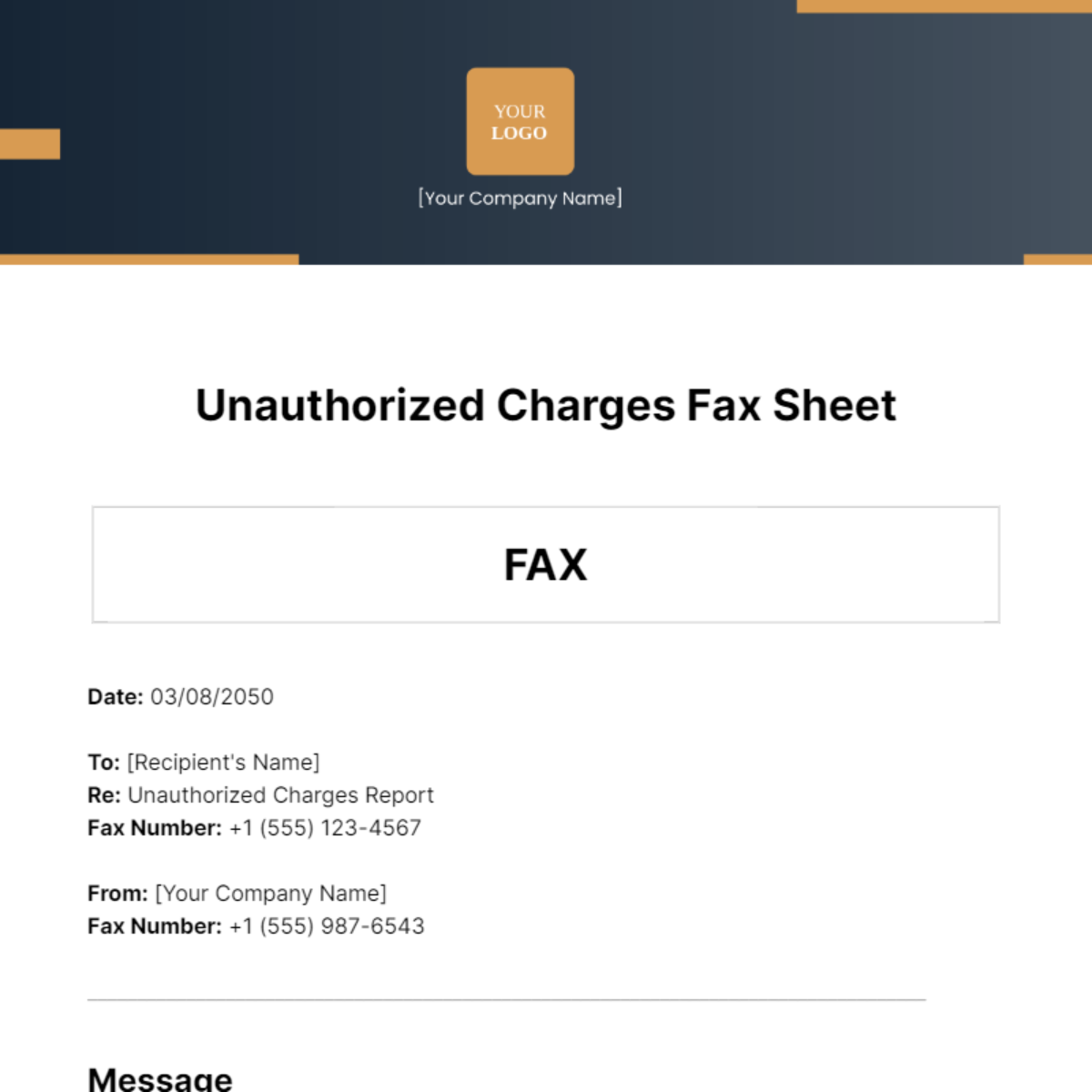

Free Unauthorized Charges Fax Sheet Template Edit Online & Download

Complaint Letter To Bank About Unauthorized Charges Template.

If So, Here’s What To Do And A Sample Letter To Help Get Your Money.

I Am Writing To Formally Dispute Several Unauthorized Charges That Have Appeared On My Credit Card Statement For The Billing Cycle Of [Statement Date].

The Transaction Dispute Form Allows Cardholders To Formally Dispute Unauthorized Charges.

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-17-790x1022.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-02-790x1022.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-05.jpg)

![Dispute Letter Unauthorized Transaction Sample [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2023/03/Sample-Dispute-Letter-Unauthorized-Transaction.jpg?fit=1414%2C2000&ssl=1)