Transfer Beneficiary Personal Property Form Template

Transfer Beneficiary Personal Property Form Template - Creating a beneficiary deed is essential for estate planning. It allows the owner to. A transfer on death instrument form is used to designate who will inherit a specific asset, such as a real estate property or a financial account, upon the owner's death. This type of deed helps. If a grantee beneficiary predeceases. It allows the property owner to name a. Transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: It is a legal document which allows a person to transfer ownership of their property to a chosen individual upon their death,. A transfer on death instrument form is used to designate who will inherit a specific asset, such as a real estate property or a financial account, upon the owner's death. This type of deed helps. Creating a beneficiary deed is essential for estate planning. It allows the property owner to name a. It allows the owner to. Transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: If a grantee beneficiary predeceases. It is a legal document which allows a person to transfer ownership of their property to a chosen individual upon their death,. This type of deed helps. It is a legal document which allows a person to transfer ownership of their property to a chosen individual upon their death,. If a grantee beneficiary predeceases. Transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: A transfer on death instrument form is used. It allows the property owner to name a. If a grantee beneficiary predeceases. It is a legal document which allows a person to transfer ownership of their property to a chosen individual upon their death,. It allows the owner to. A transfer on death instrument form is used to designate who will inherit a specific asset, such as a real. Transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: It is a legal document which allows a person to transfer ownership of their property to a chosen individual upon their death,. If a grantee beneficiary predeceases. It allows the owner to. It allows the property owner to name a. It is a legal document which allows a person to transfer ownership of their property to a chosen individual upon their death,. Creating a beneficiary deed is essential for estate planning. If a grantee beneficiary predeceases. A transfer on death instrument form is used to designate who will inherit a specific asset, such as a real estate property or a. It allows the owner to. Transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: This type of deed helps. It allows the property owner to name a. It is a legal document which allows a person to transfer ownership of their property to a chosen individual upon their death,. Creating a beneficiary deed is essential for estate planning. This type of deed helps. Transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: If a grantee beneficiary predeceases. A transfer on death instrument form is used to designate who will inherit a specific asset, such as a real estate. It allows the owner to. Transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: This type of deed helps. It allows the property owner to name a. It is a legal document which allows a person to transfer ownership of their property to a chosen individual upon their death,. Creating a beneficiary deed is essential for estate planning. Transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: A transfer on death instrument form is used to designate who will inherit a specific asset, such as a real estate property or a financial account, upon the owner's death. It. It is a legal document which allows a person to transfer ownership of their property to a chosen individual upon their death,. If a grantee beneficiary predeceases. It allows the property owner to name a. Transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: It allows the owner to. This type of deed helps. A transfer on death instrument form is used to designate who will inherit a specific asset, such as a real estate property or a financial account, upon the owner's death. It allows the property owner to name a. It is a legal document which allows a person to transfer ownership of their property to a. Transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: Creating a beneficiary deed is essential for estate planning. If a grantee beneficiary predeceases. It is a legal document which allows a person to transfer ownership of their property to a chosen individual upon their death,. It allows the owner to. It allows the property owner to name a.Affidavit for transfer of personal property Fill out & sign online

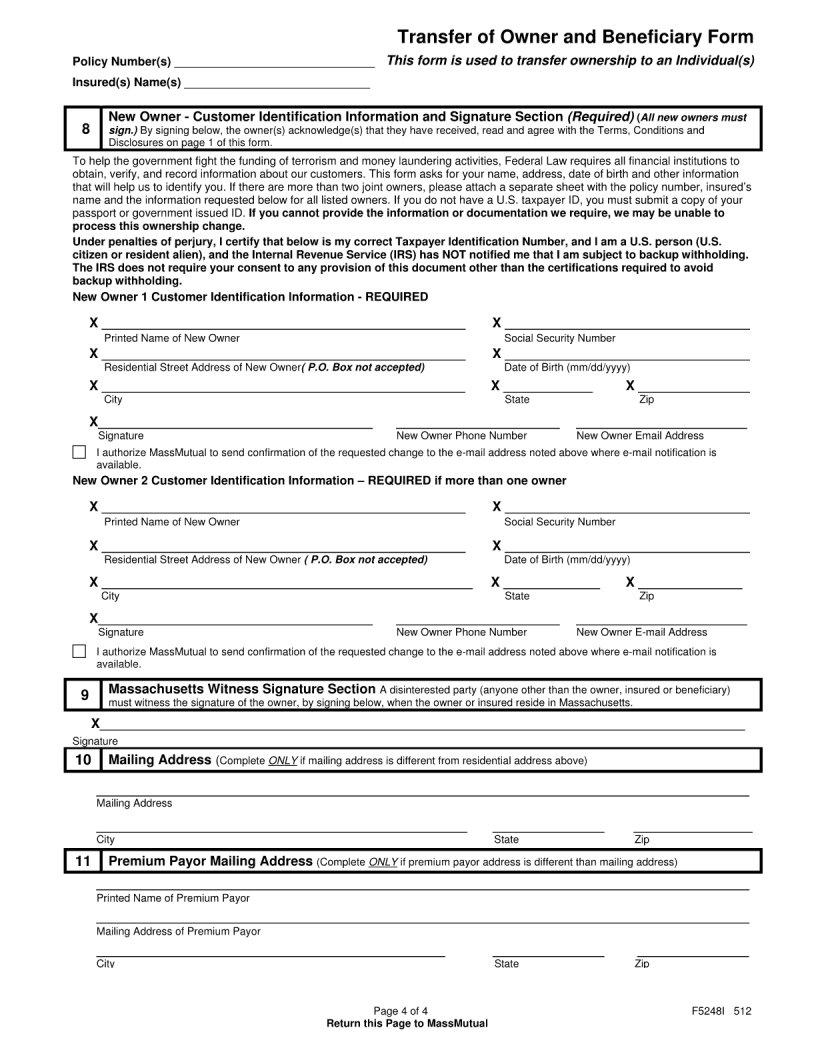

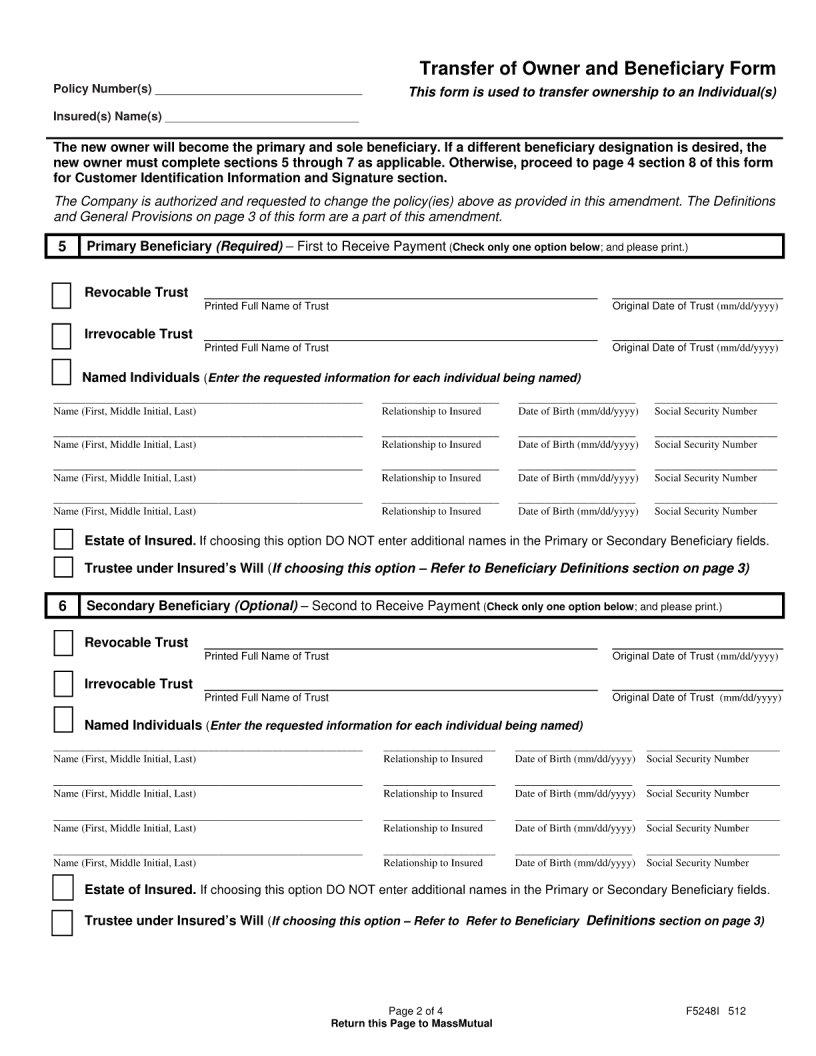

Mass Mutual Transfer Beneficiary PDF Form FormsPal

Transfer Of Property Template

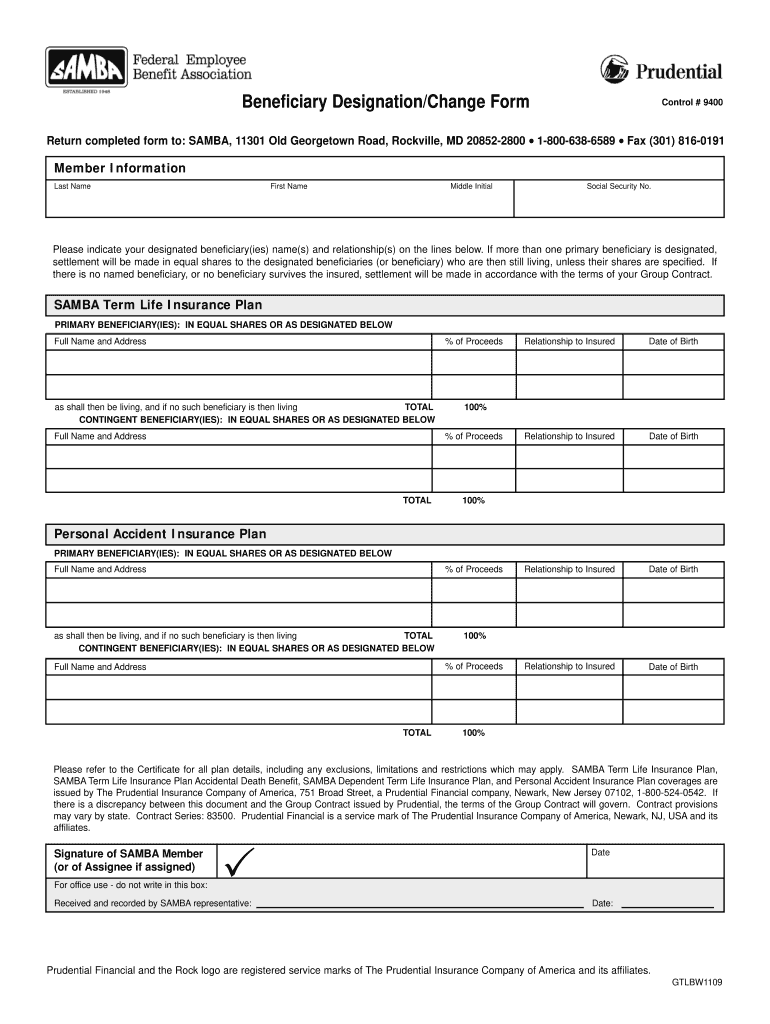

FREE 7+ Sample Beneficiary Release Forms in PDF MS Word

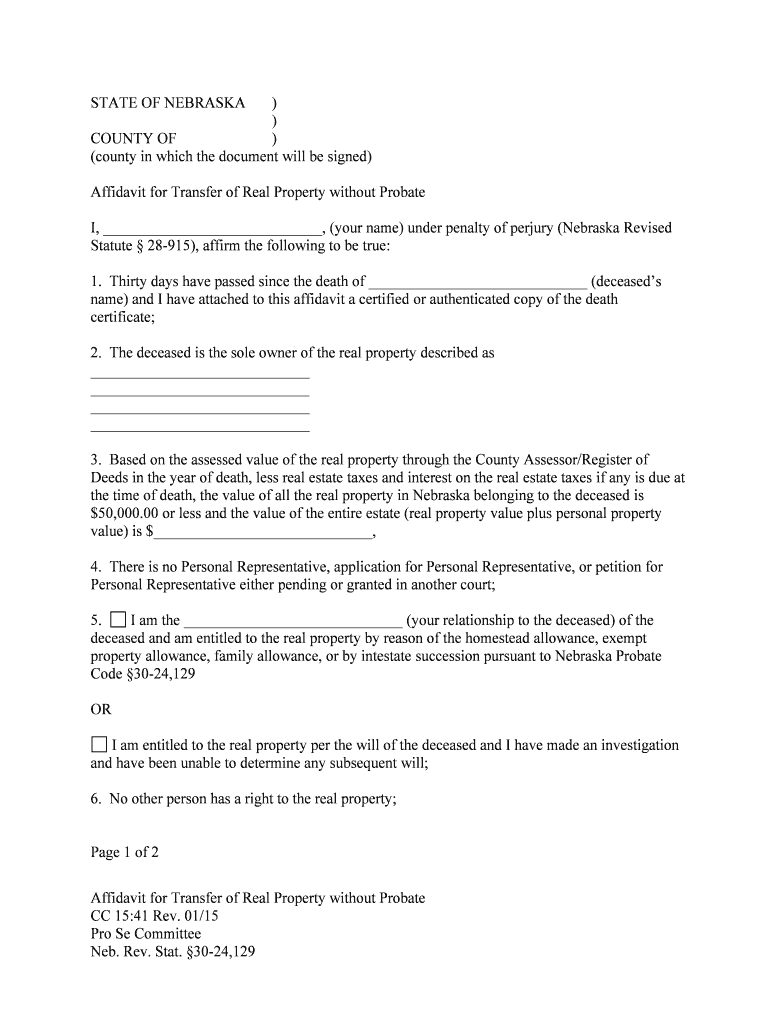

Affidavit for Transfer of Real Property Without Probate Form Fill Out

beneficiary deed Doc Template pdfFiller

Printable Beneficiary Form Template

Mass Mutual Transfer Beneficiary PDF Form FormsPal

Printable Beneficiary Form Template

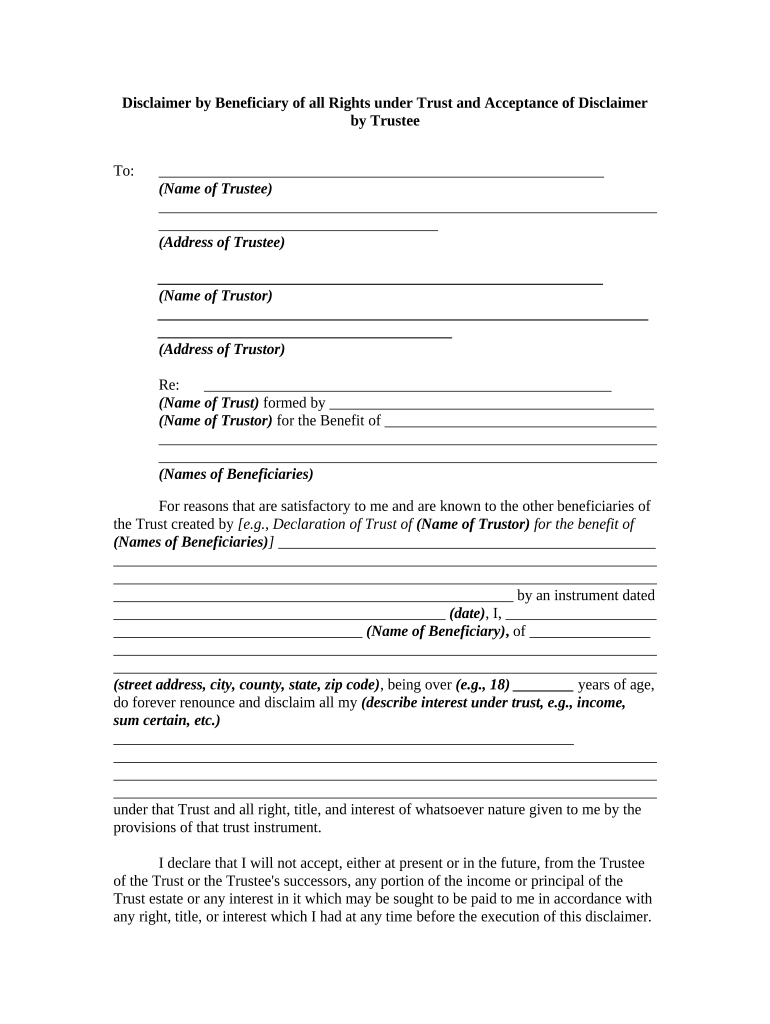

beneficiary rights under Doc Template pdfFiller

This Type Of Deed Helps.

A Transfer On Death Instrument Form Is Used To Designate Who Will Inherit A Specific Asset, Such As A Real Estate Property Or A Financial Account, Upon The Owner's Death.

Related Post: