Virginia Living Trust Template

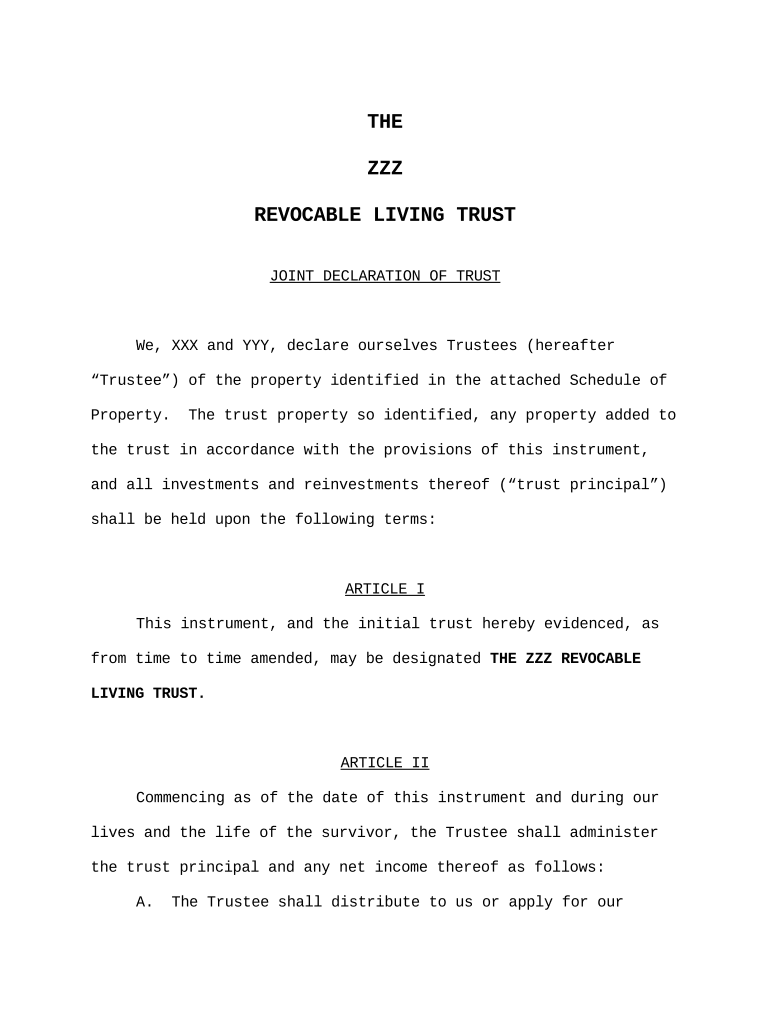

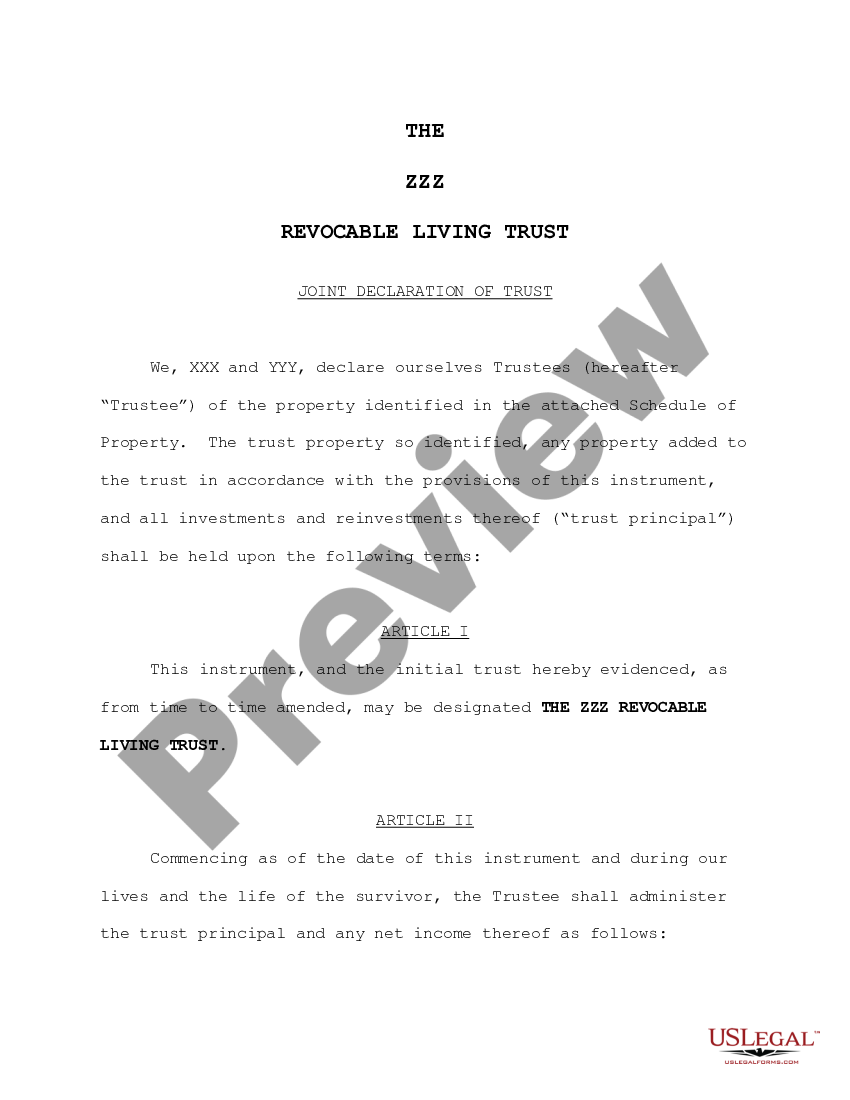

Virginia Living Trust Template - Setting up a trust in virginia requires compliance with the virginia uniform trust code (utc), codified in title 64.2 of the code of virginia. Virginia certificate of trust form diy. Virginia law requires that every account be signed by all trustees. In this guide, we discuss the steps you need to take to set up a living trust in the state of virginia. Choose whether to make an individual or shared trust. To make a living trust in virginia, you: Up to 40% cash back to make a living trust in virginia, you: The adobe reader allows you to read, edit and print pdf documents. _____ hereinafter known as the “grantor,” agrees to fund this trust with the assets and property. Decide what property to include in the trust. _____ hereinafter known as the “grantor,” agrees to fund this trust with the assets and property. During the life of the settlor, the trustee shall hold, manage, sell, exchange, invest, and reinvest the trust property, collect all income, and, after deducting such expenses as are properly. Download this virginia revocable living trust form which provides a way in which a grantor (an individual creating the trust) can set aside assets and property into a separate entity called a. Decide what property to include in the trust. Up to $40 cash back want to establish a iving trust? The settlor must be of sound mind,. Choose whether to make an individual or shared trust. Decide on the type of trust: If necessary you can edit and customize the forms using an appropriate document editing program. Creating a living trust in virginia involves several steps. A virginia living trust is a document used to transfer one's assets into a separate entity to be managed by a trustee until the creator's, or grantor's, death. To make a living trust in virginia, you: Use our revocable living trust form to transfer your estate and other assets to your heirs easily and quickly, avoiding court processes. Virginia certificate. Up to $40 cash back want to establish a iving trust? Download this virginia revocable living trust form which provides a way in which a grantor (an individual creating the trust) can set aside assets and property into a separate entity… Up to $40 cash back a virginia living trust — revocable is a legal document that allows individuals in. A virginia living trust is a document used to transfer one's assets into a separate entity to be managed by a trustee until the creator's, or grantor's, death. Up to $40 cash back want to establish a iving trust? Download this virginia revocable living trust form which provides a way in which a grantor (an individual creating the trust) can. Download this virginia revocable living trust form which provides a way in which a grantor (an individual creating the trust) can set aside assets and property into a separate entity called a. These forms are available as pdf documents. The settlor must be of sound mind,. To make a living trust in virginia, you: If necessary you can edit and. The settlor must be of sound mind,. Choose whether to make an individual or shared trust. Us legal forms provides living trust forms for virginia residents. Up to 40% cash back to make a living trust in virginia, you: Up to $40 cash back want to establish a iving trust? These forms are available as pdf documents. Up to $40 cash back us legal forms is the perfect choice for you to find verified virginia living trusts legal templates for your use case and prepare them without juridical assistance. Up to $40 cash back want to establish a iving trust? Decide on the type of trust: In this guide, we. Virginia law requires that every account be signed by all trustees. Up to $40 cash back a virginia living trust — revocable is a legal document that allows individuals in virginia to transfer their assets into a trust during their lifetime, with the ability to. Up to $40 cash back want to establish a iving trust? Determine if you need. If necessary you can edit and customize the forms using an appropriate document editing program. Up to 25% cash back how do i make a living trust in virginia? Only those forms that can be submitted to the court by a member of the. Up to $40 cash back us legal forms is the perfect choice for you to find. Decide what property to include in the trust. Virginia certificate of trust form diy. Download this virginia revocable living trust form which provides a way in which a grantor (an individual creating the trust) can set aside assets and property into a separate entity called a. Our virginia trust forms are available free in both microsoft word and pdf format.. Up to 40% cash back a living trust in virginia is an estate planning option that allows you to place your assets in trust while continuing to use and control them. Here’s a general outline of the process: Decide what property to include in the trust. Up to $40 cash back a virginia living trust — revocable is a legal. Virginia certificate of trust form diy. Virginia law requires that every account be signed by all trustees. Up to $40 cash back want to establish a iving trust? Download this virginia revocable living trust form which provides a way in which a grantor (an individual creating the trust) can set aside assets and property into a separate entity… Up to 40% cash back a living trust in virginia is an estate planning option that allows you to place your assets in trust while continuing to use and control them. The adobe reader allows you to read, edit and print pdf documents. Our virginia trust forms are available free in both microsoft word and pdf format. If necessary you can edit and customize the forms using an appropriate document editing program. Setting up a trust in virginia requires compliance with the virginia uniform trust code (utc), codified in title 64.2 of the code of virginia. These forms are available as pdf documents. Setting up a living trust is easier than you think. The settlor must be of sound mind,. Up to $40 cash back us legal forms is the perfect choice for you to find verified virginia living trusts legal templates for your use case and prepare them without juridical assistance. Up to $40 cash back a virginia living trust — revocable is a legal document that allows individuals in virginia to transfer their assets into a trust during their lifetime, with the ability to. Here’s a general outline of the process: Download this virginia revocable living trust form which provides a way in which a grantor (an individual creating the trust) can set aside assets and property into a separate entity called a.Virginia Revocable Living Trust for Husband and Wife Revocable Living

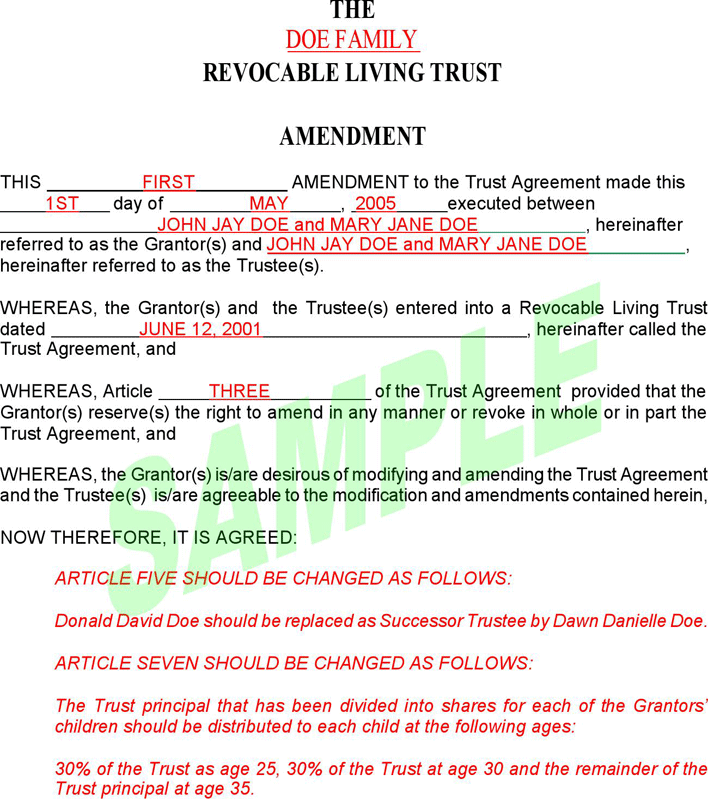

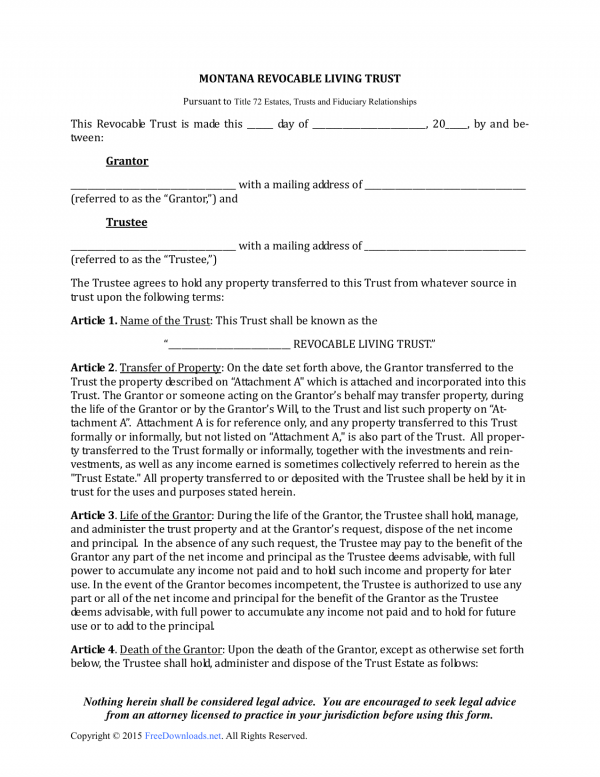

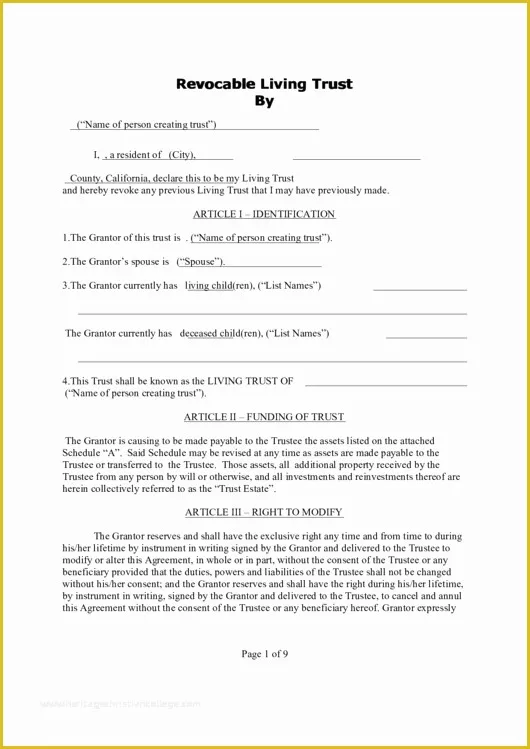

Free Printable Living Trust Templates [PDF] Irrevocable

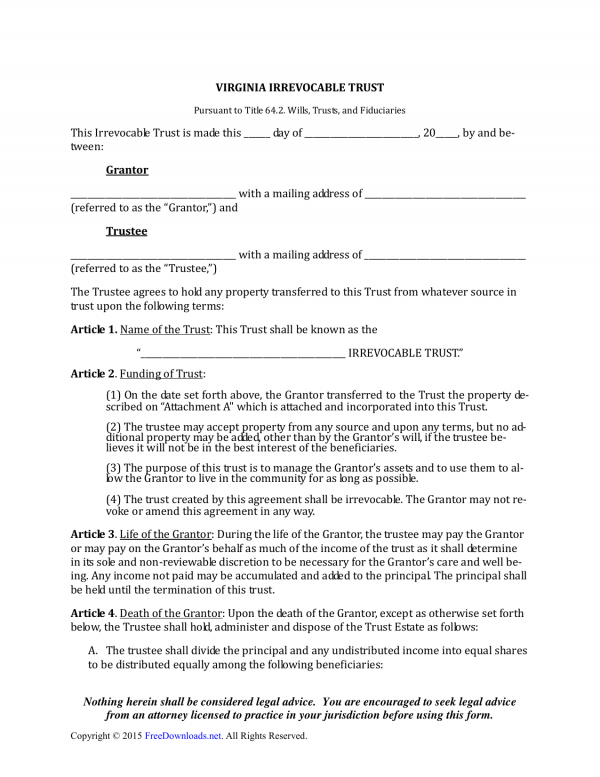

Download Virginia Irrevocable Living Trust Form PDF RTF Word

Free Printable Living Trust Templates [PDF] Irrevocable

Living Trust Revocation Form Living Revocable Trust Rocket Lawyer

Download Montana Revocable Living Trust Form PDF RTF Word

Virginia Living Trust Template

Free Printable Living Trust Templates [PDF] Irrevocable

virginia revocable living trust Doc Template pdfFiller

Free Printable Revocable Living Trust Form Printable Forms Free Online

Choose Whether To Make An Individual Or Shared Trust.

Living Trust (“Trust”) Made On _____, Is Created By:

In This Guide, We Discuss The Steps You Need To Take To Set Up A Living Trust In The State Of Virginia.

_____ Hereinafter Known As The “Grantor,” Agrees To Fund This Trust With The Assets And Property.

Related Post:

![Free Printable Living Trust Templates [PDF] Irrevocable](https://www.typecalendar.com/wp-content/uploads/2023/06/Blank-Form-of-Revocable-Living-Trust.jpg?gid=625)

![Free Printable Living Trust Templates [PDF] Irrevocable](https://www.typecalendar.com/wp-content/uploads/2023/05/Living-Trust.jpg)

![Free Printable Living Trust Templates [PDF] Irrevocable](https://www.typecalendar.com/wp-content/uploads/2023/06/Free-Template-of-Revocable-Living-Trust.jpg?gid=625)